Ethereum's Fusaka hard fork set for November completion, Glamsterdam upgrade near 100%

Ethereum’s upcoming Fusaka hard fork, scheduled for November, is expected to make the network much more scalable and secure. Several upgrades are underway by core developers, including the integration of 11 Ethereum Improvement Proposals (EIPs).

The EIP-7825 is one of several major features of the Fusaka upgrade, aimed at making the network resistant to malicious attacks. In addition, developers have proposed raising the gas limit to 150M to enhance the network throughput and support more complex operations. However, some other proposals, such as EIP-7907, which would expand the size of contract code, have been eliminated to speed up tests.

The Fusaka upgrade leverages the most recent hard fork of the Ethereum network, Pectra, which introduced account abstraction, the ability to stake more ether on a validator, and improved the efficiency of layer-2 networks.

Such improvements play a significant role in making Ethereum competitive with other blockchains. These blockchains are becoming increasingly popular in decentralized finance (DeFi).

Fusaka has not suffered any shortage of hitches in the release schedule. Nixo, an Ethereum protocol support member, raised the issues of submission deadlines, mainly the impending Devconnect event in November.

“If we want to ship by Devconnect, we need our timeline TIGHT. We’ll go over that in detail. Can we get client releases in the ~next month & a half?”

~ Nixo

Validator support and gas limit adjustments

Moreover, the Ethereum development team resolved to add the Glamsterdam upgrade immediately after Fusaka. Glamsterdam updates are still under completion until early August, with additional features to follow in 2026. Among the suggested improvements, there is a block time reduction to 6 seconds.

Ethereum validators have also significantly promoted a layer 1 gas limit of 45 million. This additional amount, which increases the current cap on gas of 37.3 million, is to lower transaction costs and add scalability to the network.

Vitalik Buterin, co-founder of Ethereum, stressed that almost half of the validators in support of this increase is indicative of widespread support for the change.

Although this would lower the cost of transactions and increase throughput, it has also raised the issue of network centralization. The potential rise in the gas limit may also increase the burden on solo validators, who may not be able to cope with the new demands of the blockchain.

ETH price surge

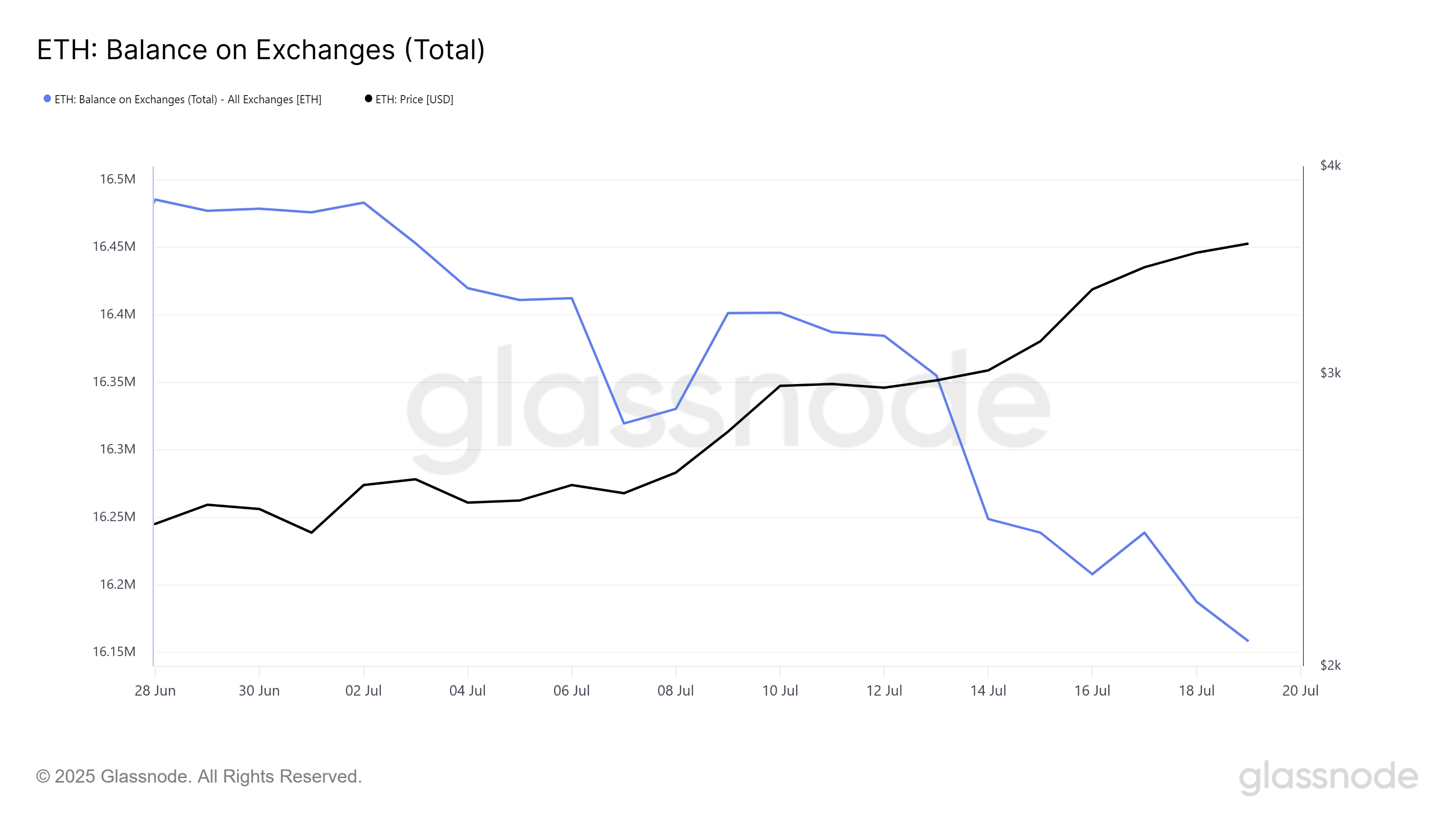

Ethereum has rocketed to a seven-month high at $3,745. The price increased by 27% in the last seven days due to robust investor accumulation. Over 317,000 ETH or more than $1.18 billion worth has been taken off exchanges since the beginning of July, which indicates holding behavior and low supply in the market.

On-chain metrics reveal that Ethereum is approaching an important turning point. The Network Value to Transactions (NUPL) ratio has reached the belief-denial zone. Historically, this indicator has been an indicator that holders start to earn a profit, and this can precede short-term corrections.

Analysts caution that should ETH rise beyond 4,000, it may initiate major sell pressure related to profit-taking.

Dutch market analyst Gert Van Lagen believes ETH is on its fifth wave of a long-term cycle. Van Lagen, in his analysis of market structures, forecasts this wave to take the asset to $10,000.

#Ethereum is poised to complete its 2019–2025 Bull Market with a textbook Expanding Diagonal as Wave v.

Each subwave within this structure is corrective. The current and final wave up is expected to break out of the Wave 3–4 megaphone pattern, completing Wave a, followed by a… pic.twitter.com/wvwAQbwXAy

— Gert van Lagen (@GertvanLagen) July 19, 2025

In the meantime, Ethereum developer Eric Conner disagreed with the arguments that the present rally is almost at its end. He adds that a 30% rise over present levels is not the doomsday. Conner notes that ETH increased 59 times during the past cycle. Assuming the token manages half that level, it may be valued up to $41,000 with the Ethereum market cap entering the trillion-dollar level.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More