Ripple Price Forecast: XRP supported above $1.40 despite cooling buying activity

- XRP pares losses as bulls target a short-term breakout above $1.50.

- The MACD upholds a buy signal while the MFI indicator rises above the midline, suggesting a potential bullish shift.

- Muted buying interest among retail and institutional traders could keep XRP rangebound.

Ripple (XRP) is supported above $1.40, and trading around $1.47 at the time of writing on Wednesday. The increase, although minor, has erased losses posted the previous day. However, low activity in both the institutional and retail environments may temper XRP’s bullish scope, currently targeting Sunday's high at $1.67.

XRP retail and institutional demand weakens

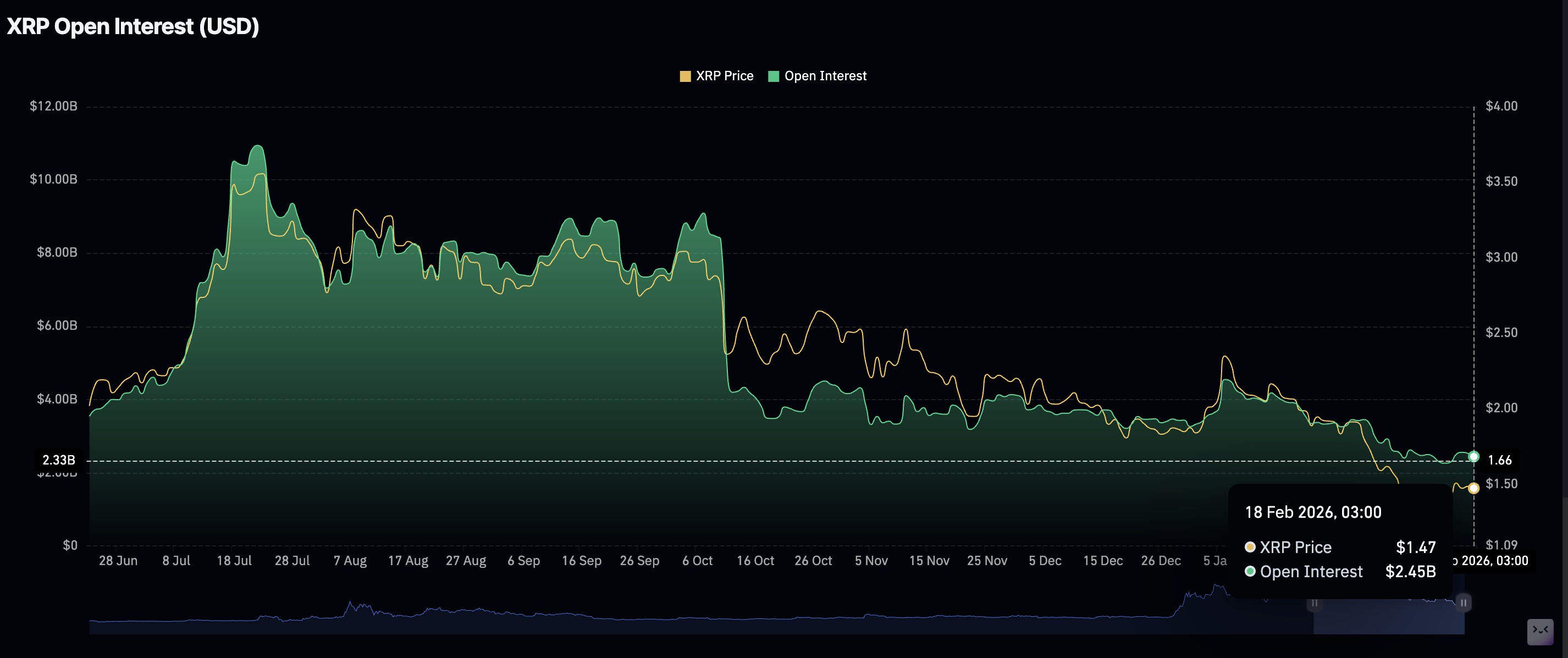

Since reaching its record high of $3.66 in July, XRP has struggled to sustain rebounds, leading to volatile price fluctuations amid a weakening retail derivatives market.

The XRP futures Open Interest (OI) stands at $2.45 billion on Wednesday, down from the $2.53 billion recorded on Tuesday. In contrast, the futures OI peaked at $10.94 billion in July, coinciding with the token’s all-time high.

The overextended decline in retail activity mirrors the drawdown in XRP price. As OI fades, traders close positions in droves and refuse to open new ones, leaving XRP vulnerable to market pressures and risk-off sentiment.

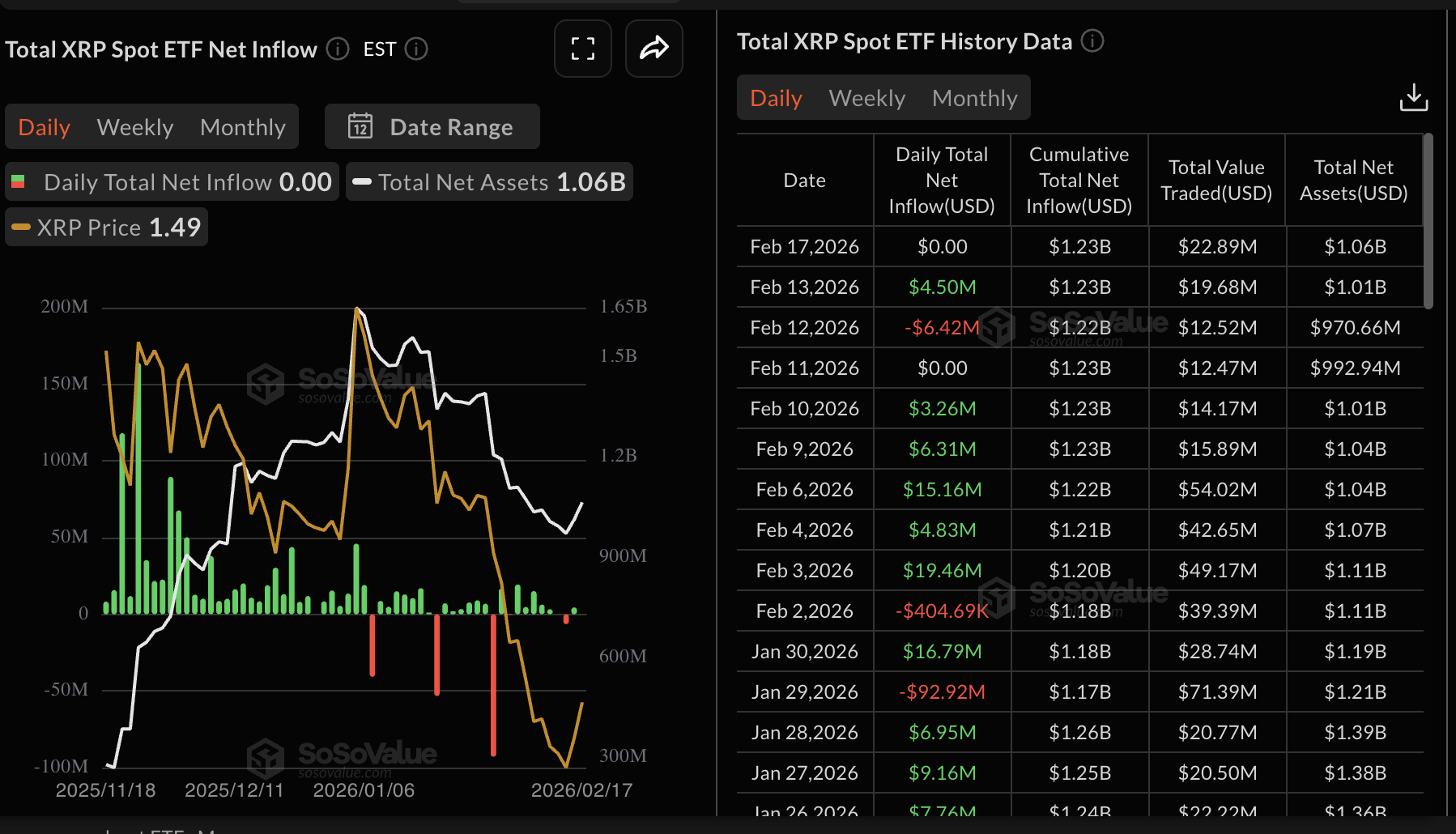

XRP spot Exchange-Traded Funds (ETFs) also experienced a steady decline in investor interest, as evidenced by muted activity on Tuesday. According to SoSoValue data, US-listed XRP spot ETFs remained quiet, with no flows, leaving cumulative inflows at $1.23 billion and net assets under management at $1.06 billion.

As interest in related investment products fades, overall risk appetite also diminishes. Weak sentiment dampens XRP’s recovery potential, while increasing the probability of an extended bearish trend.

Technical outlook: XRP steadies above support as sideways trading extends

XRP has remained below the high on Sunday at $1.67, while support around $1.40 holds. Despite the Moving Average Convergence Divergence (MACD) indicator having sustained a buy signal since Saturday, the overall structure remains bearish.

The 50-day Exponential Moving Average (EMA) at $1.71, the 100-day EMA at $1.92 and the 200-day EMA at $2.13 trend lower, limiting the upside. A continued decline below the demand zone at $1.40 may retest last Friday’s low at $1.35.

Meanwhile, the Money Flow Index (MFI), an indicator that tracks the flow of money in and out of XRP, is rising to 53, suggesting steady risk appetite. A higher increase in the MFI would confirm a bullish shift, with XRP likely to break out toward $1.67.

Near-term targets include a break above the psychological hurdle at $1.50 and the next seller concentration at $1.54, which aligns with the February 6 high.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.