Is Citigroup Stock a Buy Now?

Key Points

Citigroup is a large bank with huge name recognition.

The company got into trouble during the Great Recession but has since regained its footing.

Investors appear well aware of the success the company has been experiencing.

- 10 stocks we like better than Citigroup ›

The reading was very good when Citigroup (NYSE: C) released its third-quarter 2025 earnings. Revenue rose 9% year over year, net income advanced 23%, and adjusted earnings (taking out a one-time impairment charge) rocketed 48% higher.

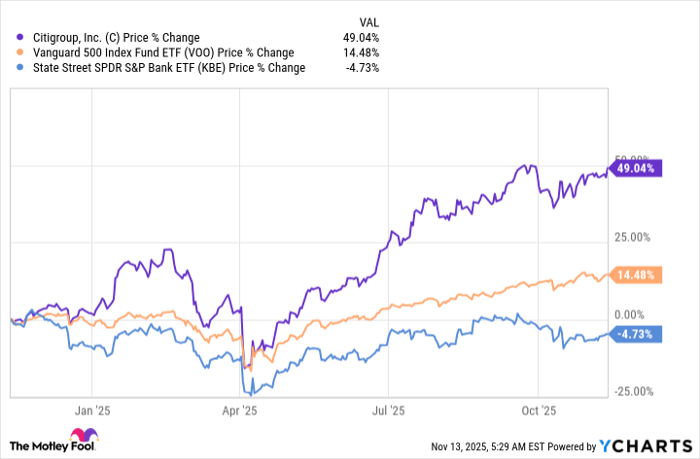

Given that backdrop, it's not really surprising that Citigroup's stock has risen nearly 50% during the past year, with most of that gain coming since April. But is it worth buying Citigroup stock right now?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The problem with Citigroup's rally

The stock price advance for Citigroup is impressive on an absolute basis. A roughly 50% gain in a year is huge. But it becomes even more impressive when you do some comparisons. For example, the average large U.S. bank stock actually fell nearly 5% during the same span, using SPDR S&P Bank ETF (NYSEMKT: KBE) as a proxy for the industry. Meanwhile, the S&P 500 index (SNPINDEX: ^GSPC) is up about 14%. Any way you look at it, Citigroup's stock has been a stellar performer.

C data by YCharts

That's great if you bought the stock 52 weeks ago. But the swift price advance has changed the value proposition. At this point, Citigroup's price-to-sales ratio is 2.2 times versus a five-year average of 1.5 times and the price-to-earnings ratio is about 14 compared to a longer-term average that's just shy of 9.

From a valuation perspective, Citigroup is no longer as cheap as it once was. And just as notably, it looks a bit stretched relative to the average bank, too. The average P/E ratio for SPDR S&P Bank ETF is 11.2 times. There are about 100 stocks in this exchange-traded fund (ETF), so it provides a fairly diversified comparison point. Citigroup looks pricey today.

Image source: Getty Images.

The caveat with Citigroup's business

Clearly, if you are a value investor, you should probably avoid Citigroup. Dividend investors probably don't have much more to draw them in, either, given that Citigroup's 2.3% dividend yield is slightly below the 2.4% average for large banks. The bigger story is the business turnaround that may be starting to pick up speed.

If you look back to 2007, just before the Great Recession began, Citigroup shares are down roughly 80%. That recession was particularly deep and centered in the finance sector. Citigroup ultimately received a government bailout and reduced its dividend. The bank has been slowly working to get its business back on track since then.

However, the business isn't the same as it was in 2007, having undergone significant changes. There's a very real possibility that Citigroup will never regain the highs it saw back then. The turnaround that's taken place with the business has effectively created a more conservative company. That's probably not a bad thing, but given the valuation and the yield, the turnaround story seems as if it may have played out. Referring back to the stock's highs before the Great Recession may not be a realistic comparison point.

Citigroup is a wishlist stock

It probably wouldn't be a huge mistake to buy Citigroup even though you are paying a premium to do so. It is a well-run bank and operating fairly conservatively at this point.

However, most investors should probably keep this stock on their wishlist, given the swift price advance during the past year. It doesn't present a compelling value, the growth opportunity looks priced in, the yield isn't exciting, and the turnaround lens probably shouldn't go all the way back to 2007.

Should you invest $1,000 in Citigroup right now?

Before you buy stock in Citigroup, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Citigroup wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Citigroup is an advertising partner of Motley Fool Money. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.