Forex Today: US politics, data releases to lift volatility as Q3 ends

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

Here is what you need to know on Tuesday, September 30:

The US Dollar (USD) stays on the back foot early Tuesday as investors grow increasingly concerned about a possible government shutdown, which could cause a delay in data releases later in the week. The economic calendar will feature inflation data from Germany. Later in the session, CB Consumer Confidence data for September and the JOLTS Job Openings report for August from the US will be watched closely by market participants. Position re-adjustments on the last trading day of the third quarter could also ramp up volatility.

US Dollar Price This week

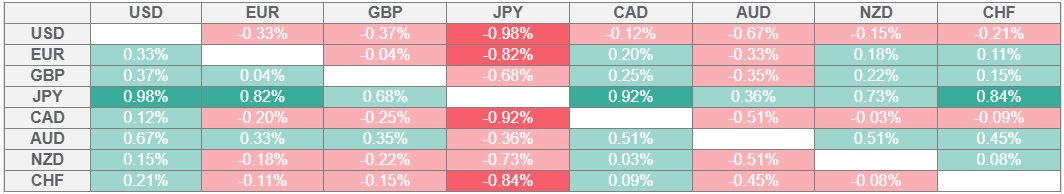

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Following a high-level meeting on Monday, Democrats and Republicans failed to come to terms on funding the government ahead of the Tuesday midnight deadline. Vice President JD Vance said late Monday that he thought they were headed to a shutdown, while Senate Democratic Leader Chuck Schumer noted that the two sides still have "very large differences." After closing marginally lower on Monday, the USD Index continues to edge lower in the European morning on Tuesday, trading below 97.80. In the meantime, US stock index futures lose about 0.2%, reflecting a cautious market stance.

Meanwhile, the White House announced early Tuesday that US President Donald Trump signed a proclamation adjusting imports of timber, lumber and derivative products into the US.

During the Asian trading hours, the data from Japan showed that the NBS Manufacturing PMI edged higher to 49.8 in September from 49.4, while the NBS Non-Manufacturing PMI declined to 50 from 50.3.

The Reserve Bank of Australia (RBA) announced that it left the policy rate unchanged at 3.6%, as widely anticipated. In its policy statement, the RBA refrained from offering any hints about the next policy action and reiterated that they will be attentive to the data and the evolving assessment of the outlook and risks to guide its next decisions. In the post-meeting press conference, RBA Governor Michele Bullock explained that they will focus on the quarterly inflation figures to decide whether they will opt for rate cuts. After rising above 0.6600 earlier in the day, AUD/USD lost its traction and was last seen trading flat on the day at around 0.6575.

EUR/USD clings to small daily gains slightly below 1.1750 in the European morning on Tuesday. Later in the session, European Central Bank (ECB) President Christine Lagarde will deliver a keynote speech at the 4th Bank of Finland's International Monetary Policy Conference in Helsinki. In the meantime, the data from Germany showed that Retail Sales declined by 0.2% on a monthly basis in August, missing the market expectation for an increase of 0.6% by a wide margin.

The UK's Office for National Statistics announced early Tuesday that it revised the annualized Gross Domestic Product (GDP) growth for the second quarter to 1.4% from 1.2% in the previous estimate. GBP/USD stays relatively quiet in the European session and holds comfortably above 1.3400.

After losing more than 0.6% on Monday, USD/JPY stays under heavy bearish pressure and trades slightly below 148.00 early Tuesday.

Gold benefits from safe-haven flows and trades at a new record-high at around $3,850 in the European morning.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.