Is This Nevada-Based Company a Strong Play for Growth-Oriented Portfolios?

Key Points

Good news for China-U.S. trade policy has been bad news for MP Materials.

The stock is down about 35% from recent highs, despite no change in its fundamental business.

For growth investors, MP has plenty of potential -- and risk -- to become the U.S.'s go-to for rare earth metals.

- 10 stocks we like better than MP Materials ›

MP Materials (NYSE: MP) sits on one of the most strategically important patches of earth in the U.S.: the Mountain Pass rare-earth mine in California.

It's the only major U.S. source of the metals that power electric vehicles (EVs), smartphones, drones, and wind turbines, among other applications. That fact alone has made it both a national security asset and a darling among materials stocks.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Indeed, by mid-October, MP stock underwent a euphoric gain, surging over 500% on the year. Since then, however, the mining stock has started to fall back to Earth.

For growth-oriented investors, this back-and-forth begs the question: Is MP a long-term winner, or should you wait this one out?

A red October for MP

MP Materials had a red October -- red-hot for the first half, then deep in the red for the second.

After doubling in value over the summer, MP's shares shot even higher on news that China would expand export controls on rare-earth elements. Investors were bullish on the possibility that, sans China, MP would become the U.S.'s go-to supplier for rare earth metals. Bitter tension between Beijing and Washington seemed to support that hypothesis sweetly.

Then came a chill.

Toward the end of October, hints of a U.S.-China trade thaw cooled red-hot enthusiasm for rare earth miners in the West. Indeed, when word spread that China and the U.S. could be reaching a truce on tariffs, MP's upward trajectory reversed. As of this writing, the stock is now down over 34% since its recent highs.

What does this mean for MP's business? On the one hand, it could hurt MP's future profitability. If the U.S. increases its supply of rare earth metals from China, it could lead to lower prices later on. MP is already struggling to become profitable. At this point, it doesn't need any more headwinds.

At the same time, it might not hurt profitability that much. Even if relations between China and the U.S. improve, it's unlikely Washington will return to its deep dependence on Chinese metals. Add in the fact that the Pentagon has already invested hundreds of millions in MP (more on that below), and the company's outlook doesn't look doomed.

Does MP have growth ahead?

There's a strong case to be made that MP's growth story is just beginning.

For one, look at its partners. In July, the Department of Defense (DOD) became its biggest shareholder with a $400 million investment. At the same time, it also guaranteed a 10-year price floor of $110 per kilogram of NdPr (neodymium-praseodymium). For context: The price for NdPr at the end of September was about $79 per kilogram.

Crushing operations at Mountain Pass, an essential first step in breaking down rare earth ore. Image source: MP Materials.

Then there's Apple (NASDAQ: AAPL). Many of Apple's devices need the high-performance magnets that MP specializes in. As such, the tech giant agreed to a $500 million partnership that will help MP build its second magnet factory (10X Facility) in exchange for a long-term supply of recycled magnets.

Finally, let's not forget the market itself: data centers, EV motors, wind turbines. Each new electrified technology needs what MP makes. So far, there's no near-term substitute for high-performance magnets, nor even a competitor that can rival MP's strength.

All the pieces are there. The question is whether MP can execute to bring them all together.

What investors should watch out for

To gauge MP's growth potential, investors might want to focus less on the day-to-day swings and more on what happens next operationally.

First, I'd keep an eye on MP's construction of its 10X Facility. The investment case improves materially as MP builds out its capacity to turn mined ore into magnets. Currently, it doesn't have the manufacturing arm to meet the market's demands, and this second magnet factory will be a crucial step for future profitability.

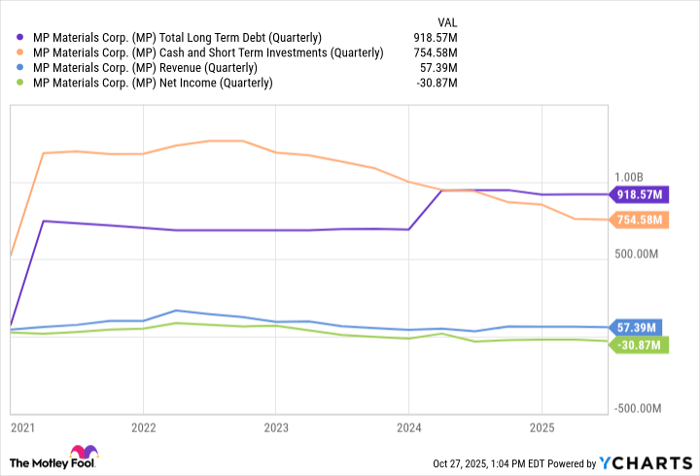

Next, I'd watch its balance sheet closely. MP is a mining company, after all, and capital expenditures are expected to be costly. At the end of June, MP had more than $750 million in cash and short-term investments, but its total debt was just shy of $920 million. And although its net losses have been shrinking, MP is still unprofitable.

MP Total Long Term Debt (Quarterly) data by YCharts

To be sure, it could take a few years before MP has the manufacturing capacity to generate meaningful revenue. Consistent quarter-to-quarter progress toward positive operating cash flow, however, will be the signal that it's executing well on its promise.

For growth-oriented investors, MP still has plenty of fuel in the tank for a positive run. Patience will matter more than time, as the growth thesis here isn't a quick gain but a slow build toward something more durable.

Should you invest $1,000 in MP Materials right now?

Before you buy stock in MP Materials, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MP Materials wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $603,392!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,241,236!*

Now, it’s worth noting Stock Advisor’s total average return is 1,072% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Steven Porrello has positions in MP Materials. The Motley Fool has positions in and recommends Apple. The Motley Fool recommends MP Materials. The Motley Fool has a disclosure policy.