Roblox Faces Class-Action Lawsuit: Metaverse Pioneer Deeper in Crisis as Shares Tumble Anew. Still an Investment Opportunity?

TradingKey - Roblox (RBLX.US), often hailed as the "leading metaverse stock," has recently faced significant joint lawsuits, causing its share price to decline for several consecutive days. Despite this setback, we believe Roblox maintains a stable user base and healthy, growing cash flow, suggesting continued investment value. From a technical perspective, the $100 psychological level offers strong support, presenting an opportunity for investors to consider buying Roblox stock on pullbacks.

What Kind of Company Is Roblox?

Founded in 2004 (originally as Dynablox), Roblox is an interactive entertainment platform company driven by user-generated content (UGC). Essentially, it functions as a virtual world infrastructure enterprise, integrating game engines, social networks, and a digital economic system.

Its popular games include "99 Nights in the Forest," "Fish It!," and "Steal a Brainrot," among others.

【Top 5 Games on the Roblox Platform, Source: www.roblox.com】

Unlike most gaming companies, Roblox is not a traditional "game developer" in the conventional sense. Instead, it provides a comprehensive suite of tools, engines, and an ecosystem that enables millions of developers and players globally to collaboratively create, share, and monetize content on its platform.

All "games" (officially referred to as experiences) on the Roblox platform are user-developed. This model is akin to a "game platform version of YouTube"—Roblox itself does not create content but relies on incentivizing creators within its ecosystem to produce content, thereby sustaining its growth.

Users can also purchase gift cards to redeem on the Roblox platform, unlocking expanded gameplay experiences.

More About Roblox

How Has Roblox Stock Performed?

Roblox went public on Nasdaq via a Direct Public Offering (DPO) (companies like Spotify and Palantir used the same method). It surged 55% above its reference price on its debut. After nearly three quarters of sideways trading, Roblox stock had its first moment in the spotlight.

Q3 2021 earnings significantly surpassed market expectations, with revenue doubling and continued user growth fueling market optimism. On the first trading day after the earnings release, the stock surged over 42%, going on to hit a new all-time high since its DPO in subsequent trading sessions.

Following this surge driven by an emerging concept, the market realized that even the most promising future concepts struggle to sustain such high valuations amid persistent losses.

With the easing of the COVID-19 pandemic, macroeconomic interest rate adjustments, and the bursting of the metaverse bubble, Roblox's stock price began to decline after reaching its peak. By mid-2022, it had plummeted over 70% and endured a two-and-a-half-year period of sideways consolidation.

【Roblox Stock Performance (with Meta/Metaverse Concept Stocks Overlay), Note: Red is Roblox, Blue is Meta, Green is Metaverse Concept Stocks, Source: TradingView】

In 2025, the Federal Reserve's continued dovish policy and the clearing of the metaverse bubble spurred Roblox's stock price higher. Following unexpectedly strong Q2 2025 earnings, the stock opened up over 20% and hit a new high on the news.

However, the good times were short-lived. After Roblox's Q3 earnings release in late October, disappointing results and conservative guidance cast a shadow over investors, causing Roblox stock to plunge over 15% that day.

Further exacerbating investor concerns, state attorneys general across the U.S., along with numerous private plaintiffs, recently accused the Roblox platform of posing risks to children and disregarding state and federal cybersecurity laws.

These multi-jurisdictional lawsuits have introduced greater uncertainty for Roblox investors, leading to a several-day Roblox stock sell-off that pushed the price down to the psychological threshold of $100 per share on November 6.

Is Roblox Stock Still a Good Investment?

Despite the recent significant decline in Roblox's stock price, we still believe it holds substantial investment value. Below are our reasons for considering buying Roblox stock.

On the Fundamentals:

1. Daily Active Users Continue to Climb

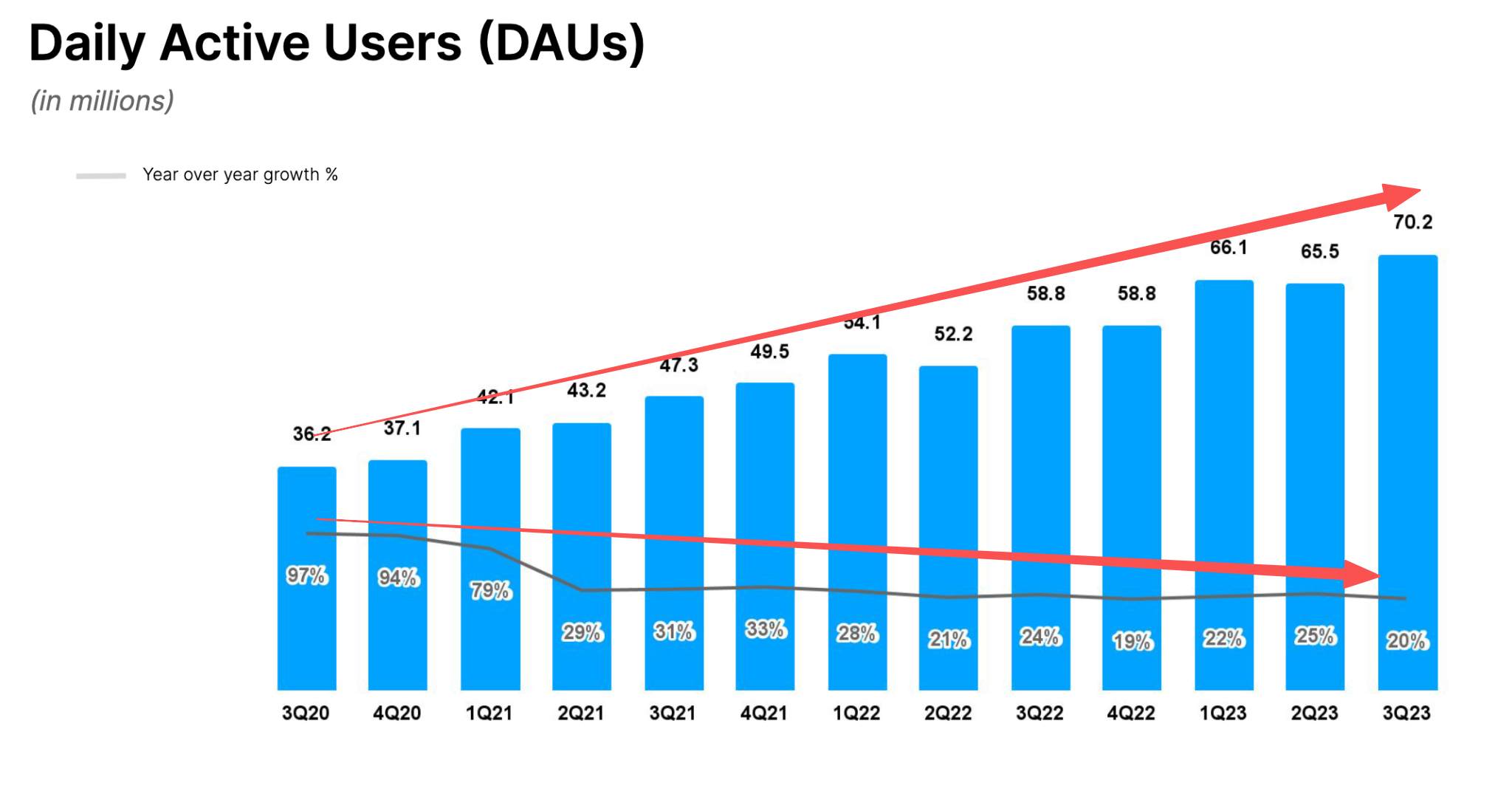

Quarterly data indicates that Roblox's user base has been consistently growing, with an accelerating upward trend observed since 2025. The company's profitability is highly correlated with its user base.

【Roblox Daily Active Users, Source: Roblox 3Q23 and 3Q25 Earnings Reports】

We believe the most significant highlight is that Roblox has reversed its previously slow year-over-year growth rate.

Since Q4 2024, both the growth rate and user numbers have shown a simultaneous upward trend, and earnings reports indicate this trend is widening. This suggests that Roblox's fundamentals continue to improve, and its underlying growth potential is expanding.

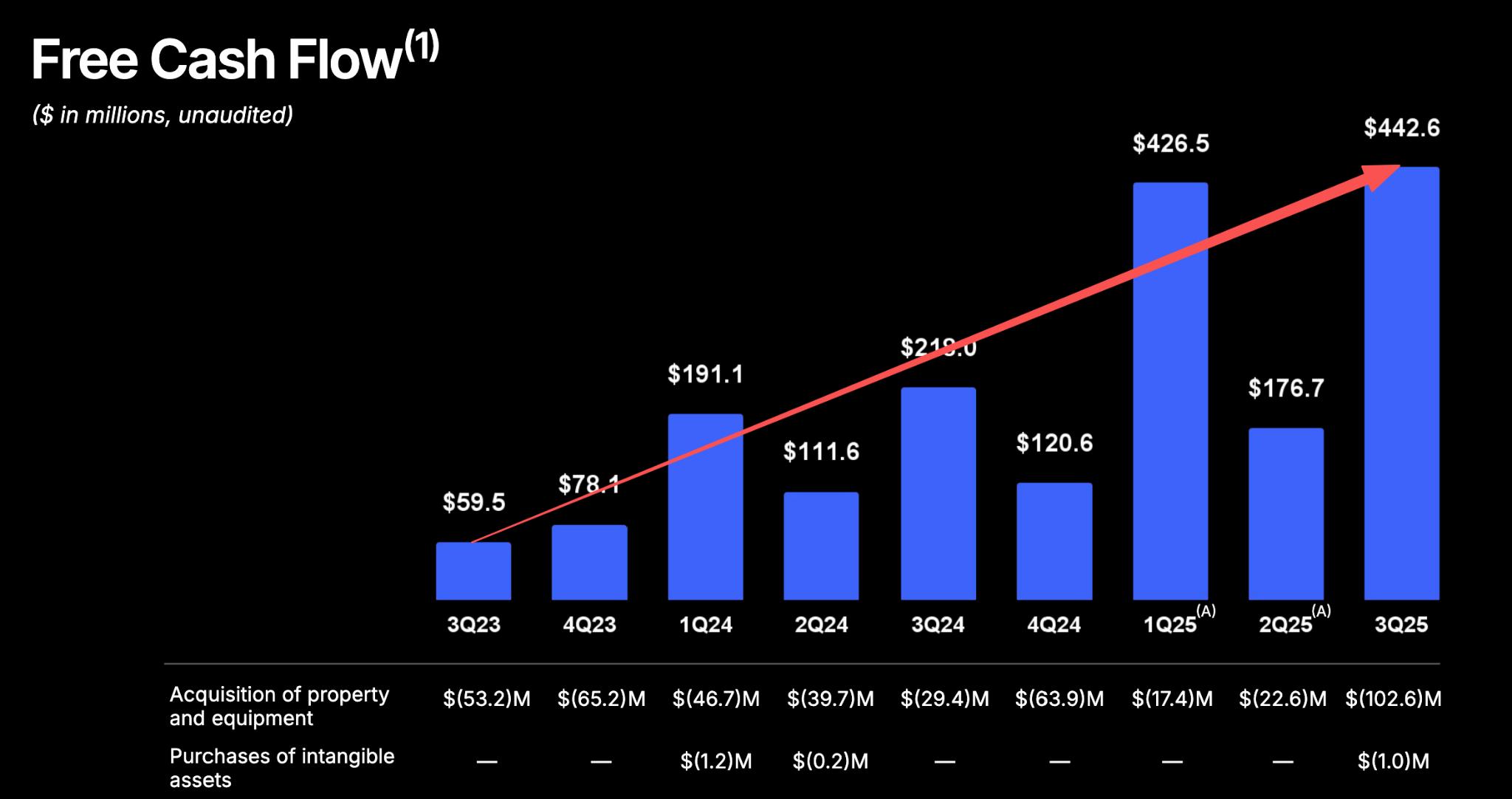

2. Robust Cash Flow Support

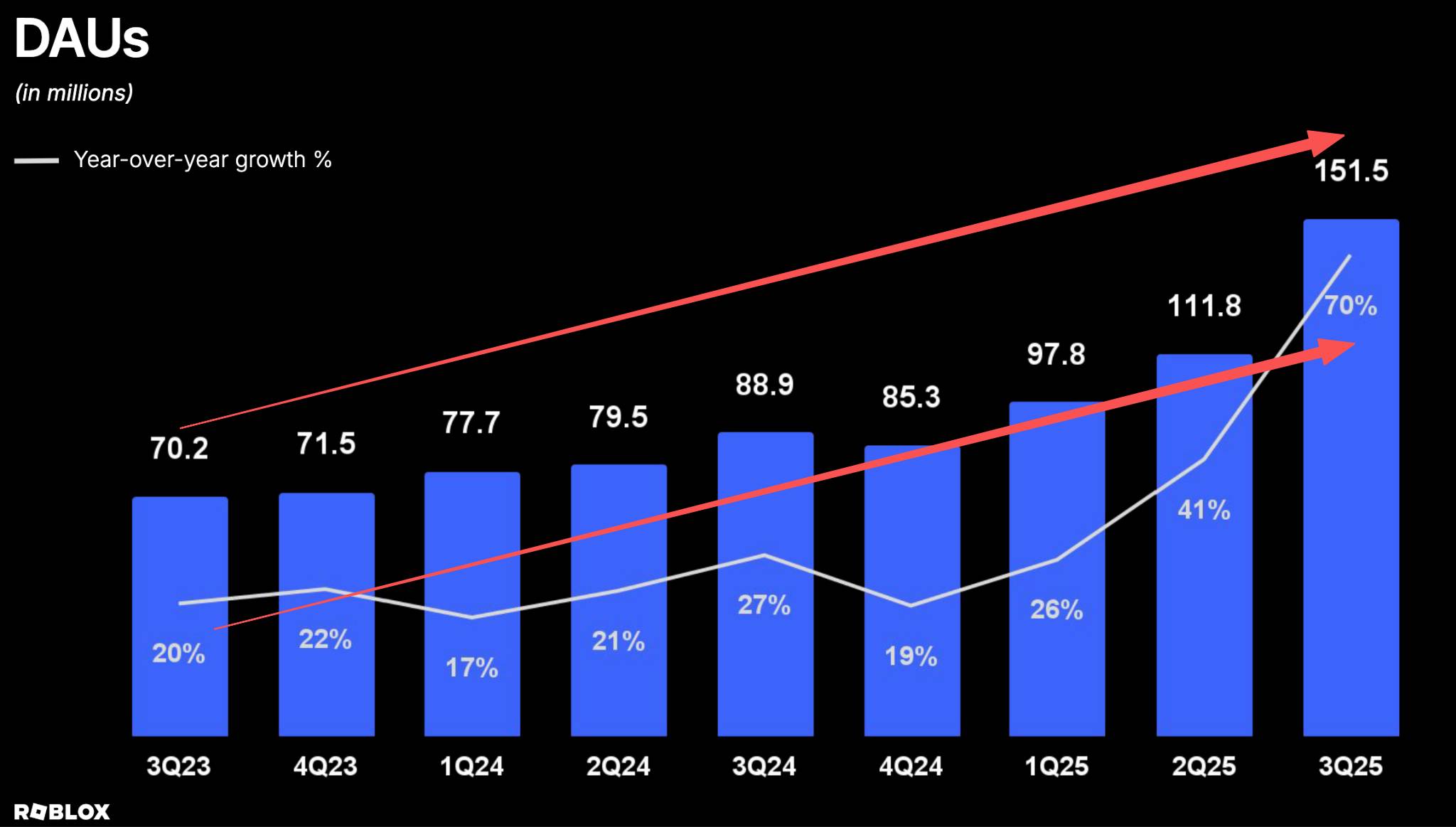

【Roblox Quarterly Free Cash Flow, Source: Roblox 3Q23 and 3Q25 Earnings Reports】

As evident, Roblox's cash flow has significantly improved.

After free cash flow turned negative in Q2 2022, leading to a continuous deterioration of the company's fundamentals, cash flow turned positive in Q3 2023 and has remained positive since. In its Q3 2025 earnings report, Roblox's free cash flow reached an all-time high.

3. Benefiting from the AI Application Wave

Roblox (RBLX.US) is one of the earliest and most direct beneficiaries of Artificial Intelligence (AI) technology adoption in the metaverse sector.

Unlike Meta, which relies on a hardware ecosystem, Roblox's core asset lies in its User-Generated Content (UGC) ecosystem. AI provides UGC with a more convenient and efficient engine, enabling complex operational content to be completed via AI.

For example, since 2024, Roblox has launched AI generation tools (Code Assist and Material Generator), allowing developers to directly generate game logic, virtual items, and environmental assets through natural language.

Furthermore, through generative AI and personalized algorithms, Roblox dynamically generates quests, scenes, and even NPC interactions based on player behavior, thereby creating a personalized, immersive gaming experience.

For instance, Roblox's generative AI NPC system can provide real-time feedback based on player conversations, giving the virtual world human-like interaction characteristics. This feature transforms Roblox's "virtual world" from static scenes into dynamic ones, enhancing user retention, as continually evolving dynamic storylines align more with the concept of a "virtual world" game than static, repetitive narratives.

On the Technical Front:

Emotional Sell-off

Disappointing Q3 earnings revenue and guidance led to a significant market sell-off of Roblox stock.

Secondly, the multi-jurisdictional lawsuits have introduced greater uncertainty for Roblox investors, causing a several-day Roblox stock sell-off that pushed the price down to the psychological threshold of $100 per share on November 6. However, signs of a rebound appeared on the trading day of November 7.

【Roblox Stock Chart, Source: TradingView】

If Roblox stock stabilizes after the panic-driven sell-off around the $100 psychological level clears, investors may consider short-term entry opportunities.

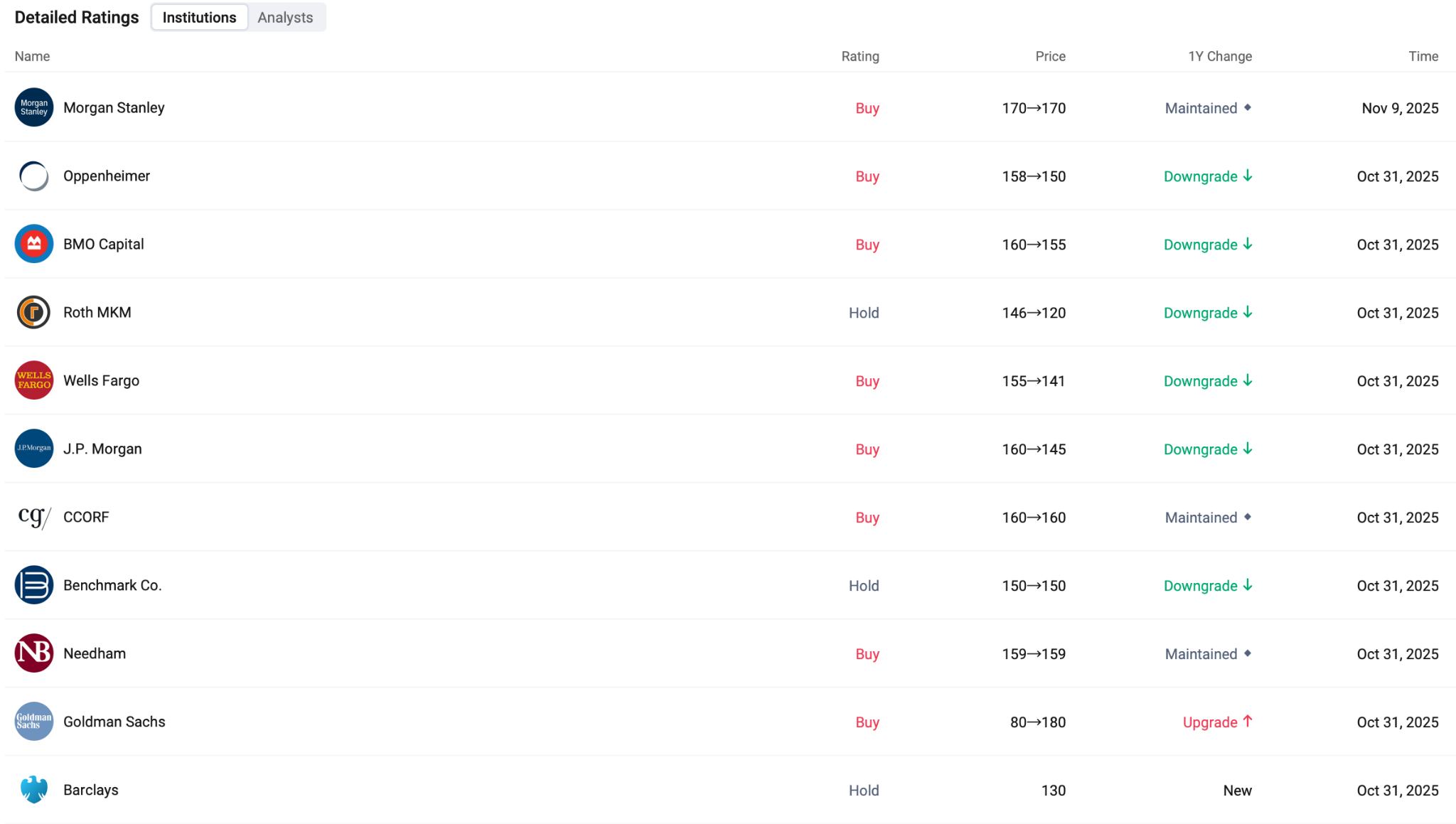

Furthermore, our outlook is not unique, as several institutions continue to hold a positive view on Roblox.

Goldman Sachs upgraded Roblox from "Neutral" to "Buy" and adjusted its price target from $155 to $180. Morgan Stanley maintained its "Buy" rating on Roblox with a price target of $170. JPMorgan Chase also maintained its "Buy" rating on Roblox and adjusted its price target to $145.

Even if most institutions have lowered Roblox's price target, there remains significant upside potential compared to the current stock price.

What's Next for Roblox Stock?

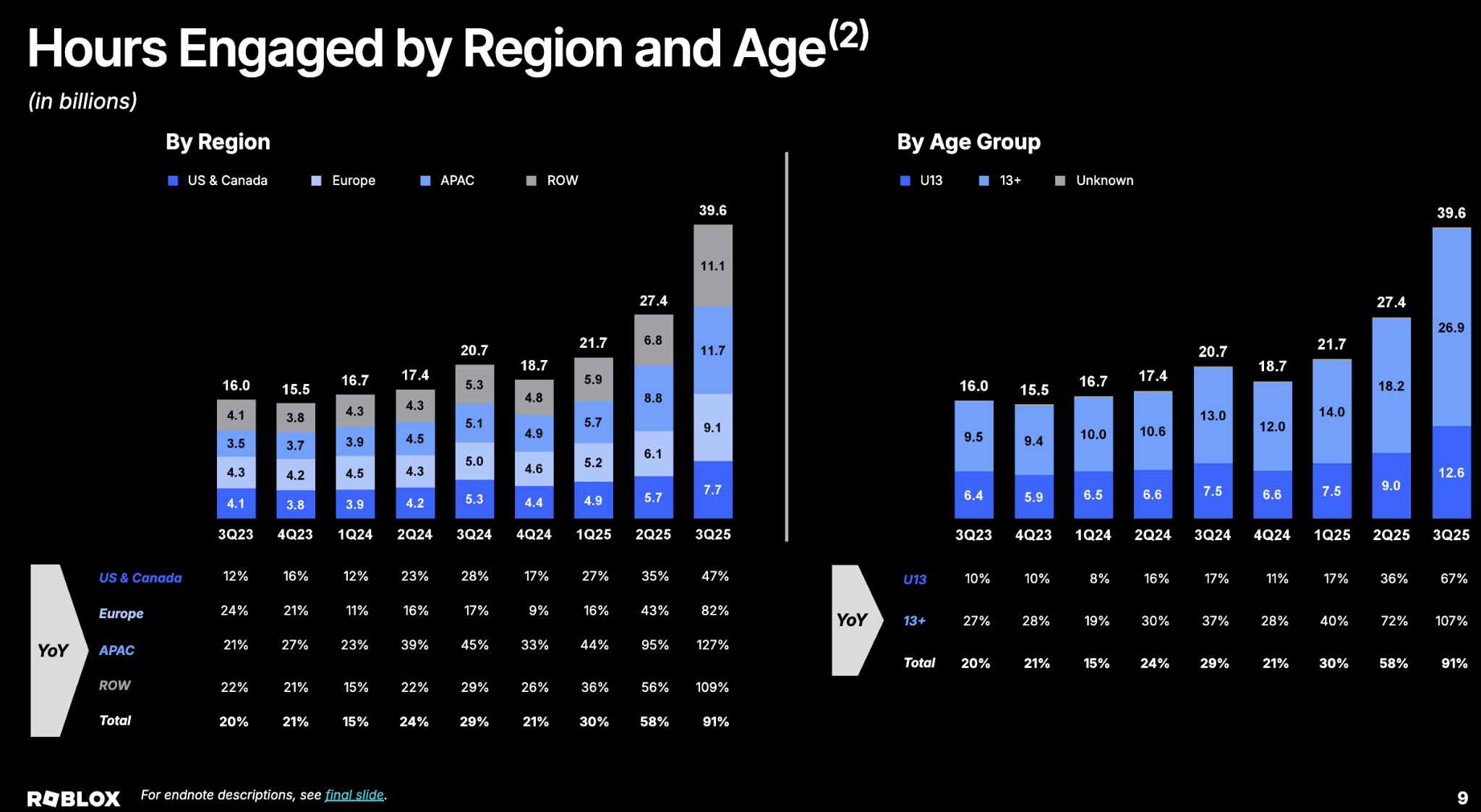

Roblox's peak activity in the Asia-Pacific (APAC) region typically falls between the European/U.S. peak traffic during the Christmas season and the peak traffic around Chinese New Year.

【Roblox Engagement Hours by Region and Age, Source: Roblox 3Q25 Earnings Report】

This means that from mid-December to mid-February, the platform benefits from nearly two consecutive months of high activity during K-12 student holidays globally, making this Roblox's golden period.

More simply, we can largely predict that the Q4 2025 data will be significantly impressive to market investors.

Summary

We believe Roblox's fundamentals remain strong, suggesting continued investment value.

Although Roblox is currently grappling with multiple ongoing lawsuits and its stock price has declined for several days, we anticipate that as the emotional trading sell-offs near an end and the market refocuses on fundamentals, Roblox stock is poised to receive sustained inflows of value-driven capital.