Forex Today: US Dollar extends weekly uptrend ahead of Powell speech at Jackson Hole

Here is what you need to know on Friday, August 22:

The US Dollar (USD) stays resilient against its rivals early Friday after posting decisive gains on Thursday. Later in the American session, Federal Reserve (Fed) Chair Jerome Powell will deliver a speech on "Economic Outlook and Framework Review" at the annual Jackson Hole Economic Policy Symposium, hosted by the Kansas City Fed.

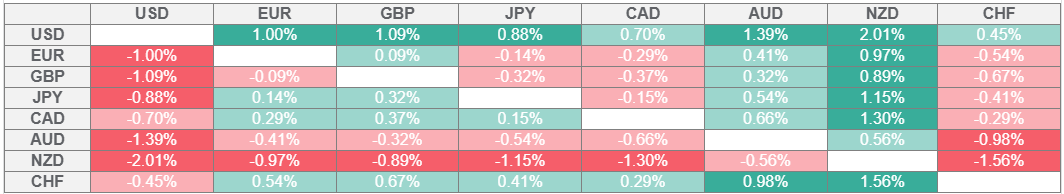

US Dollar Price This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD gathered strength in the second half of the day on Thursday after the preliminary S&P Global Purchasing Managers' Index (PMI) data for August showed that the economic activity in the private sector expanded at a faster pace than anticipated. The Manufacturing PMI rose to 53.3 from 49.8 in July and the Services PMI came in at 55.4, beating the market expectation of 54.2. The USD Index rose about 0.4% on the day and continued to stretch higher early Friday. At the time of press, the index was trading at an 11-day high at 98.75, gaining nearly 1% for the week. Meanwhile, US stock index futures lose between 0.2% and 0.6% in the European morning on Friday after Wall Street's main indexes closed in the red on Thursday.

USD/CAD trades at a fresh three-month high above 1.3900 in the early European session on Friday. In the second half of the day, Statistics Canada will publish Retail Sales data for July.

EUR/USD stays under modest bearish pressure and trades below 1.1600. On Thursday, the pair lost about 0.4%, pressured by the broad-based USD strength.

GBP/USD fell 0.3% on Thursday and closed the fourth consecutive day in negative territory. The pair stays on the back foot in the European morning and tests 1.3400.

Following Wednesday's rebound, Gold lost its traction and registered losses on Thursday as the benchmark 10-year US Treasury bond yield pushed higher following the upbeat US PMI data. XAU/USD continues to edge lower and trades near $3,330 in the European session.

USD/JPY gathered bullish momentum and rose more than 0.7% on Thursday. The pair holds its ground and trades at a fresh three-week high near 148.50.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.