1 Warren Buffett Stock to Buy Hand Over Fist in November

Key Points

American Express is the classic Buffett stock, and he hasn't sold it since Berkshire Hathaway first bought it in 1995.

It's benefiting from higher spending in affluent circles.

It's attracting younger customers to its platform who will drive future growth.

- 10 stocks we like better than American Express ›

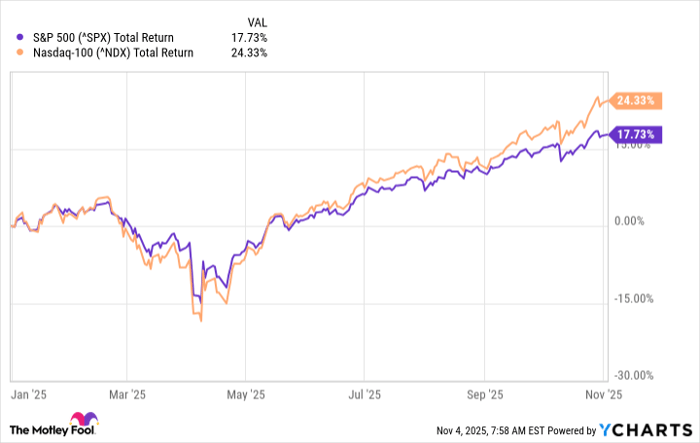

The market is back to strong bull growth, and as we get closer to the end of the year, it looks like it's going to be another double-digit percentage gain for the S&P 500.

As usual in strong bull markets, the gains are being driven by growth stocks. Consider how the Nasdaq-100, which is predominantly comprised of tech growth stocks, is performing in comparison with the broader index:

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

^SPX data by YCharts

This is a pattern in bull markets. However, there are still value stocks that have a lot to offer, even beyond their stability and security. American Express (NYSE: AXP) is beating the market right now, and coming into holiday spending season, it's a great time to pick up shares.

Warren Buffett's favorite

Warren Buffett says his favorite investment holding period is forever, but he sells stocks all the time. Consider that in the 2025 third quarter, Berkshire Hathaway was a net seller of stocks for the 12th straight quarter.

However, American Express is one stock he hasn't sold since he bought it in 1995. It makes up 17.6% of Berkshire Hathaway's equity portfolio at today's prices, and it owns 22% of the company's outstanding shares.

Buffett has praised it numerous times over the years for many reasons. He loves its global brand strength, its varied revenue streams, its excellent management, and its dividend. If you go through all of the traits Buffett loves in a stock, American Express is the paradigm of the classic Buffett stock.

This is the kind of company that can manage through many different kinds of economic cycles and keep growing. It's celebrating its 150th anniversary this year, and it feels as fresh as ever.

Image source: American Express.

Resilient consumers in any economy

American Express is unique in several ways that give it an economic moat and make it very hard for any competitor to step into the niche it's carved out for itself in finance. It has a fee-based model that lends itself to loyalty, and 72% of new card acquisitions in the third quarter were for fee-based products. The company recently refreshed many of its fee-based cards and raised the annual fees, yet new U.S. Platinum account acquisitions doubled compared to pre-refresh levels.

These cards, and the rewards they come with, appeal to American Express' core affluent consumer base. These customers have more discretionary income, and they're more resilient despite continued macroeconomic pressure. American Express' U.S. platinum card consumers spend more than $500 billion annually alone, and the company uses its insights into their spending patterns to design an attractive rewards program.

Analysts have been talking about the "K" economy that seems to be taking place, where things are getting worse for lower socio-economic levels but better for higher-income earners. American Express is benefiting from trends of higher-income earners having more to spend.

The short- and long-term opportunity

The proof is already in the pudding. Revenue increased 9% year over year in the third quarter to $421 billion, and earnings per share (EPS) rose 19% to $4.14. Management raised it full-year forecast from a low of 8% to a low of 9% revenue growth, and an EPS low from $15 to $15.20. With the holiday shopping season approaching, it should continue to see robust growth.

That may make now a great time to buy shares, but the long-term opportunity also looks compelling. American Express added 3.2 million new cards in the quarter, of which 64% were to millennial or Gen Z customers. These age cohorts account for 36% of spend, the same percentage as Gen X, and these are the shoppers who will drive new growth for years.

The company also benefits from the network effects of increasing its membership, which makes its platform appealing to more merchants. As more members sign up and the company adds more merchants, there's so much opportunity for this Buffett stock to keep up its growth and reward shareholders for years.

Should you invest $1,000 in American Express right now?

Before you buy stock in American Express, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and American Express wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $591,613!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,152,905!*

Now, it’s worth noting Stock Advisor’s total average return is 1,034% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

American Express is an advertising partner of Motley Fool Money. Jennifer Saibil has positions in American Express. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.