XRP Price Hits Local Bottom, Chances of 11% Breakout Rally Strengthen

XRP has remained under pressure since the start of the month, sliding into a sustained downtrend that pushed the token to a monthly low.

While the decline appears bearish on the surface, historical behavior suggests this phase may signal exhaustion rather than continuation. Such setups often precede reversals when selling pressure weakens and accumulation begins.

XRP Holders Exert Bullishness

On-chain data points to growing confidence among long-term holders. XRP’s Liveliness metric has declined sharply over the past six weeks and now sits at a two-month low. Liveliness measures whether holders are spending or holding coins. A falling value indicates accumulation rather than distribution.

Long-term holders tend to influence price direction during corrective phases. Their sustained accumulation reduces circulating supply and dampens sell-side pressure. For XRP, this behavior suggests conviction remains intact despite recent weakness, improving the probability of a recovery once broader sentiment stabilizes.

XRP Liveliness. Source: Glassnode

XRP Liveliness. Source: Glassnode

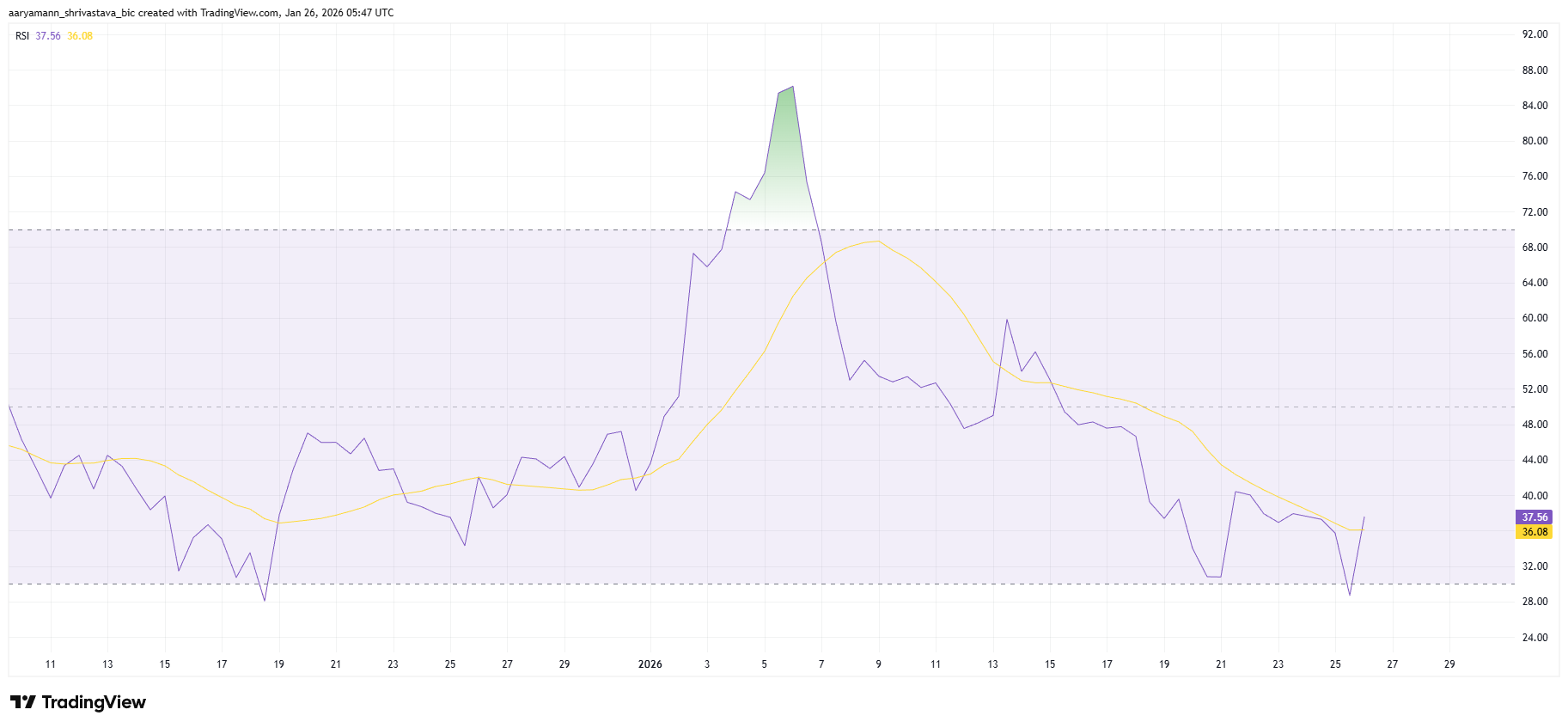

Momentum indicators reinforce the reversal narrative. The Relative Strength Index recently bounced from the oversold zone after dipping below the 30 threshold. RSI tracks momentum extremes, with oversold conditions often marking local bottoms rather than breakdown points.

XRP’s move into oversold territory reflects capitulation among weaker hands. The subsequent bounce suggests selling pressure has eased. Assets exiting oversold conditions frequently attempt short-term recoveries, especially when supported by accumulation from long-term holders.

XRP RSI. Source: TradingView

XRP RSI. Source: TradingView

XRP Price Breakout Likely

XRP has traded within a descending wedge since the beginning of the month. This pattern is typically considered bullish, as it reflects slowing downside momentum. Breakouts from such structures often occur when sellers lose control, and buyers regain influence.

The wedge projects an upside move of roughly 11.7% following confirmation. With XRP trading near $1.87, the technical target stands at $2.10. A more conservative outlook places confirmation near $2.03, which would validate the breakout and signal improving momentum.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

The bullish thesis weakens if the price fails to break the wedge. Continued bearish pressure could drag XRP toward $1.79. A deeper slide may extend losses to $1.75, invalidating the reversal setup and reinforcing the broader downtrend.