Dow Jones Industrial Average hits record highs after dovish Powell appearance

- The Dow Jones shattered price records on Friday, hitting above 45,700 for the first time ever.

- Equities and general risk appetite soared after Fed Chair Powell made a dovish appearance.

- A September rate cut looks like a sure thing, bolstering general market sentiment.

The Dow Jones Industrial Average (DJIA) soared to new all-time highs on Friday, testing above 45,700 for the first time since the index’s inception. The Dow Jones soared over 900 points in a single day as investors piled ferociously back into bullish bets, as a September interest rate cut looks to be in the bag.

The Dow Jones is once again testing frontier territory, exploring chart regions north of 45,500. It has been nine months since the Dow posted a record monthly high, and as long as the wheels stay on the cart, August could prove to be one of the best months of 2025. The Dow Jones is up over 3.4% from August’s opening bids, and is up almost 25% from the early April tariff plunge that landed near 36,615.

Powell opens the door to rate cuts

Jerome Powell delivered surprisingly dovish remarks on Friday at the annual Jackson Hole economic symposium, hosted by the Federal Reserve (Fed) Bank of Kansas. Powell acknowledged that, despite the Fed’s overall cautious stance on interest rates, policy adjustment may be needed as downside risks grow.

“With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

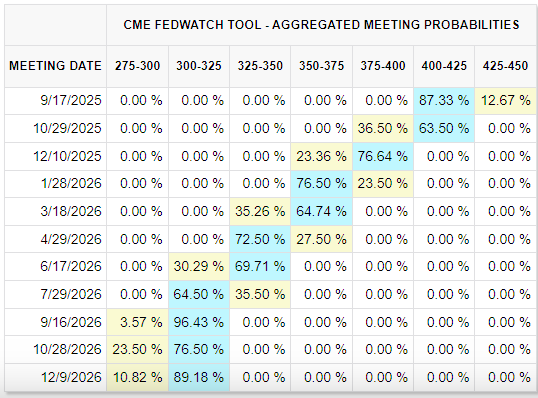

While Fed Chair Powell didn’t outright say whether or not he endorsed immediate interest rate action, his comments were enough to send markets full-tilt into bets of an interest rate cut on September 17, and equities piling into record highs. According to the CME’s FedWatch Tool, rate markets are now pricing in around 90% odds of at least a quarter-point rate trim in September, up from ~70% just the day before.

A follow-up interest rate cut in October remains unlikely, given the general unease Fed officials appear to have toward rate cuts. However, markets still have another rate trim chalked in for December.

Despite dovish Fed tones, key data risks remain

Some key roadblocks on the path to rate cuts still exist, however. Despite a steady unemployment rate and softening labor figures, both of which lend themselves to supporting interest rate cuts, US inflation remains a sticky affair, and there will be several iterations of key inflation data landing in markets’ laps before the Fed’s next interest rate decision.

The latest round of core Personal Consumption Expenditure Price Index (PCE) inflation data is expected to be released next week, one of the Fed’s key inflation metrics. Although inflation has certainly cooled from its post-pandemic highs, PCE inflation has not dipped below 2.6% since April of 2021. The upper bound of the Fed’s inflation target sits at 2.0%, well below the current figures. Any fresh sparks in inflation data could knock back the Fed’s willingness to explore interest rate cuts next month.

Dow Jones 5-minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.