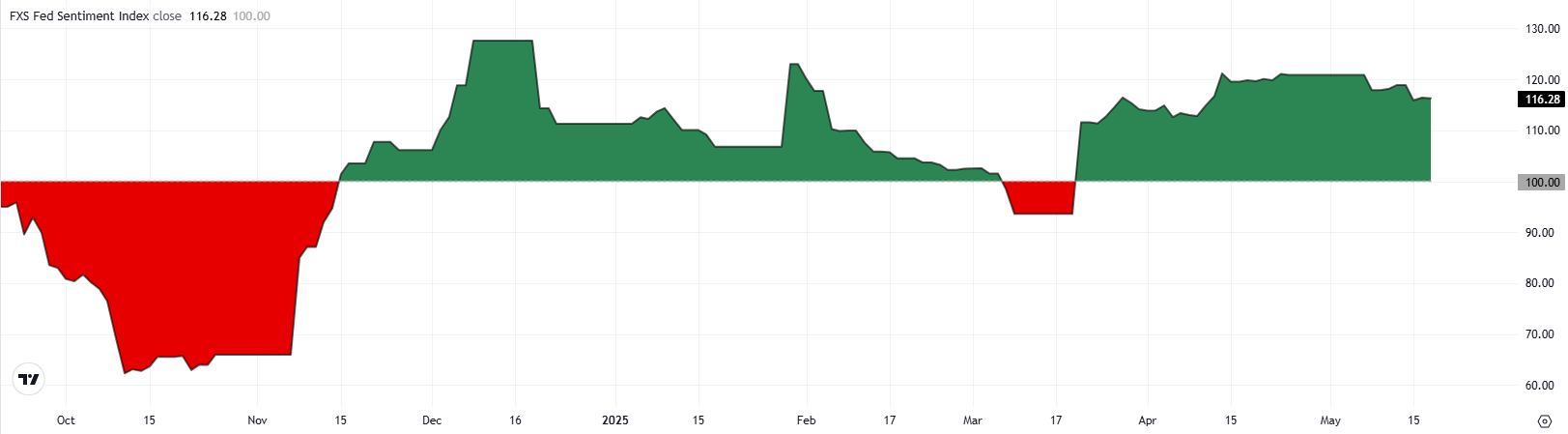

FXS Fed Sentiment Index stays in hawkish territory as markets await fresh comments

- FXStreet Fed Sentiment Index remains in hawkish territory after May meeting.

- Several Fed policymakers will be delivering speeches later in the day.

- Markets see virtually no chance of a Fed rate cut in June.

The Federal Reserve (Fed) left the interest rate unchanged at 4.25%–4.50% following the May policy meeting, as widely anticipated. In the policy statement, the Fed noted that the economic outlook uncertainty has increased further. While speaking to reporters in the post-meeting press conference, Fed Chairman Jerome Powell argued that the right thing to do in the current environment is to await further clarity.

FXStreet (FXS) Fed Sentiment Index declined slightly in the immediate aftermath of the Fed meeting but remained in the hawkish territory well above 100. Although the FXS Fed Sentiment Index continued to stretch lower, it is yet to point to a noticeable change in the Fed's overall hawkish tone.

The data published by the US Bureau of Labor Statistics showed earlier in the month that the annual inflation, as measured by the change in the Consumer Price Index (CPI), softened to 2.5% in April from 2.4%. Fed Vice Chair Philip Jefferson noted that the inflation data was consistent with further progress toward the 2% goal but said that it was still not clear whether an increase in inflation because of tariffs would be temporary or persistent. On a more hawkish note, Atlanta Fed President Raphael Bostic said that he was projecting the Fed to lower the policy rate just once in 2025 amid uncertainty.

Bostic is scheduled to speak again on Monday. Later in the day, New York Fed President John Williams, Dallas Fed President Lorie Logan and Minneapolis Fed President Neel Kashkari will be delivering speeches as well.

The CME Group FedWatch Tool shows that markets see little to no chance of a 25 basis points (bps) rate cut in June. Meanwhile, the probability of the Fed lowering the policy rate at least twice in 2025 stays around 70%, suggesting that the US Dollar (USD) could gather strength in case Fed officials voice their preference for a single rate cut.

The USD stays under pressure to start the week, with the USD Index losing more than 0.8% on the day at 100.12 at the time of writing. Moody's decision to lower the United States' credit rating late last week seems to be causing the USD to weaken against its peers on Monday. The rating agency announced that it downgraded the US' credit rating to 'AA1' from 'AAA', citing concerns about the growing $36 trillion debt pile. "Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs," Moody's explained, per Reuters.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.