Ethereum Key Support: Cost Basis Data Points To $1,890 As Make-Or-Break Level

In line with major losses across the crypto market, Ethereum (ETH) declined by 17.08% in the past week reaching as low as $2,104. While the prominent altcoin has shown some minor gains in the past 12 hours, the general market sentiment remains bearish.

ETH Correction Likely Headed To $1,890 – Here’s Why

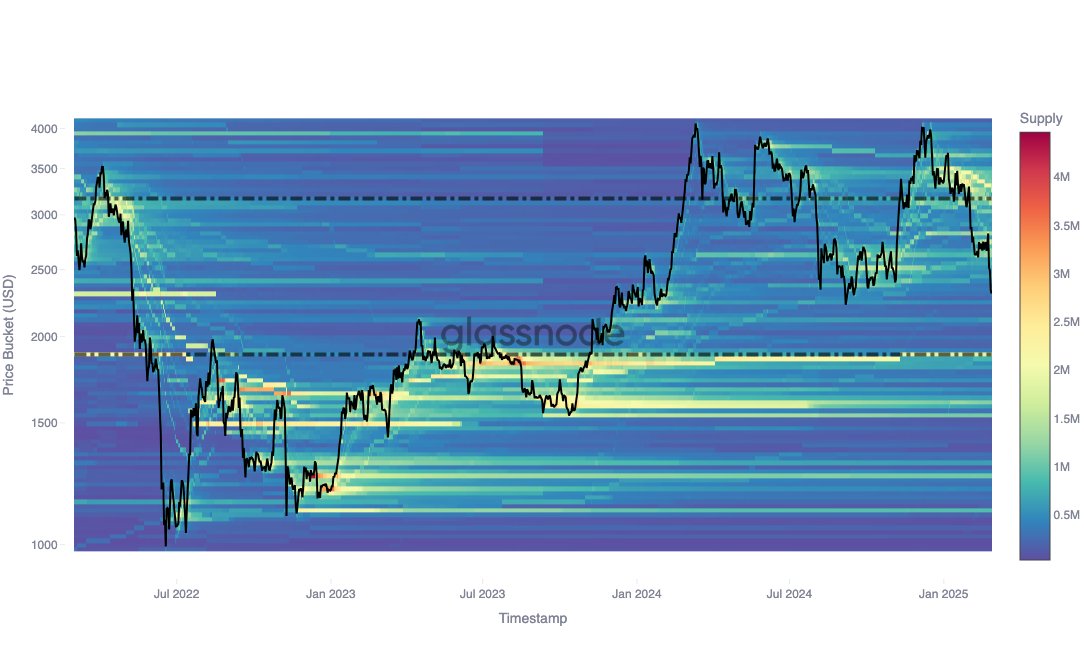

The ETH market is currently navigating a strong market correction with several analysts now spotlighting potential key support levels. According to prominent on-chain analytics firm Glassnode, data from the Cost Basis Distribution (CBD) metric indicates Ethereum is poised for a decline to $1,890 which represents its next major accumulation zone.

For context, CBD is used to identify significant levels of an asset’s accumulation or distribution. These identified zones often act as support or resistance and are influential on price actions. Analysts at Glassnodes state that the major ETH accumulation zone below its current price is $1,890 at which investors acquired approximately 1.82 million ETH in August 2023.

Interestingly, a two-year analysis of Ethereum’s CBD shows that some of these investors who accumulated ETH in August 2023 remain active. Notably, a significant number of them increased their cost basis during the crypto market in November 2024 while executing no distribution at range highs – a behavior that signals a strong confidence in long-term price appreciation.

However, it is worth stating that $1,890 is not the immediate support zone for the ETH market. Glassnode states that CBD data also highlights $2,100 as the next support zone if Ethereum’s correction continues.

This support level only holds around 500,000 ETH i.e. significantly lower than the accumulation seen at $1890. Albeit, investors can expect $2,100 to offer some short-term support before ETH experiences a deeper correction to $,1890.

Is ETH Accumulation On Amid Price Dip?

In a further analysis of the Ethereum market, Glassnode also reveals that a six-month perspective on the cost basis trend shows strong investor activity with at cost basis levels far higher than the current market price, particularly around $3,500.

Notably, this cost basis has shown a gradual decline while increasing in concentration. This development indicates that rather than initiating a sell-off, investors are actively absorbing market supply as prices decline in anticipation of long-term gains.

At the time of writing, Ethereum trades at $2,250 following a 3.84% gain in the past day. Meanwhile, its heavy decline over the past week moves its monthly losses to around 30.48%. However, its market activity has increased by 7.74% and is now valued at $29.91 billion.