AUD/USD tumbles to near 0.6450 amid US-China trade frictions

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

AUD/USD slumps 0.5% to near 0.6450 amid trade tensions between the US and China.

RBA dovish bets have accelerated amid rising Australian jobless rate.

US-China trade frictions and Fed dovish bets remain drags on the US Dollar’s outlook.

The AUD/USD pair trades 0.5% down to near 0.6450 during the European trading session on Friday. The Aussie pair faces intense selling pressure as the Australian Dollar (AUD) underperforms its peers amid growing trade frictions between the United States (US) and China.

Australian Dollar Price Today

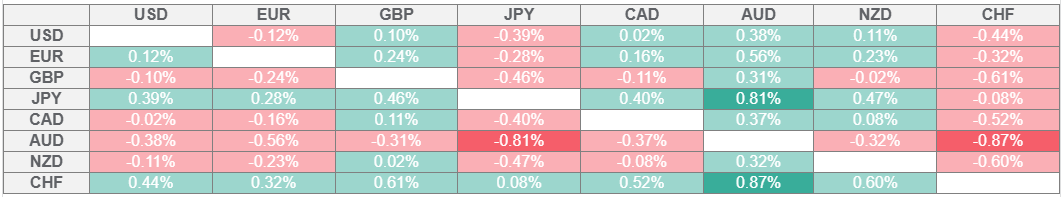

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Trade tensions between the US and China emerged after Washington imposed additional 100% tariffs on imports from Beijing, which will come into effect from November. Tariff threats from the US came after China announced export control measures on rare earth minerals.

In response, China’s Commerce Ministry has stated that Washington’s interpretation on Beijing’s rare earth export control measures is seriously “distorted and exaggerated”, and clarified that the demand of export licence is mere a regulatory measure, and not a ban on export of critical minerals, Reuters reported.

The impact of uncertainty over China’s economic outlook remains a major drag on the Australian Dollar (AUD), given that the Australia economy relies heavily on its exports to Beijing.

On the domestic front, Reserve Bank of Australia (RBA) dovish bets have accelerated due to an unexpected increase in the jobless rate. In September, the Unemployment Rate rose to 4.5% against estimates and the prior reading of 4.3%.

Meanwhile, the US Dollar Index (DXY) strives to gain ground after posting a fresh 10-day low near 98.00 earlier in the day. The outlook of the US Dollar (USD) remains bearish amid US-China trade tensions and accelerating Federal Reserve (Fed) dovish bets.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.