Virtuals Protocol Price Forecast: VIRTUAL set to extend losses as triple top formation emerges

- Virtuals Protocol price drops over 10% on Monday after a failed breakout above key resistance.

- Santiment data shows traders increase profit-taking activity, adding to the selling pressure.

- The technical outlook highlights a possible triple top pattern with a potential breakdown, targeting the $1.23 mark.

Virtuals Protocol (VIRTUAL) price drops over 10% at the time of writing on Monday, trading around $1.78 following a failed attempt to break above a key resistance level over the weekend.

The decline suggests holders may be locking in profits and adding to the selling pressure. From a technical standpoint, forming a potential triple top pattern suggests that bearish momentum could intensify and target the $1.23 mark.

VIRTUAL holders book profits as bearish bets rise

Virtuals Protocol’s on-chain metrics show that VIRTUAL holders are booking some profits, according to Santiment’s Network Realized Profit/Loss (NPL), which computes a daily network-level Return On Investment (ROI) based on the coin’s on-chain transaction volume. Strong spikes in a coin’s NPL indicate that its holders are, on average, selling their bags at a significant profit. On the other hand, strong dips imply that the coin’s holders are, on average, realizing losses.

The chart below shows that the metric showed a strong spike on May 8 and May 9, the highest spike since December 16. Historically, when this spike occurred, prices fell nearly 20% to 30% due to increased selling pressure.

[14-1747643858765.07.24, 19 May, 2025].png)

VIRTUAL NPL chart. Source: Santiment

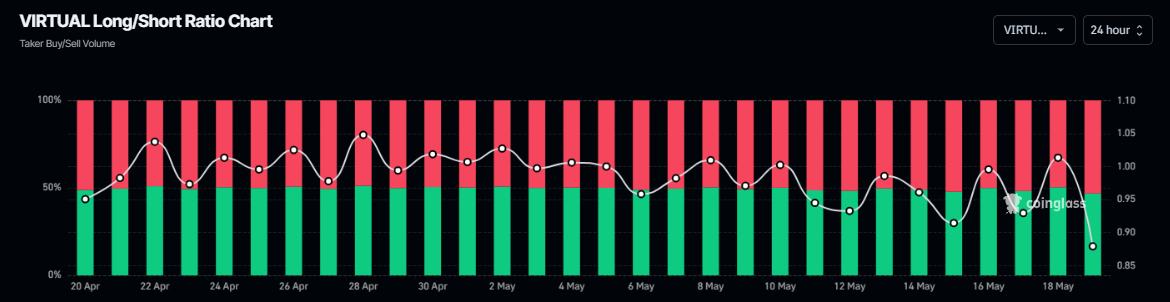

Another bearish sign is Coinglass’s VIRTUAL long-to-short ratio, which reads 0.87, the lowest level in over a month. A ratio below one reflects bearish sentiment in the markets as more traders are betting on the asset price to fall.

VIRTUAL long-to-short ratio chart. Source: Coinglass

VIRTUAL Price Forecast: Triple top price formation

Virtuals Protocol’s price action on the 4-hour chart has faced resistance around the $2.08 level since May 9, getting rejected multiple times. Meanwhile, the token has consistently found support near the neckline area around $1.66 and rebounded after revisiting it over the weekend. Another failed attempt to break above $2.08 on Sunday shows the formation of a potential triple top pattern, which often signals a shift in momentum from bulls to bears. At the time of writing on Monday, the coin trades down over 10%, approaching its neckline at $1.66.

If VIRTUAL breaks and decisively closes below $1.66, it would extend the fall to retest its technical target at $1.23. The target is obtained by extrapolating lower the distance from the top to the neckline.

The Relative Strength Index (RSI) on the 4-hour chart reads 48, below its neutral level of 50 and points downward, indicating increasing bearish momentum.

VIRTUAL/USDT 4-hr chart

However, if VIRTUAL recovers, it could extend its recovery to retest its daily resistance level at $2.08.