2 Hidden Reasons Why Amazon Will Crush the Market in 2026

Key Points

AWS makes up the majority of Amazon's operating profits.

Digital advertising revenue helps deliver incredible margins for Amazon.

- 10 stocks we like better than Amazon ›

When you hear Amazon (NASDAQ: AMZN) discussed as an investment option, the first thing you probably think of is its gigantic e-commerce business. With so many clients around the world, it may seem like there is not a lot of expansion left in this industry. That's mostly a correct assumption, but that's not Amazon's only growth lever.

Two far less discussed segments of Amazon's business will make it a great investment moving forward, and each of these units is putting up superior growth rates to its legacy commerce division. Furthermore, the margins for these two segments are way higher, which has the effect of raising profits faster than revenue.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

I think this primes Amazon's stock for a great 2026, and I won't be surprised if it crushes the market thanks to these two divisions.

Image source: Amazon.

Amazon Web Services provides the majority of Amazon's operating profits

Amazon splits its business into three units: North American commerce, international commerce, and Amazon Web Services (AWS). AWS gets its own segment because it's such a huge part of Amazon's profitability picture, despite accounting for just 18% of revenue during Q3. AWS is Amazon's cloud computing wing, and it has been a massive part of Amazon's business for some time. It benefits from two tailwinds right now: the general migration to the cloud by all sorts of businesses, and artificial intelligence.

These two trends have nothing to do with each other, and each is gigantic in its own right. This creates a positive boost for Amazon, which is why AWS delivered 20% revenue growth in Q3 -- its best in several years. Cloud computing, at its core, involves a client running workloads on Amazon's servers rather than maintaining expensive computing equipment on-site to do it. This is a win-win for all partners involved, and Amazon has benefited from it dramatically.

In Q3, Amazon generated $17.4 billion in operating income. Of that, $11.43 billion came from AWS, or about 66%. While commerce may deliver massive revenue, its margins aren't nearly as good as AWS. As long as AWS continues to grow at a rapid pace, so will Amazon's profits.

But another division within Amazon's commerce business is also boosting margins.

Advertising is Amazon's fastest-growing segment

When consumers visit Amazon's website, they're specifically looking to buy something. Amazon has information about their visit, so it knows exactly what they're looking for. This gives Amazon a gold mine of advertising info that it can sell. Advertising services is Amazon's quickest growing segment, and saw its revenue rise 24% year over year during Q3. That's an impressive rise, but Amazon doesn't break out advertising's operating margin like it does AWS.

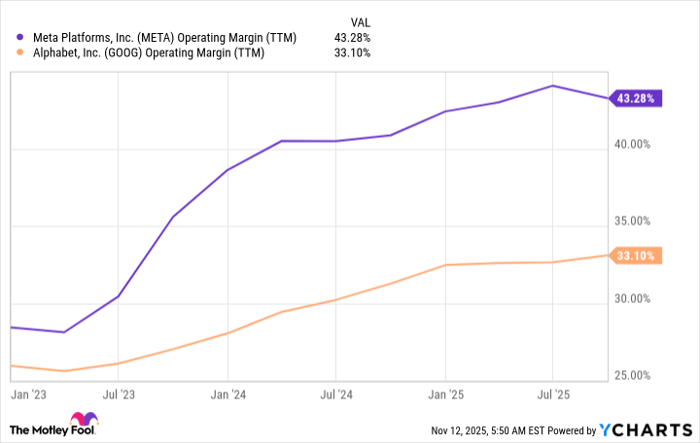

However, we can look at other advertising-focused businesses, like Meta Platforms and Alphabet, to get an idea of what operating margin advertising services could be putting up.

Data by YCharts.

Both companies deliver operating margins in the 30% to 45% range, and have never dipped below 25% over the past few years. During Q3, AWS put up a 35% operating margin, so advertising services aren't that far off.

The rise of both advertising and AWS, growing at a faster rate than the commerce divisions, has boosted Amazon's profits far faster than its revenue. As a result, Amazon is a profit growth story, not a revenue growth one. However, Amazon's overall revenue growth for Q3 was quite strong at 13%. I think this primes Amazon as a stock that could have an excellent 2026, as it's benefiting from rising margins and strong growth even in its legacy commerce division.

Amazon wasn't the best investment in 2025, but I'm betting that that will flip in 2026.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, and Meta Platforms. The Motley Fool has a disclosure policy.