Stablecoin issuers are projected to become major holders of US Treasuries by 2030 – Citibank GPS report

- Citibank's GPS report, released on Thursday, highlights that stablecoin issuers are projected to become major holders of US Treasuries by 2030.

- The report identifies 2025 as the potential year for blockchain's 'ChatGPT' moment in adoption, driven by regulatory change.

- Blockchain adoption in the public sector is rising, driven by a push for transparency and accountability in public spending.

Citibank's "Digital Dollars" report, released on Thursday, highlights that stablecoin issuers are projected to become major holders of US Treasuries by 2030. The report identifies 2025 as the potential year for blockchain's 'ChatGPT' moment in adoption, driven by regulatory change. Moreover, the adoption of blockchain in the public sector is rising, driven by a push for transparency and accountability in public spending, evident in the US government’s Department of Government Efficiency (DOGE) initiative and blockchain pilots by central banks.

Stablecoins and their issuers are making an entrance

Citibank's GPS report, released on Thursday, highlights that stablecoin issuers are projected to become major holders of US Treasuries by 2030. The report explains that creating a US regulatory framework for stablecoins would support demand for dollar-risk-free assets inside and outside the US. As a measure of having safe underlying collateral, stablecoin issuers will have to purchase US Treasuries or comparable low-risk assets against each stablecoin.

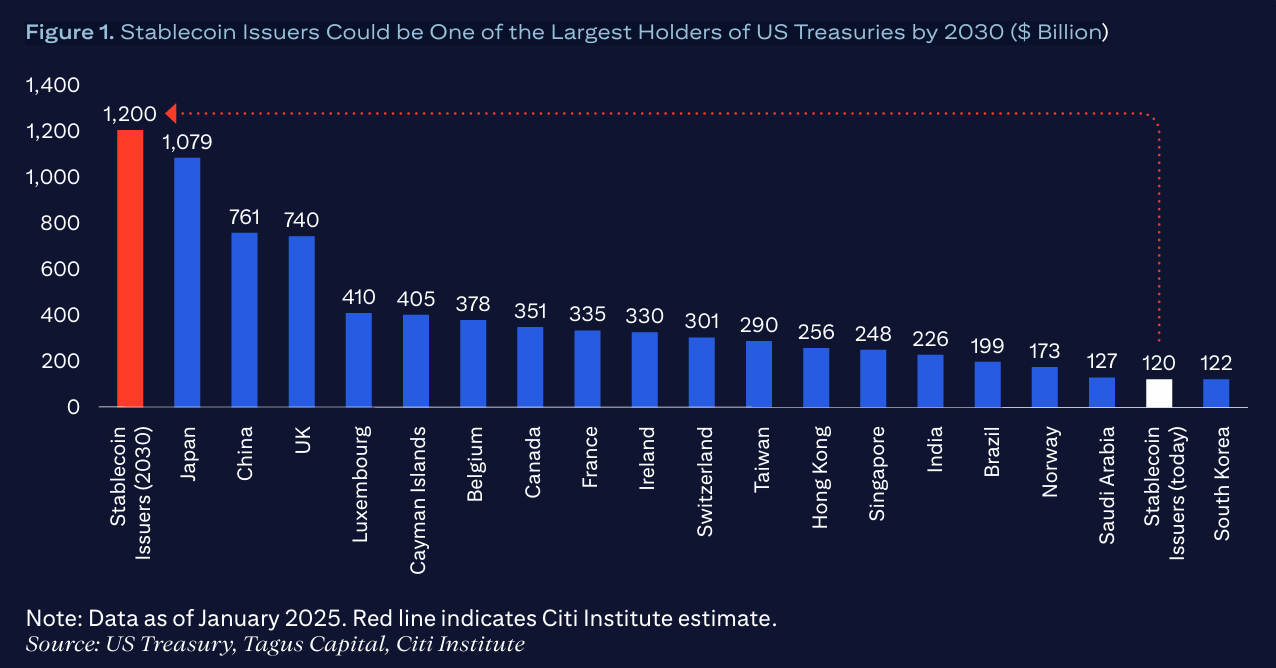

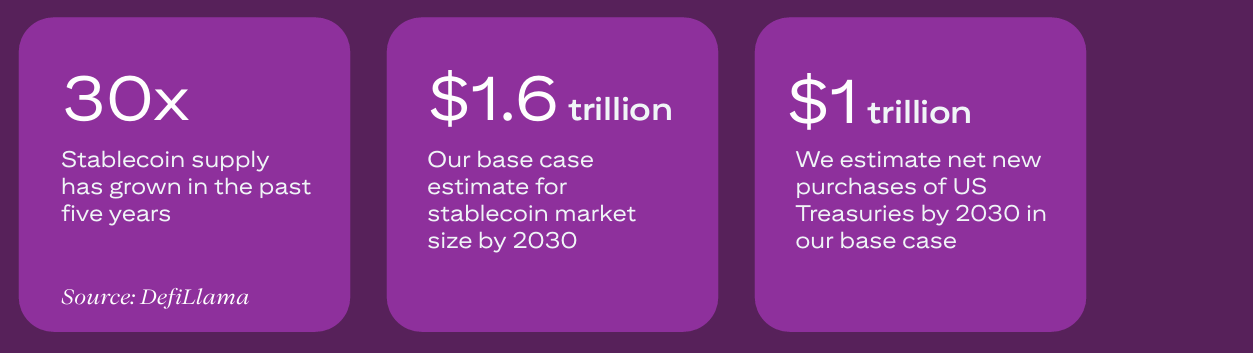

The chart below shows that the GPS's base-case stablecoin issuance scenario is expected to result in an additional $1 trillion or more of US Treasury purchases. Stablecoin issuers could hold more US Treasuries by 2030 than any jurisdiction today.

Stablecoin issuers could be one of the largest holders of US Treasuries by 2030. Source: Citibank report

The report further explains that the total outstanding supply of stablecoins could grow to $1.6 trillion by 2030 in the base case and to $3.7 trillion in the bull case. That said, the number could be closer to half a trillion dollars if adoption and integration challenges persist.

The Stablecoin bill (GENIUS ACT) is advancing rapidly through US Congress, with strong bipartisan support, and is expected to be enacted this year. It aims to establish a robust framework for Dollar-denominated stablecoins, enhancing US financial innovation and US Dollar (USD) dominance while mitigating associated risks. If the bill becomes an Act, the GPS report projections could hold strong.

Blockchain could have a 'Chat GPT' moment in 2025

The GPS report highlights that 2025 has the potential to be blockchain's "ChatGPT moment" for adoption in the financial and public sectors. A more favorable US regulatory stance on blockchain is expected to drive what could be a game-changing year. This could be seen as the departure of Gary Gensler, the former Chairman of the US Securities and Exchange Commission (SEC), on January 20, and the appointment of crypto-friendly Paul Atkins as SEC Chair on Monday.

The report further explains that a supportive US regulatory stance could lead to greater adoption of blockchain-based money and spur other use cases, financial and beyond, in the US private and public sectors. Key drivers include the European Union's Markets in Crypto Asset Regulation (MiCA), rising institutional crypto activity, and the US government's Strategic Bitcoin Reserve (SBR).

While banks, asset management, and public sector and government institutions have increased their involvement in blockchain, they have fallen short of some of the more bullish expectations.

"But times are changing. Digital finance already exists for consumer and institutional finance, including internet banking, but this is built on proprietary databases and centralized systems. We are now seeing the process of accelerating the integration of internet native technology, money, and use cases that are blockchain and digitally native," says the GPS report.

Moreover, the report explains that blockchain adoption in the public sector is also gaining traction, driven by an ongoing focus on transparency and accountability in public spending, as evident in the US government's DOGE initiative and blockchain pilots by central banks and Multilateral Development Banks.