Pump.fun Price Forecast: PUMP rallies on renewed user demand

- PUMP token rises nearly 10% on Tuesday, extending the previous day's gains and crossing above the 100-day EMA.

- On-chain data shows a surge in user activity and DEX volume, reflecting renewed interest in Solana’s meme coin launchpad.

- Renewed retail interest fuels the PUMP futures Open Interest by 33% in 24 hours, confirming the upside bias.

Pump.fun (PUMP) edges higher by nearly 10% at press time on Tuesday, building on the 10% gains from the previous day. The renewed recovery in PUMP aligns with a surge in network activity, including increased user numbers and platform volume after the announcement of a $3 million Pump Fund. In the derivatives market, risk-on sentiment has returned in PUMP investors, evidenced by a spike in Open Interest, short liquidations, and positive funding rates.

The technical outlook for PUMP is bullish, as the price has exceeded the 100-day Exponential Moving Average (EMA) and the Moving Average Convergence Divergence (MACD) indicator is flashing a buy signal.

Pump Fund sparks network activity, retail interest

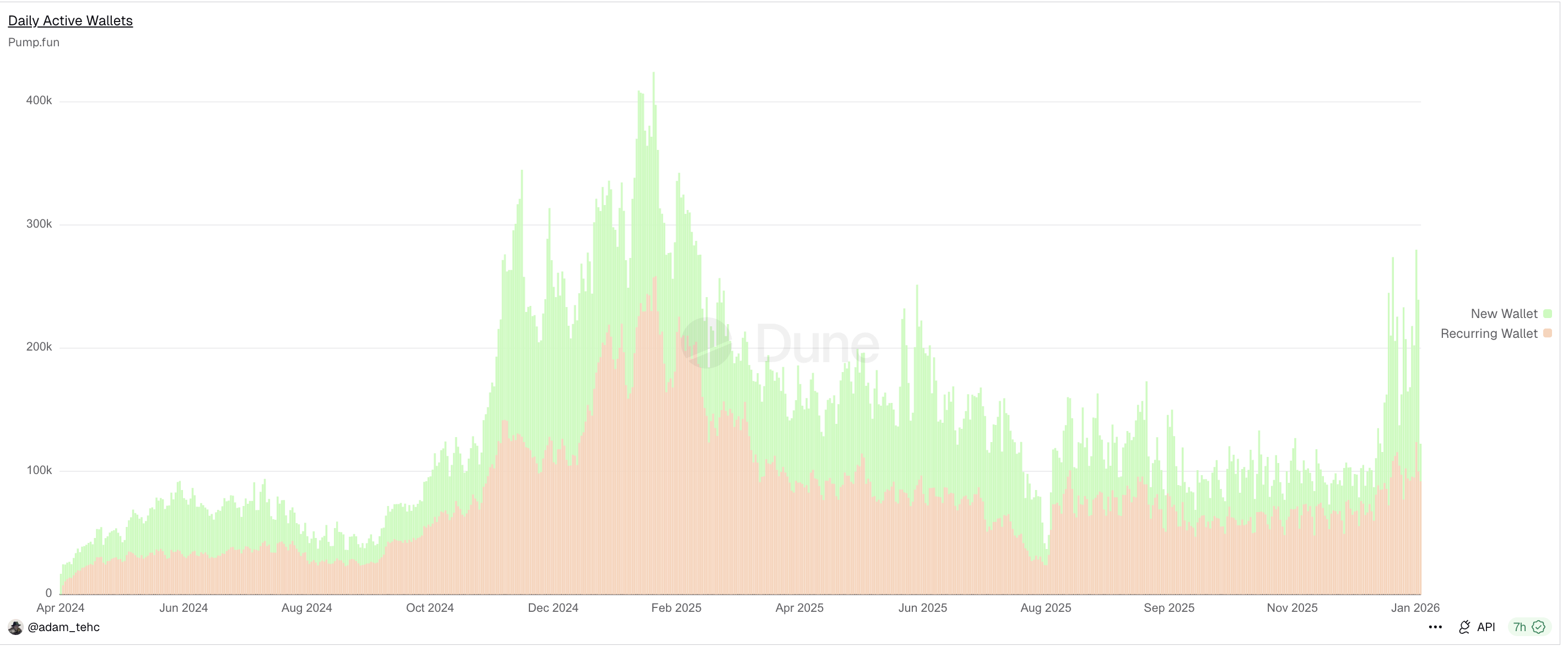

Data from the Dune dashboard by “adam_tehc”, with over 1,500 queries and 44 dashboards, shows a sharp increase in Pump.fun’s activity in January, reaching 280,121 users on Saturday, including 156,166 new users. As of Monday, the user count stood at 122,628 with 30,630 new users.

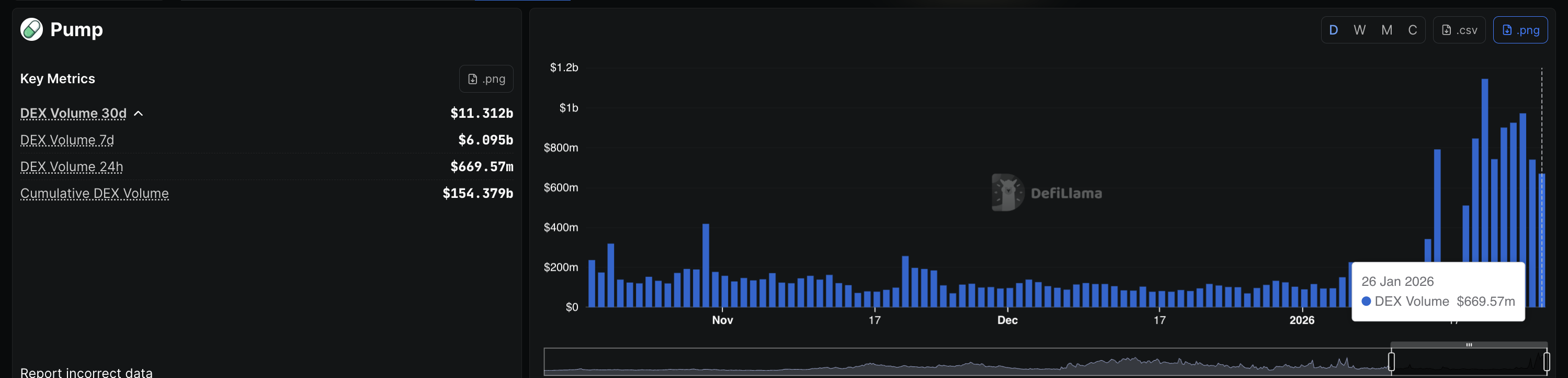

A boost in user engagement led to increased platform volume, reaching $1.145 billion on January 20, in line with the announcement of the $3 million Pump Fund. This fund will sponsor 12 projects in the Build in Public Hackathon, allocating $250,000 at a $10 million valuation.

Meanwhile, the retail demand is steadily increasing, evidenced by the 33% jump in PUMP futures Open Interest (OI) to $235.72 million over the last 24 hours. This increase in capital inflow reflects a risk-on sentiment among investors anticipating further upside in PUMP.

Corroborating the bullish bias, the funding rates are positive at 0.0039%, reflecting the investors' inclination to hold long positions. Additionally, the short liquidations of $939,200 over the last 24 hours outpace the long liquidations of $108,770, indicating a massive wipeout of bearish positions.

Pump.fun’s heightened network activity, which aligns with increased retail optimism, signals significant upside potential.

Technical outlook: Will PUMP extend gains above the 100-day EMA?

PUMP is crossing above the 100-day EMA at $0.002930 by press time on Tuesday, which previously capped the gains mid-January, making it a make-or-break zone. The rebound in the meme coins launchpad token extends a trendline breakout rally.

A decisive close above $0.002930 could extend gains toward the $0.003399 resistance, marked by the November 20 high, followed by a higher target at $0.004842, last tested on November 11.

The momentum indicators on the daily chart suggest that buyers are regaining short-term control. The MACD has flipped bullish, with a cross above the signal line and the histogram turning positive, indicating renewed upside momentum. At the same time, the Relative Strength Index (RSI) is at 59, bouncing back from the midline with further room on top before reaching overbought conditions.

If PUMP fails to close above $0.002930 on the day, a potential reversal could face the initial line of defense at the 50-day EMA at $0.002597.