Bitcoin Now Outpacing Ethereum, Solana In Futures Volume, Data Shows

Data shows Bitcoin has recently seen an increase in futures trading volume, breaking away from the likes of Ethereum (ETH) and Solana (SOL).

Bitcoin Futures Volume Has Rebounded Recently

In a new post on X, the on-chain analytics firm Glassnode has talked the latest trend in the futures trading volume for Bitcoin and two other top cryptocurrencies.

The “futures trading volume” here refers to an indicator that keeps track of the total amount of a given cryptocurrency that’s becoming involved in futures-related trades on the centralized derivatives exchanges.

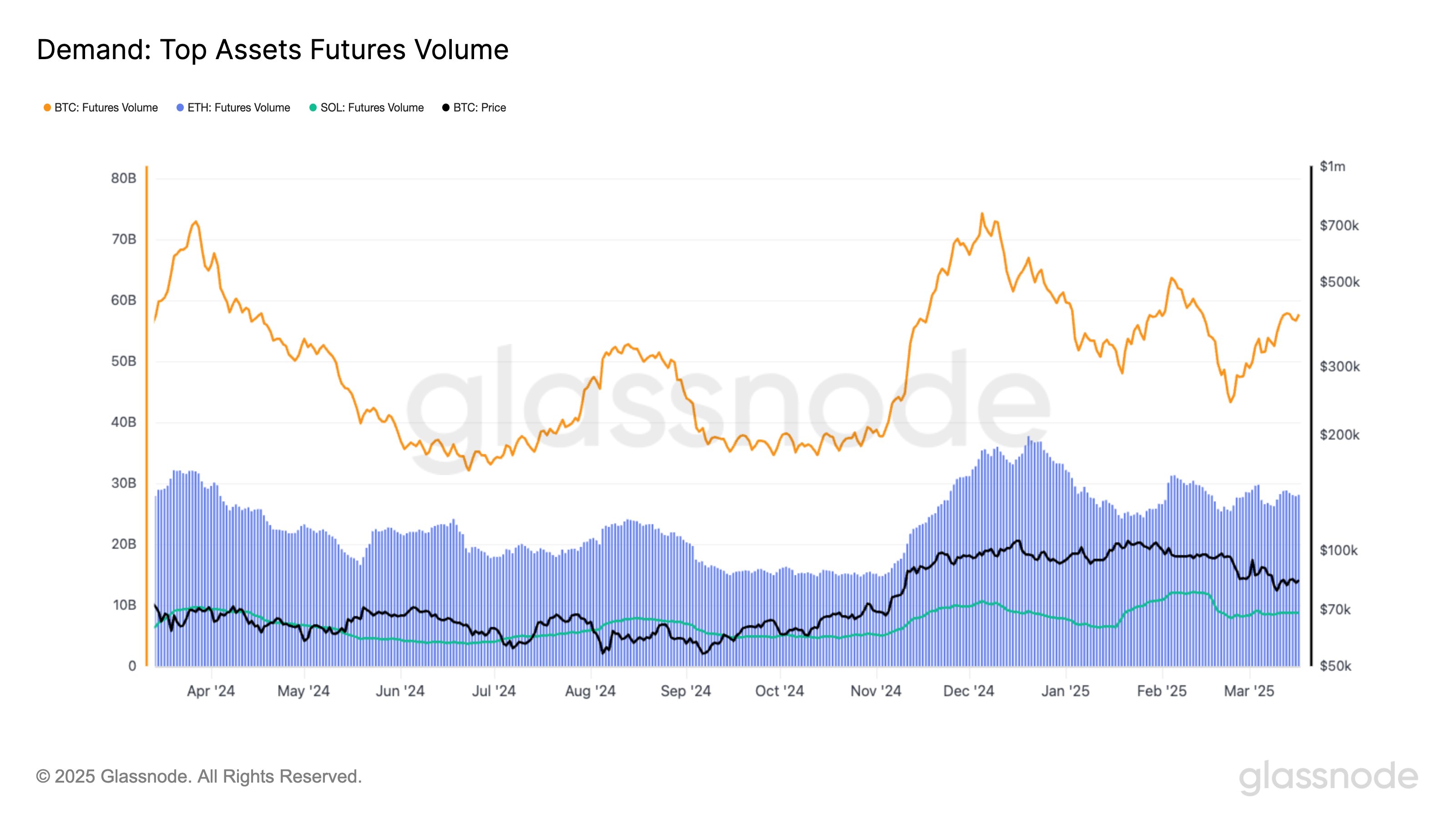

First, here is a chart that puts focus on the futures trading volume of Bitcoin:

As displayed in the above graph, the BTC futures trading volume observed a decline last month, but its value has recently found a rebound. At its low, the indicator approached the $40 billion mark, but it has since climbed to $57 billion.

“Bitcoin Futures volume started the year at $60B, peaked at $63B YTD, and now sits at $57B – 32% higher since Feb 23 but still below December’s $74B peak,” notes the analytics firm.

While the number one cryptocurrency has registered an increase in the metric recently, the same hasn’t been true for Ethereum and Solana. From the chart, it’s apparent that the indicator has been moving relatively flat for these two assets.

The Ethereum futures volume measured around $32 billion at the start of the year and today it sits at $28 billion, which isn’t that big of a difference. Similarly, the indicator kicked off the year at $7 billion for Solana and it’s now at $8.7 billion, once again a relatively small change.

The futures trading volume serves as a look into how the speculative interest around a cryptocurrency is like. The recent trend would imply Bitcoin has been attracting the attention from the investors while altcoins remain stale.

In some other news, the market intelligence platform IntoTheBlock has revealed in an X post how the Bitcoin long-term holders have started to increase their supply recently.

The analytics firm defines “long-term holders” as the investors who have been holding onto their coins since more than one year ago, without having transferred or sold them even once.

According to IntoTheBlock, the long-term holders generally accumulate during bear markets, so this latest shift could be a sign that sentiment is changing towards a bearish one. The analytics firm also notes, however, “keep in mind that this isn’t always a reliable signal: i.e. in mid-2021, similar accumulation did not lead to a prolonged downturn.”

BTC Price

At the time of writing, Bitcoin is floating around $81,800, down more than 3% over the last 24 hours.