Deepfake Crypto Fraud Hits $200 Million in Q1 2025, GoPlus Reveals New Scam Tactics

GoPlus Security unveiled the latest playbook employed by a well-coordinated scam network targeting unsuspecting crypto users with promises of effortless USDT earnings.

Meanwhile, deepfake AI is progressively becoming a concern. Bad actors leverage authoritative voices in the industry to target unsuspecting victims. These mark an alarming disclosure that mirrors the growing sophistication of crypto fraud.

GoPlus Security Reveals Crypto Scammers’ Latest Playbook

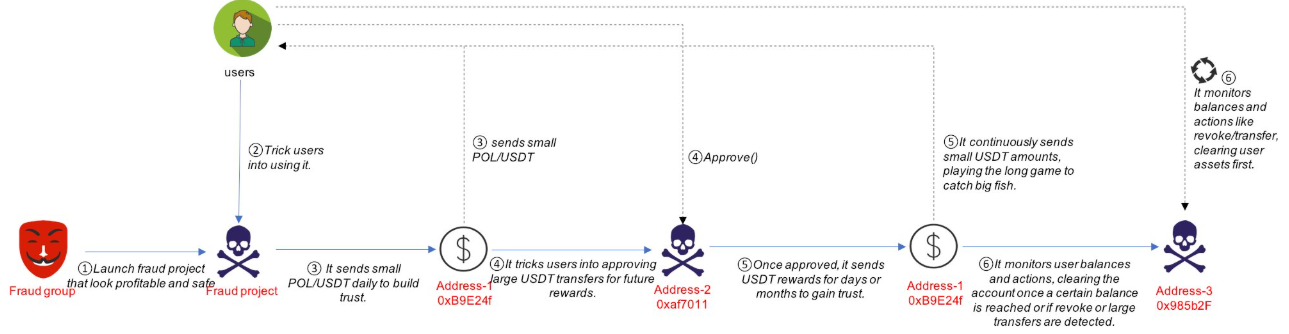

The analysis exposes a multi-stage deception that begins with trust-building micro-transactions and ends with the silent draining of victims’ wallets.

GoPlus Security covers major blockchain networks with multidimensional risk detection. The firm revealed that the attackers operate through addresses linked to a campaign that starts with the launch of seemingly legitimate projects.

These projects entice users with the promise of “zero-cost, stable USDT rewards” in exchange for completing simple, low-effort tasks. Once initial contact is established, scammers send small tokens and minimal USDT over several days to establish legitimacy. But it’s all a calculated ruse.

Hackers’ latest methods for stealing crypto. Source: GoPlus Security on X

Hackers’ latest methods for stealing crypto. Source: GoPlus Security on X

The ultimate goal is to convince users to grant token approval permissions, often to externally owned accounts (EOAs). Once approvals are in place, the scammers continue sending rewards for days or weeks while monitoring wallets.

When a user’s balance crosses a threshold or revocation activity is detected, high-speed front-running bots swoop in and drain funds in seconds. These trading bots are willing to burn gas at any cost.

“This is a long game to catch big fish,” GoPlus warned in its statement.

Against this backdrop, GoPlus Security cautions against granting unlimited token approvals, especially to EOAs. The firm also urges users to adopt proactive on-chain security tools.

“There’s no such thing as free money — don’t trust projects that claim you can easily earn just by participating,” it added.

Their findings closely align with recent guidance from on-chain sleuth ZachXBT. The investigator outlined critical checks every user should perform to avoid crypto scams.

As BeInCrypto reported, these range from verifying token contracts and approval histories to using tools that limit permissions or automatically revoke dormant approvals.

Deepfake Deception: The Next Frontier of Crypto Fraud

Beyond blockchain, crypto scams are exploiting artificial intelligence at a dangerous scale. Bad actors also weaponize deepfake technology, which creates convincingly fake videos of public figures, to defraud investors.

In a warning earlier this year, Binance co-founder Changpeng Zhao (CZ) revealed AI-generated clips promoting fake investment platforms falsely endorsed by major crypto personalities.

“There are deepfake videos of me on other social media platforms. Please beware,” CZ stated.

A disturbing example recently emerged in Ghana. The country’s Ashesi University denounced a deepfake impersonation of its president, Patrick Awuah Jr. Reportedly, scammers used him to promote a scam called “Crypto Klutz.”

They embedded the video in a fake news article mimicking Graphic Online. The scammers circulated it alongside doctored X screenshots to manufacture credibility.

“…Neither Patrick Awuah nor Ashesi University is associated with this or any similar platform. Please help protect our community by reporting it as fraudulent when encountered and encourage others who see it to do the same,” the university articulated.

Cybersecurity firm McAfee added urgency to the matter, reporting that the average American now encounters three deepfake videos daily. The company outlined five red flags for spotting AI-enhanced crypto scams.

It cited too-good-to-be-true promises, fake celebrity endorsements, and non-existent exchanges or wallets. Other red flags include urgency tactics to rush decisions, and demands for private keys or upfront payments.

A Variety report confirmed that deepfake-assisted fraud surpassed $200 million in losses in Q1 2025 alone. This figure highlights how fast scammers scale operations through generative AI and synthetic media.

As on-chain scams become more patient and AI deepfakes more persuasive, the crypto community faces a dual-threat environment unlike anything seen before.

“AI-powered scams are changing the crypto game. With deepfakes, voice cloning, and AI-generated phishing, scammers are raking in millions,” trader Crypto Frontline remarked.