Litecoin Price Forecast: LTC breaks above bullish technical pattern, targets $170 mark

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

Litecoin price breaks out of an ascending channel pattern, signaling potential upside acceleration.

Open Interest reaches a record high of $1.27 billion, while hashrate continues to climb, boosting network security.

Technical setup supports a rally continuation toward the $170 target level.

Litecoin (LTC) price is showing renewed bullish strength after breaking out of an ascending channel pattern, trading above $133 at the time of writing on Wednesday. This breakout often signals the start of an accelerated uptrend, which is further supported by the rising Open Interest (OI) and a steadily climbing hashrate, targeting a rally toward $170.

Litecoin’s Open Interest hits a record high of $1.27 billion

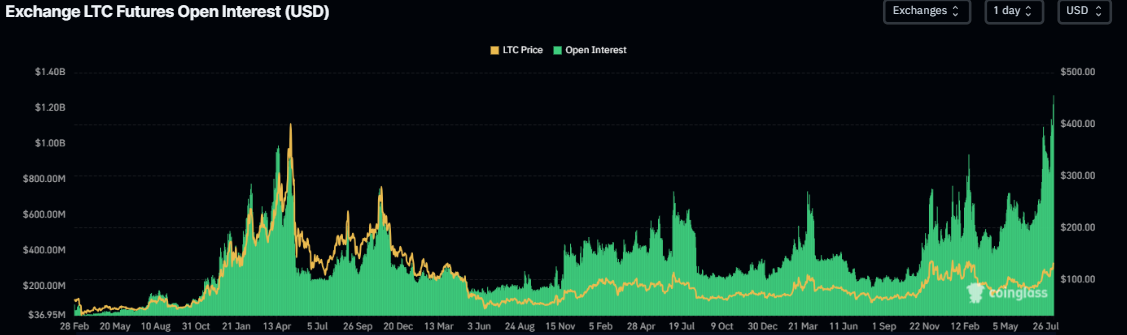

CoinGlass’ data shows that the futures OI in Litecoin at exchanges rises to a new all-time high of $1.2 billion on Wednesday from $832 million in early August. Rising OI represents new or additional money entering the market and new buying, which could fuel the current LTC price rally.

Litecoin Open Interest chart. Source: CoinGlass

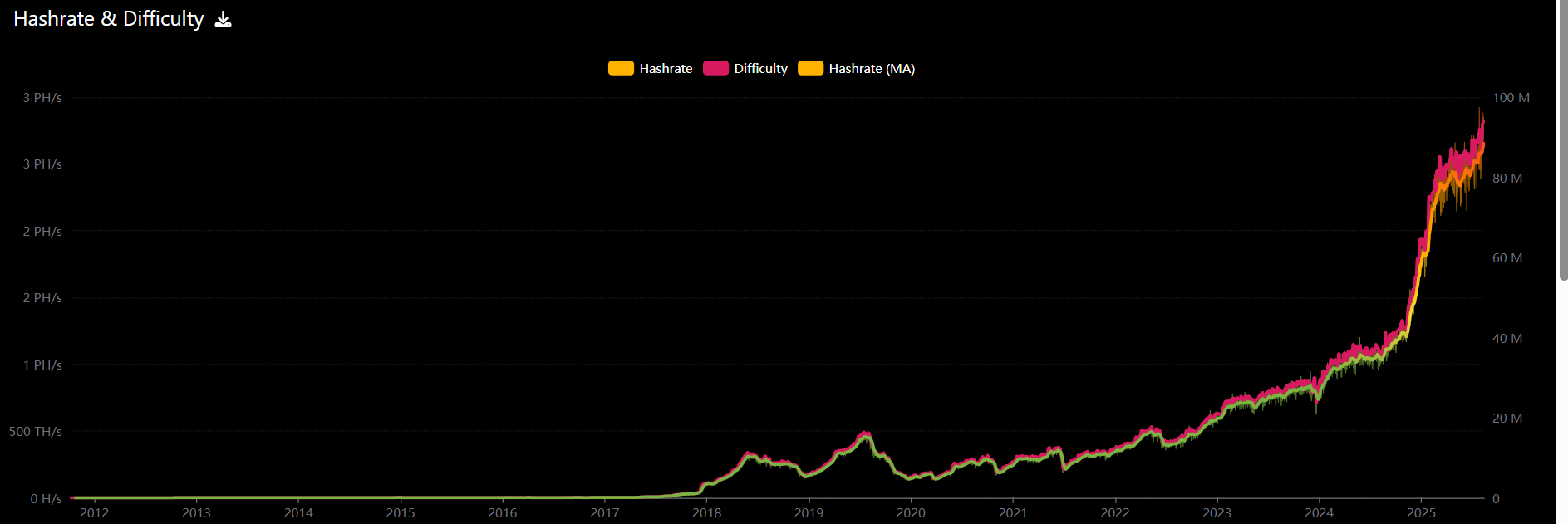

Litecoin’s hashrate has been constantly rising, as shown in the graph below, indicating a significant increase in mining power and network security since its launch, which has boosted investors’ confidence in the LTC network.

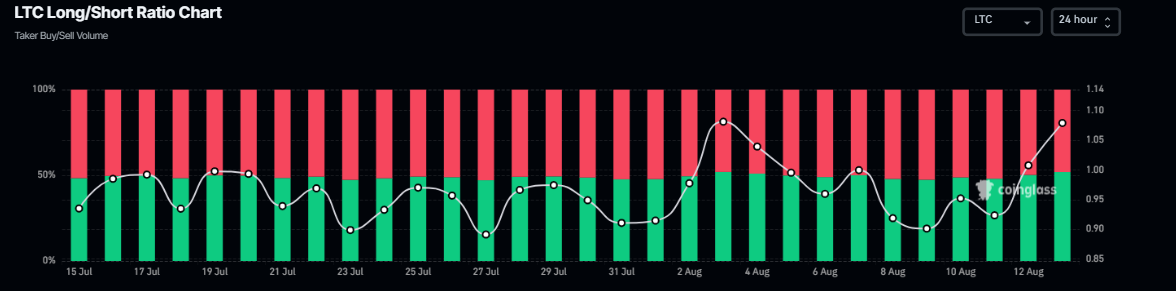

Adding to this positive narrative is the rising bullish bets among LTC traders. Coinglass’s long-to-short ratio data for LTC reads 1.08, the highest level over a month.

Litecoin long-to-short ratio. Source: CoinGlass

Litecoin Price Forecast: Bulls aiming for $170 mark

Litecoin price closed above the ascending parallel channel pattern (drawn by connecting multiple highs and lows with two trendlines since mid-March) on Tuesday. The breakout of this pattern favors the bulls, with a technical target often projected as the channel’s height from the breakout point. At the time of writing on Wednesday, it continues to trade higher above $133.

If LTC continues its upward trend, it could extend the rally toward its technical target of $170.30. Investors should be cautious of this theoretical move, as any upside move could encounter resistance at the December 5 high at $147.06, where traders could book some profits.

The Relative Strength Index (RSI) on the daily chart read 70, moving upward toward its overbought condition, indicating strong bullish momentum. The MACD showed a bullish crossover on August 5 and also shows rising green histogram bars, further supporting the bullish thesis.

LTC/USDT daily chart

However, if LTC faces a correction, it could find support at the upper channel trendline boundary at $125.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.