AXS Investments Loads Up on 213,000 SQQQ Shares

Key Points

Acquired 213,447 shares, estimated at ~$3.25 million based on the quarterly average price as of Q3 2025

Transaction value represents 1.4% of 13F reportable assets under management

Post-trade stake: 213,447 shares valued at $3.25 million

The position accounts for 1.4% of fund AUM, placing it outside the fund's top five holdings

- These 10 stocks could mint the next wave of millionaires ›

On November 4, 2025, AXS Investments disclosed a new position in ProShares UltraPro Short QQQ (NASDAQ:SQQQ), acquiring 213,447 shares for an estimated $3.25 million.

The transaction's value represents 1.4% of 13F reportable assets under management. That's outside the fund's top five holdings. AXS Investment's post-trade stake in SQQQ is 213,447 shares valued at $3.25 million, confirming that the exchange-traded fund (ETF) position was built from scratch in Q3 2025.

What happened

According to a Securities and Exchange Commission (SEC) filing dated November 4, 2025, AXS Investments LLC initiated a new position in ProShares UltraPro Short QQQ, purchasing 213,447 shares in Q3 2025. The estimated transaction value was $3.25 million.

What else to know

This new position represents 1.4% of 13F reportable AUM after the trade.

Top holdings after the filing:

- Palantir Technologies (NASDAQ:PLTR): $9.48 million (4.1% of AUM)

- Nvidia (NASDAQ:NVDA): $7.39 million (3.2% of AUM)

- Netflix (NASDAQ:NFLX): $6,894,989 (3.0% of AUM)

- Meta Platforms (NASDAQ:META): $6.78 million (2.9% of AUM)

- Alphabet Class A (NASDAQ:GOOGL): $6,643,194 (2.9% of AUM)

As of November 3, 2025, SQQQ shares were priced at $12.99, down 65.5% over the past year and underperforming the S&P 500 by 83.5 percentage points.

The fund’s dividend yield stood at 0.65% (as reported by FMP as of November 4, 2025), and the price was 76.6% below its 52-week high (as of November 4, 2025).

ETF overview

| Metric | Value |

|---|---|

| AUM | $2.97 billion |

| Dividend yield | 0.65% |

| Price (as of market close November 3, 2025) | $12.99 |

| 1-year price change | (65.5%) |

ETF snapshot

Investment strategy seeks to deliver daily investment results, before fees and expenses, that correspond to three times the inverse (-3x) of the daily performance of the Nasdaq-100 Index.

The portfolio consists of financial instruments designed to provide returns consistent with the fund's investment objective, tracking the 100 largest non-financial companies listed on the Nasdaq Stock Market. The fund is structured as a non-diversified exchange-traded fund (ETF).

It employs financial instruments to achieve its stated objective. It holds index swaps instead of stock positions. With a substantial asset base, SQQQ serves as a tool for hedging or speculative strategies in volatile markets.

Foolish take

The SQQQ ETF is an unusual beast. It's a bearish bet on the tech sector, using ETF-specific trading tricks such as index swaps and futures to do the exact opposite of what the tech-heavy Nasdaq-100 index is doing on any particular day. The index goes up, the ETF goes down.

But that's not the whole story. It's also a heavily leveraged ETF, aiming to triple the underlying index performance -- again, in reverse. So if the Nasdaq-100 gains 1% today, the SQQQ should go down by roughly 3%.

So it's a very bearish investment, running counter to the tech stocks that make up the majority of AXS Investment's holdings. At the same time, it's a rather small investment at approximately 1% of AUM, and AXS Investment isn't closing its Alphabet and Nvidia positions.

Altogether, I'd call it a hedging strategy. Just in case the tech sector falls off a cliff in the next quarter or two, this SQQQ position should soften the blow.

On the other hand, it also undermines any gains the fund's largest positions might post. This investment is risk management at a sophisticated level. You can follow along by building a small SQQQ stake in your diversified portfolio, or go a step further and create a larger anti-Nasdaq-100 investment if you're really concerned about the tech sector right now.

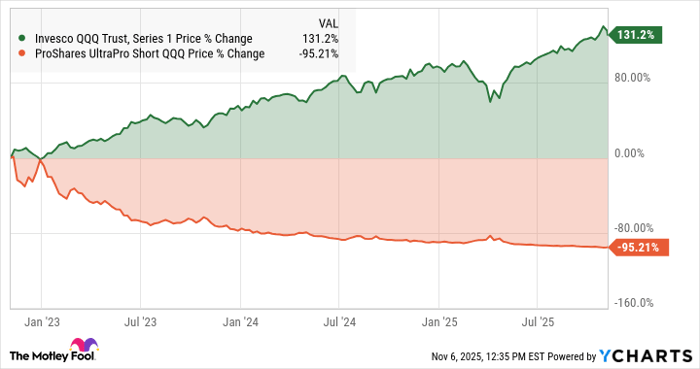

Whatever you do, please remember to check up on your leveraged ETF bet over time. Holding on to these synthetic ETFs for too long can be detrimental to your financial health. If and when the Nasdaq-100 rises again, you don't want a whole lot of SQQQ in your portfolioHere's how the fund has performed versus the plain Invesco QQQ Trust (NASDAQ:QQQ) over the last 4 years, for example. QQQ isn't even a leveraged ETF, but a direct play on the Nasdaq-100 index:

QQQ data by YCharts

Glossary

ProShares UltraPro Short QQQ (SQQQ): An exchange-traded fund (ETF) aiming to deliver three times the inverse daily performance of the Nasdaq-100 Index.

Inverse (-3x) performance: A strategy seeking to move in the opposite direction of an index, multiplied by three for daily returns.

13F reportable assets: Assets that institutional investment managers must disclose quarterly to the SEC if they exceed $100 million in qualifying securities.

Assets under management (AUM): The total market value of all assets a fund or investment manager oversees.

Dividend yield: Annual dividends paid by a fund or stock, expressed as a percentage of its current price.

Non-diversified ETF: An exchange-traded fund that invests in a limited number of securities, increasing potential risk and return.

Hedging: An investment strategy used to reduce potential losses from adverse price movements in an asset.

Speculative strategies: Investment approaches aiming for significant gains by taking higher risks, often based on market predictions.

Nasdaq-100 Index: A stock market index tracking the 100 largest non-financial companies listed on the Nasdaq Stock Market.

Financial instruments: Contracts or securities, such as derivatives, used to manage risk or achieve investment objectives.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 1,053%* — a market-crushing outperformance compared to 193% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of November 3, 2025

Anders Bylund has positions in Alphabet, Netflix, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Netflix, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.