What To Expect From Bitcoin (BTC) Price In May 2025

Bitcoin (BTC) enters May 2025 with renewed momentum, gaining over 14% in the past 30 days and trading just 6.3% below the key $100,000 mark. Behind the price action, Bitcoin’s apparent demand has turned positive for the first time since late February, signaling a shift in on-chain behavior.

However, fresh inflows—especially from US-based ETFs—remain subdued compared to 2024 levels, suggesting institutional conviction has yet to fully return. According to MEXC COO Tracy Jin, if current conditions hold, a summer rally toward $150,000 is plausible, with sentiment turning increasingly bullish.

Bitcoin Apparent Demand Turns Positive, But Fresh Inflows Still Lacking

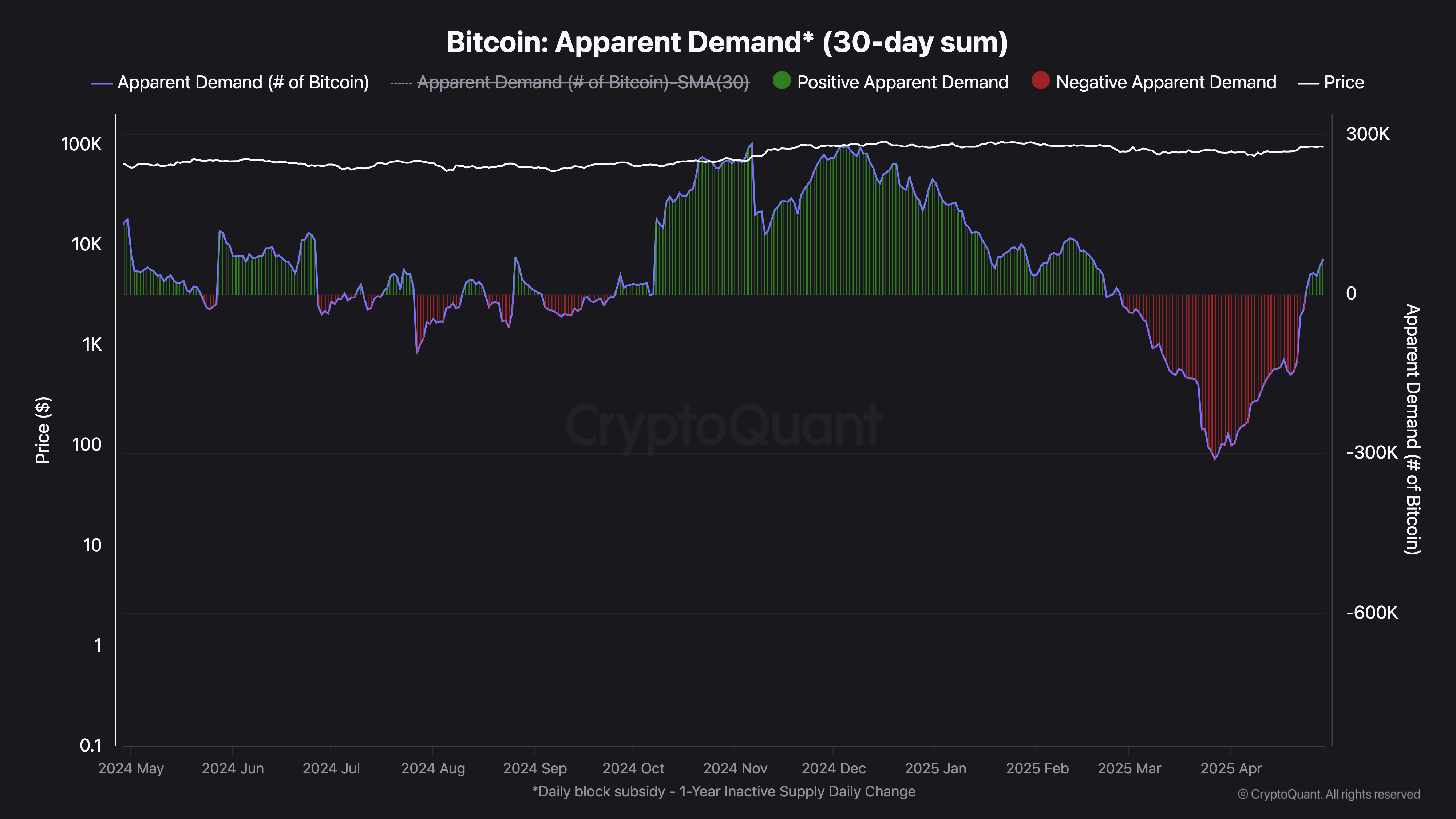

Bitcoin’s apparent demand has shown clear signs of recovery recently, rising to 65,000 BTC over the past 30 days. This marks a sharp rebound from the trough on March 27, when apparent demand—defined as the net 30-day change in holdings across all investor cohorts—reached a deeply negative level of -311,000 BTC.

Apparent demand reflects the aggregated balance shifts across wallets and provides insight into whether capital is entering or exiting the Bitcoin network.

While the current demand level is still well below earlier peaks in 2024, a meaningful inflection point occurred on April 24: Bitcoin’s apparent demand turned positive and has remained positive for six consecutive days after nearly two months of sustained outflows.

Bitcoin Apparent Demand. Source: CryptoQuant.

Bitcoin Apparent Demand. Source: CryptoQuant.

Despite this improvement, broader demand momentum remains weak.

The continued lack of significant new inflows suggests that most of the recent accumulation may be driven by existing holders rather than fresh capital entering the market.

For Bitcoin to mount a sustainable rally, both apparent demand and demand momentum must show consistent and synchronized growth. Until that alignment occurs, the current stabilization may not support a strong or prolonged price breakout.

US Spot Bitcoin ETF Inflows Still Far Below 2024 Levels

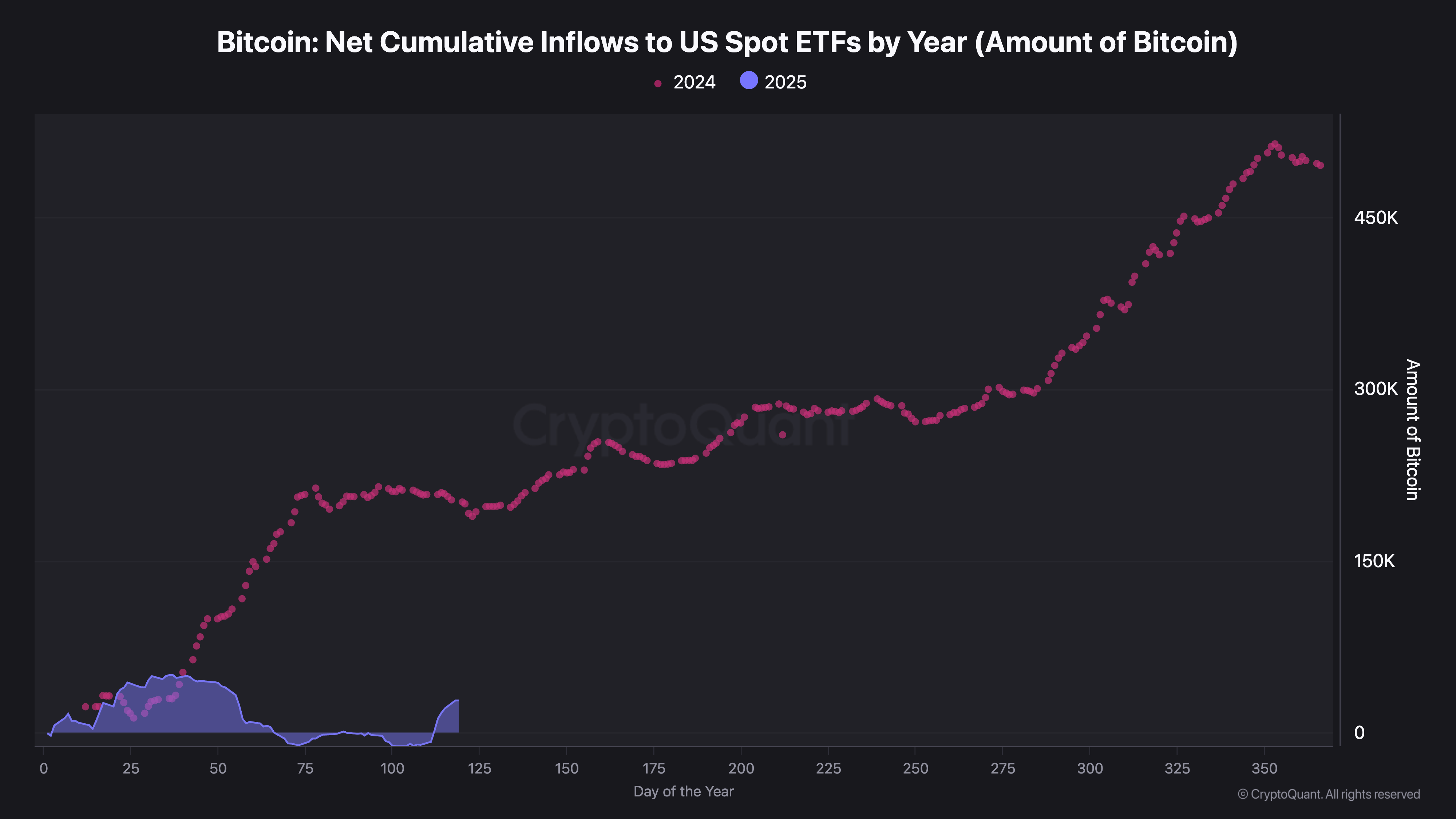

Bitcoin purchases from U.S.-based ETFs have remained largely flat since late March, fluctuating between daily net flows of -5,000 to +3,000 BTC.

This activity level sharply contrasts with the strong inflows seen in late 2024, when daily purchases frequently exceeded 8,000 BTC and contributed to Bitcoin’s initial rally toward $100,000.

So far in 2025, BTC ETFs have collectively accumulated a net total of 28,000 BTC, well below the more than 200,000 BTC they had purchased by this point last year.

This decline shows a slowdown in institutional demand, which has historically been key in driving major price movements.

Bitcoin: Net Cumulative Inflows to US Spot ETFs by Year. Source: CryptoQuant.

Bitcoin: Net Cumulative Inflows to US Spot ETFs by Year. Source: CryptoQuant.

There are early signs of a modest rebound, with ETF inflows beginning to tick higher recently. However, current levels remain insufficient to fuel a sustained uptrend.

ETF activity is often viewed as a proxy for institutional conviction, and a notable increase in purchases would likely signal renewed confidence in Bitcoin’s medium-term trajectory.

Until those inflows return in force, the broader market may struggle to generate the momentum needed for a prolonged rally.

Bitcoin Nears $100,000 as Momentum Builds Despite Macro Pressure

Bitcoin price has gained over 14% in the past 30 days, rebounding strongly after dipping below $75,000 in April.

This renewed momentum comes as BTC shows relative resilience amid broader macroeconomic volatility and policy-driven pressures, including Trump’s tariff measures that have weighed on risk assets.

While the entire crypto market has felt the impact, Bitcoin appears to be detaching slightly, showing less sensitivity to these external shocks than other digital assets.

Bitcoin Price Analysis. Source: TradingView.

Bitcoin Price Analysis. Source: TradingView.

BTC now sits just 6.3% below the $100,000 mark and remains under 17% from a potential move toward $110,000. According to Tracy Jin, COO of MEXC, sentiment is turning positive again:

“Beyond immediate price action, the growing institutional appetite and shrinking supply mechanisms against the macroeconomic uncertainty backdrop point to a structural shift in Bitcoin’s role within the global financial market. BTC is used to hedging against inflation and the fiat-based financial model. Its liquidity, scalability, programmability, and global accessibility offer a reliable modern alternative to traditional financial instruments for many corporations,” Jin said.

According to Jin, a summer rally towards $150,000 is plausible. She stressed that the $95,000 range will likely become a launch point for the brewing decisive breakout above $100,000 in the coming days.

” Should global trade tensions stabilize further and institutional accumulation continues, a summer rally towards $150,000 is plausible, potentially extending towards $200,000 by 2026. Overall, the external background remains favorable for the continuation of the upward movement, especially given the growth of stock indices on Friday, which could support Bitcoin over the weekend.”