Here is what you need to know on Friday, October 17:

Gold's impressive rally remains uninterrupted, with the precious metal surging to a new record-high well above $4,300. Meanwhile, the US Dollar (USD) continues to weaken against its rivals because of the uncertainty surrounding the US-China relations and the ongoing government shutdown. The US economic calendar will feature Industrial Production data for September on Friday.

US Dollar Price This week

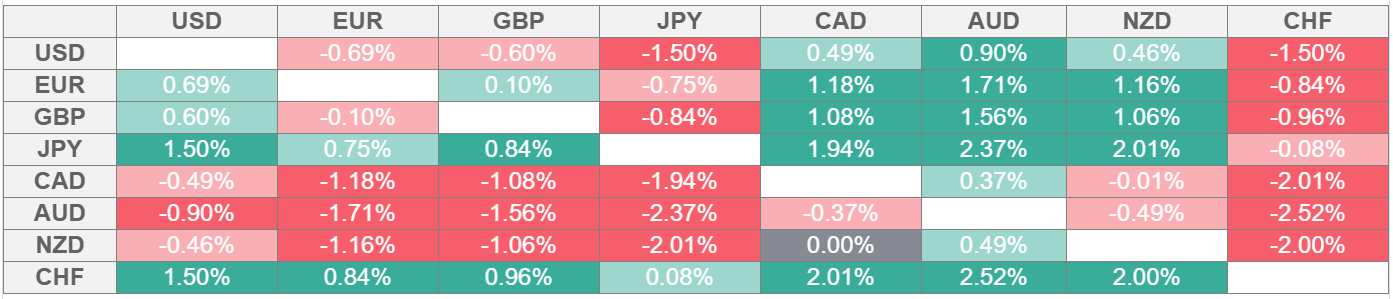

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The risk-averse market atmosphere allowed Gold to benefit from safe-haven flows and gather strength on Thursday. Resurfacing concerns over regional banks' lending practices and quality of loans in the US weighed heavily on Wall Street's main indexes, and dragged the benchmark 10-year US Treasury bond yield to its weakest level since early April below 4%, helping XAU/USD stretch higher. Early Friday, Gold clings to moderate daily gains at around $4,350, while the US Dollar Index edges lower toward 98.00, losing about 0.7% since Monday. In the meantime, US stock index futures were last seen losing between 0.6% and 0.9%, reflecting the souring risk mood.

French Prime Minister Sébastien Lecornu has survived two votes of no confidence. With this development, Lecornu will be in a parliamentary debate on next year's budget and try to approve it until the end of the year. After closing the previous three trading days in positive territory, EUR/USD holds its ground early Friday and trades modestly higher on the day above 1.1700. Later in the session, the Eurostat will publish revisions to September Harmonized Index of Consumer Price (HICP) data.

GBP/USD benefited from the selling pressure surrounding the USD and climbed to a fresh 10-day high above 1.3450 on Thursday. The pair stays in a consolidation phase at around 1.3450 in the European morning on Friday. Bank of England (BoE) Chief Economist Huw Pill and policymaker Megan Greene will be delivering speeches later in the day.

USD/JPY remains under heavy bearish pressure for the fourth consecutive day and declines toward 149.50, losing more than 0.5% on a daily basis.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.