US Dollar Index falls below 100.50 following Moody’s downgrade of US credit rating

The US Dollar Index faces pressure after Moody’s downgraded the US credit rating by one notch.

Moody’s now projects US federal debt to surge to around 134% of GDP by 2035, up from 98% in 2023.

US Treasury Secretary Bessent noted that Trump plans to impose tariffs on trade partners that fail in “good faith” negotiations.

The US Dollar Index (DXY), which tracks the US Dollar (USD) against a basket of six major currencies, has retraced its recent gains from the previous session and is trading around 100.40 during the Asian hours on Monday.

The US Dollar faces challenges as Moody’s Ratings has downgraded the US credit rating from Aaa to Aa1, aligning with previous downgrades by Fitch Ratings in 2023 and Standard & Poor’s in 2011. Moody’s now forecasts US federal debt to rise to approximately 134% of GDP by 2035, up from 98% in 2023. The federal deficit is projected to widen to nearly 9% of GDP, fueled by mounting debt-servicing costs, increased entitlement spending, and declining tax revenues.

However, the Greenback received support from renewed optimism over a 90-day US-China trade truce and expectations of further trade agreements with other nations. Meanwhile, US Treasury Secretary Scott Bessent told CNN on Sunday that President Donald Trump plans to impose tariffs at previously threatened levels on trade partners who fail to negotiate in “good faith.”

Economic data released last week showed signs of easing inflation, with both the Consumer Price Index (CPI) and Producer Price Index (PPI) indicating a slowdown in price pressures. These figures have increased expectations that the Federal Reserve could cut interest rates further in 2025, adding to the downward bias on the Greenback. Moreover, weak US Retail Sales data has reinforced concerns about a prolonged period of subdued economic growth.

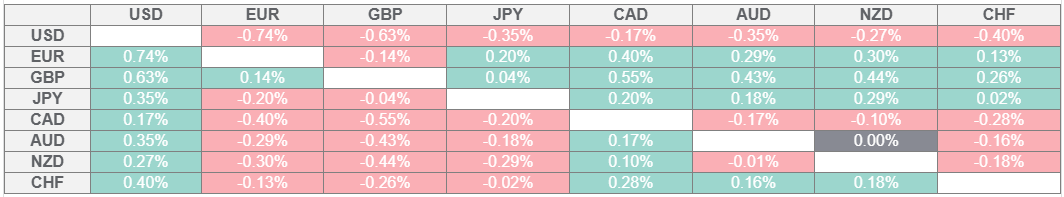

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.