Here is what you need to know on Monday, May 19:

Safe-haven flows dominate the action in financial markets at the beginning of the week. Eurostat will publish revisions to April inflation data later in the session. In the second half of the day, several Federal Reserve (Fed) policymakers will be delivering speeches.

US Dollar PRICE Today

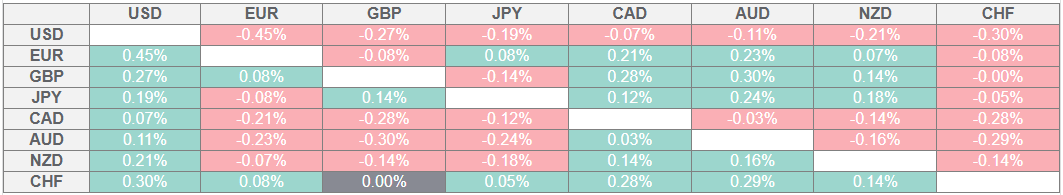

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Late Friday, Moody's announced that it downgraded the United States' credit rating to 'AA1' from 'AAA', citing concerns about the growing $36 trillion debt pile. "Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs," Moody's said, per Reuters. US stock index futures stay under strong bearish pressure in the European morning and were last seen losing between 0.8% and 1.3% on the day. The US Dollar (USD) Index retreats toward 100.50 after posting gains for fourth consecutive weeks.

On a positive note, a key congressional committee, the House panel, approved US President Donald Trump’s tax cut bill early Monday, paving the way for possible passage in the House of Representatives later this week.

Meanwhile, US Treasury Secretary Scott Bessent told CNN News on Sunday that President Trump will bring tariffs up to the April 2 levels if partners don't negotiate in good faith. "There are incoming deals with 18 important trading partners," he added.

EUR/USD holds its ground and trades slightly above 1.1200 in the early European session on Monday.

After losing more than 3% in the previous week, Gold recovers modestly and stays comfortably above $3,200.

GBP/USD gains traction and trades above 1.3300 on Monday. The pair closed the previous week marginally higher after recovering from the multi-week low it touched at 1.3140.

AUD/USD stays relatively quiet and fluctuates in a narrow range slightly above 0.6400 in the European morning. The Reserve Bank of Australia (RBA) will announce monetary policy decisions in the Asian session on Tuesday. Markets expect the RBA to lower the policy rate to 3.85% from 4.1%.

USD/JPY remains under bearish pressure and trades at around 145.00 to begin the European session. Bank of Japan (BoJ) Deputy Governor Shinichi Uchida reiterated earlier in the day that the central bank will keep raising interest rates if the economy and prices improve in line with their forecasts.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.