Bitcoin ATH Incoming? Analyst Flags Indicators That Preceded Every Major BTC Rally

Bitcoin continues to extend its recent recovery, gaining over 15% in the past two weeks to reach a market price of $97,559 at the time of writing. This renewed momentum brings the asset closer to the $100,000 psychological level, marking a potential turning point for investor sentiment in the broader crypto market.

While short-term price action often generates mixed reactions, some market analysts believe that key long-term indicators may be aligning for a larger move ahead. One of those voices is Bitcoin maxi Robert Breedlove, who shared a series of observations on X about indicators that could point toward a sustained bull run.

Miner Costs and Long-Term Holder Behavior Point to Market Strength

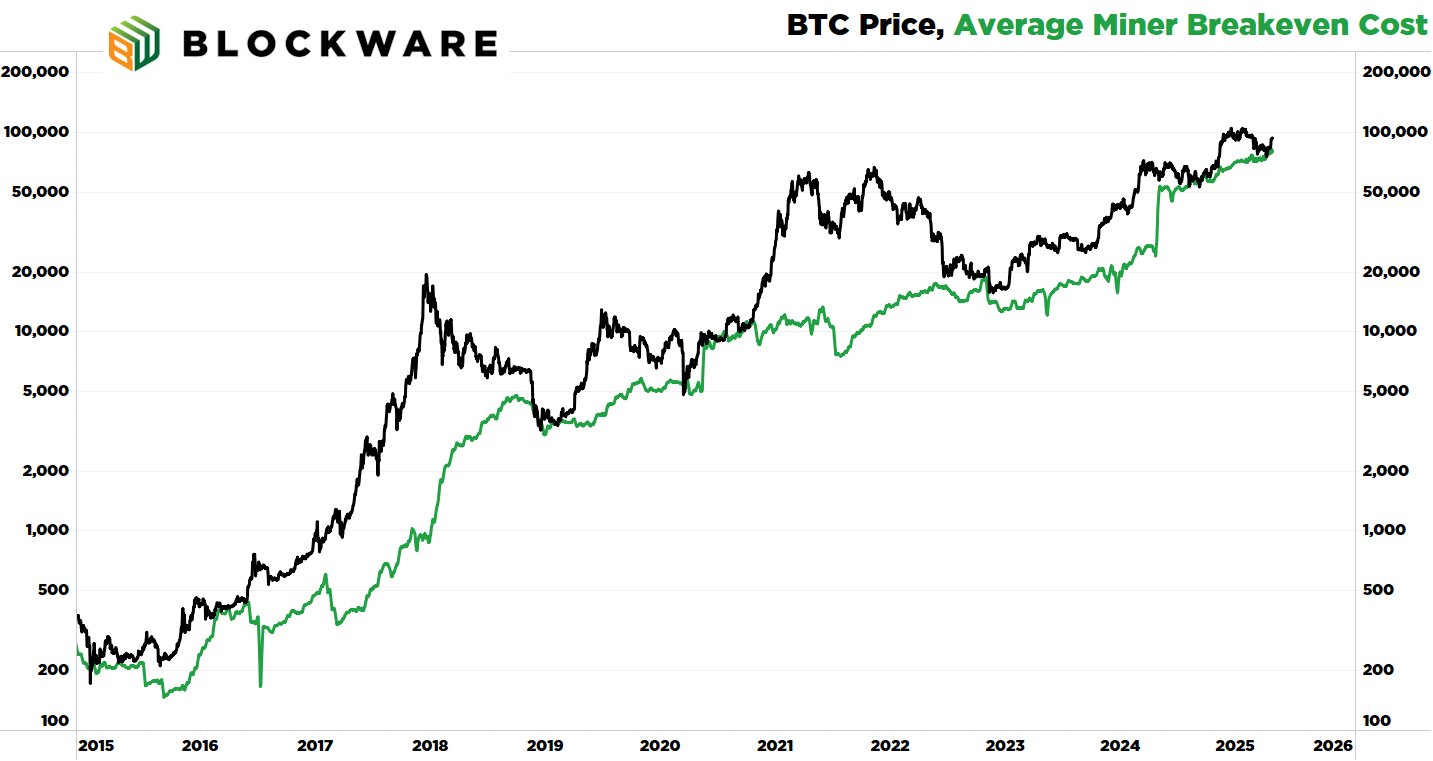

Citing analysis from Blockware, Breedlove pointed to the “industry average” miner cost of production — a model that aggregates various operational metrics such as electricity prices and hardware efficiency.

According to this metric, Bitcoin has historically bottomed out when its market price approached or dipped below the average production cost. The model previously aligned with six significant market lows, and Breedlove notes it is flashing a bottom signal once again.

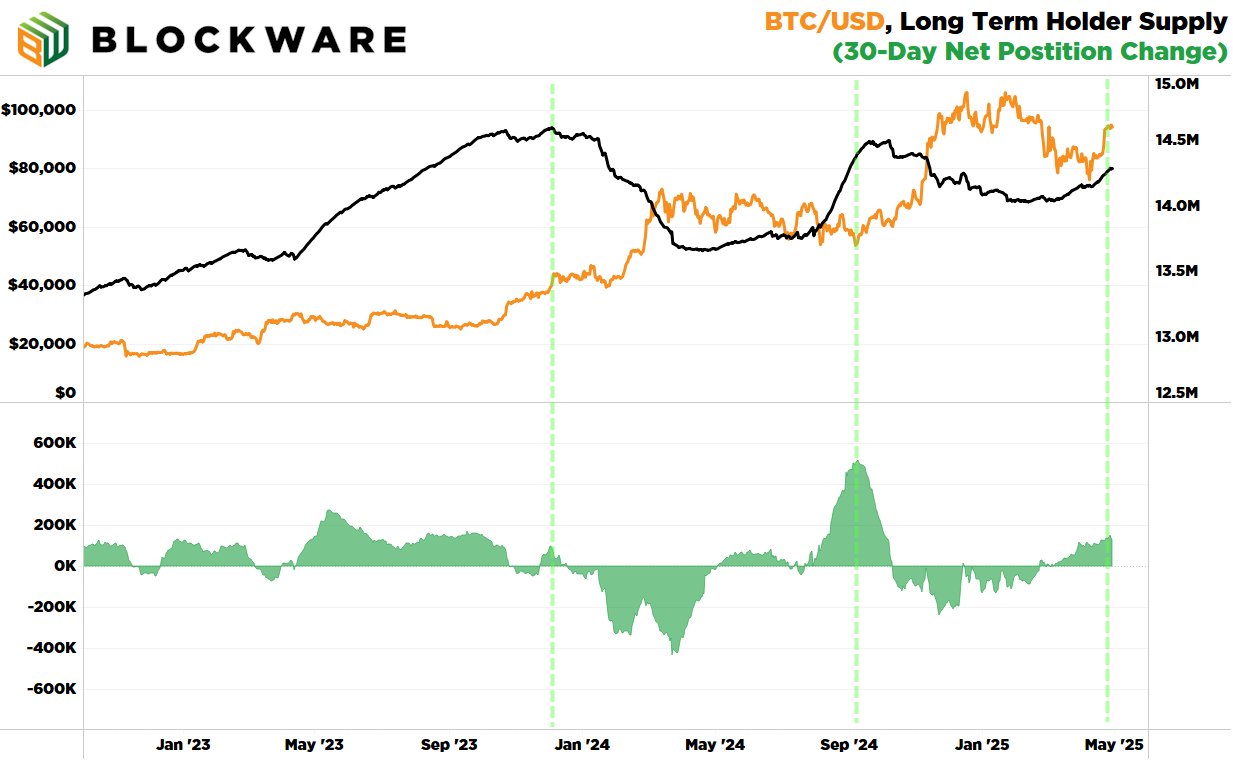

In addition to mining economics, Breedlove referenced long-term holder supply data as another crucial input. This metric tracks the amount of Bitcoin that has remained unmoved on-chain for at least 155 days, a proxy for investor conviction and potential supply constraints.

Over the past 30 days alone, long-term holders have added approximately 150,000 BTC to their balances. Historically, such accumulation during periods of price consolidation or retracement has preceded upward price movements due to the resulting decrease in sell-side pressure.

With Bitcoin trading between $80,000 and $100,000, Breedlove suggests that fewer holders appear willing to exit their positions, potentially reducing available supply at these levels.

Rising Liquidity and Macro Trends Add Fuel to Bullish Outlook on Bitcoin

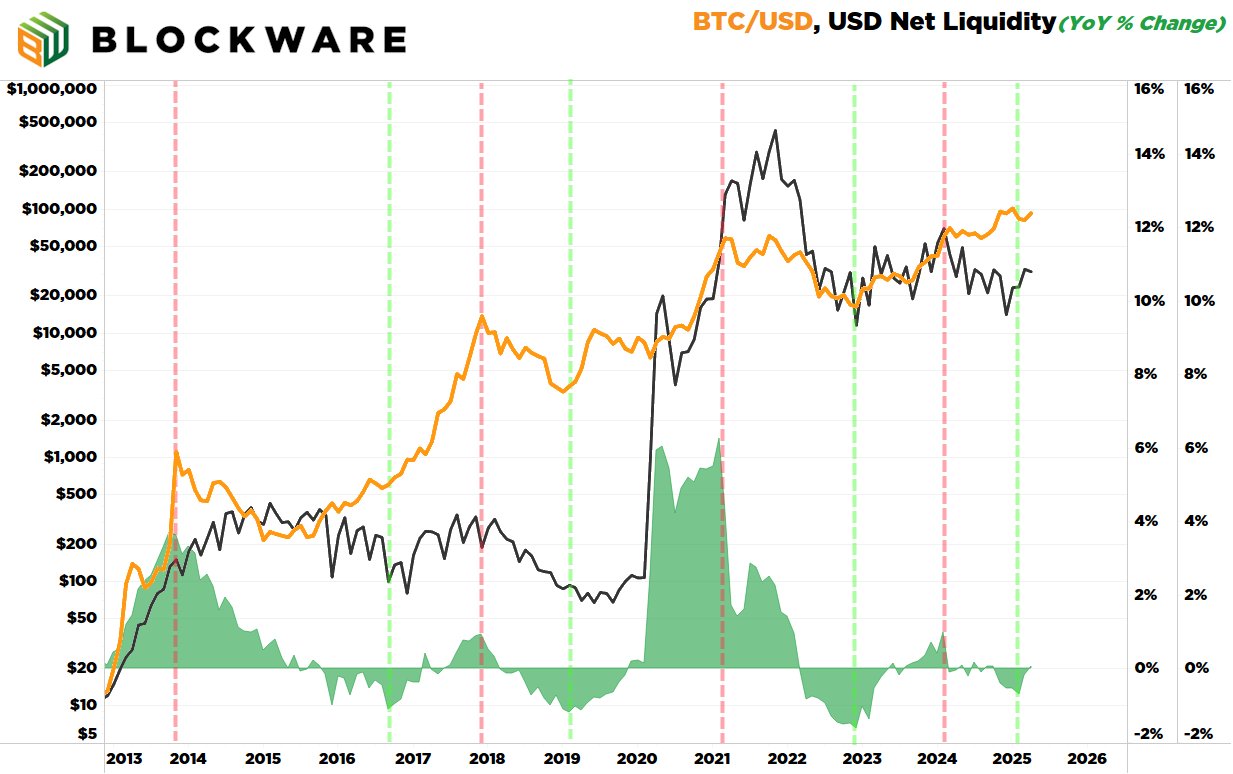

Another major factor is global fiat liquidity, which Breedlove highlights as a key demand-side component in Bitcoin’s price dynamics. The analyst points to the role of increasing dollar and international currency liquidity, driven by expanding access to Bitcoin through financial instruments like exchange-traded funds (ETFs), public company treasury holdings, and convertible bond offerings.

He argues that greater access to capital and simplified exposure pathways have enhanced Bitcoin’s correlation with broader liquidity trends, increasing the likelihood of upward movement as fiat liquidity rises.

Breedlove concluded by reaffirming that Bitcoin’s fundamentals remain unchanged — fixed supply, 10-minute blocks, and predictable halving events — but external factors such as liquidity, regulation, and institutional adoption continue to influence its price action.

Lastly, and most importantly, is USD liquidity. This effectively represents the “demand” side of the equation. More dollars in the system means more potential bidders.

Bitcoin is highly correlated to fiat liquidity – and that’s becoming increasingly more of the case as ETFs,… pic.twitter.com/i5iE6NzM55

— Robert ₿reedlove (@Breedlove22) May 1, 2025

Featured image created with DALL-E, Chart from TradingView