Crypto Today: Bitcoin, Ethereum, XRP post modest gains as ETF selling pressure intensifies

- Bitcoin rises marginally above $90,000, but intense ETF selling pressure continues to weigh on the asset.

- Ethereum trades around $3,000 amid broader crypto market volatility and waning institutional interest.

- XRP ticks up for the second consecutive day despite subdued retail demand.

Bitcoin (BTC) is extending its modest gains for the second consecutive day, trading above $90,000 at the time of writing on Thursday. Altcoins, including Ethereum (ETH) and Ripple (XRP), are attempting to stabilize after days of persistent selling pressure.

Ethereum is hovering around $3,000 while XRP maintains its position at $1.95 amid weakening institutional and retail conviction. The small gains across major crypto assets come amid sustained Exchange Traded Funds (ETF) outflows, signaling extended risk-off sentiment among institutional investors.

ETF outflows weigh on BTC, ETH, as XRP retail interest fades

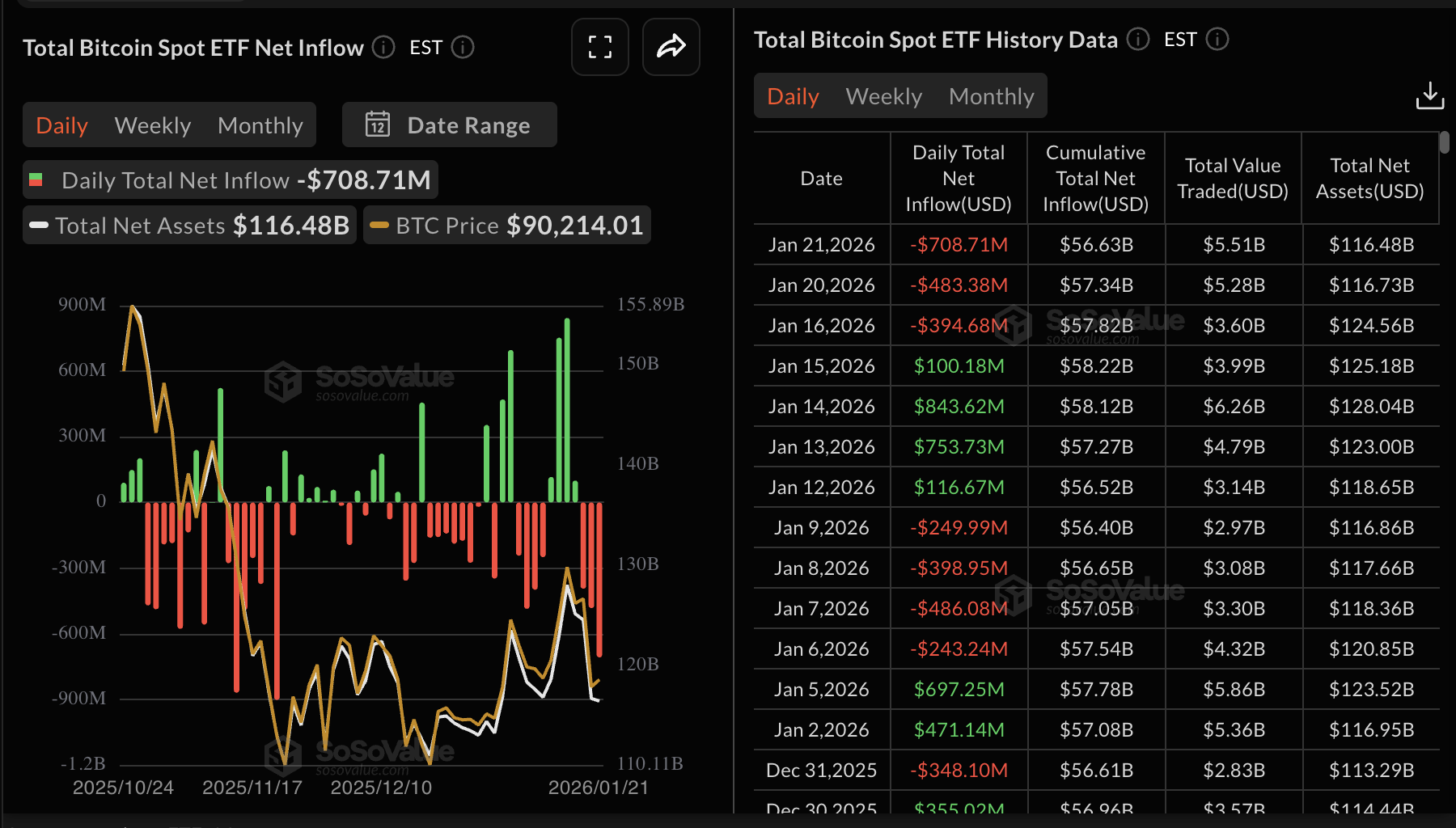

Bitcoin spot ETFs continued to face intense selling pressure, with outflows reaching a staggering $709 million on Wednesday. The cumulative total inflow stands at $56.63 billion, and the net asset at $116.48 billion, according to SoSoValue data.

If ETF outflows persist, selling pressure could weigh on Bitcoin and further deteriorate sentiment. So far, outflows total $$1.19 billion this week.

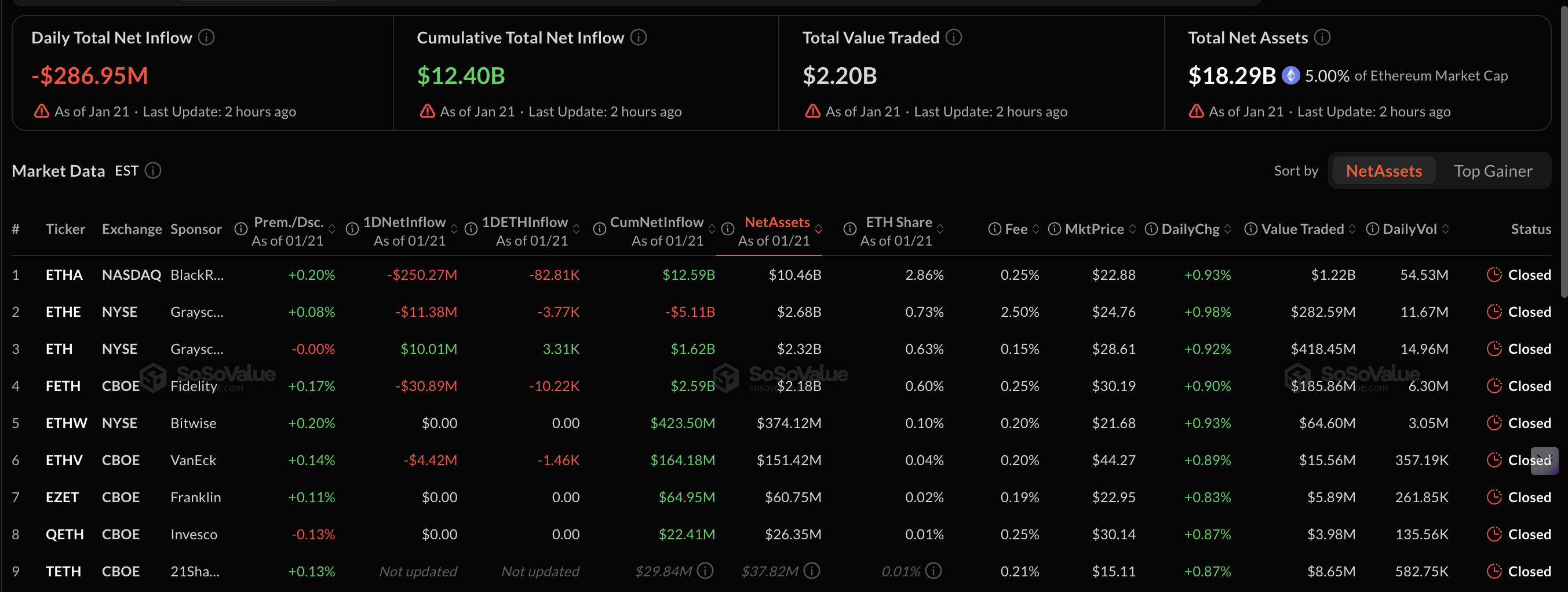

Ethereum ETFs have not been spared by the headwinds in the crypto market, as outflows neared $287 million on Wednesday, with the only inflows of approximately $10 million coming from Grayscale. The cumulative total inflow currently stands at $12.68 billion, and the net asset at $18.41 billion, according to SoSoValue data.

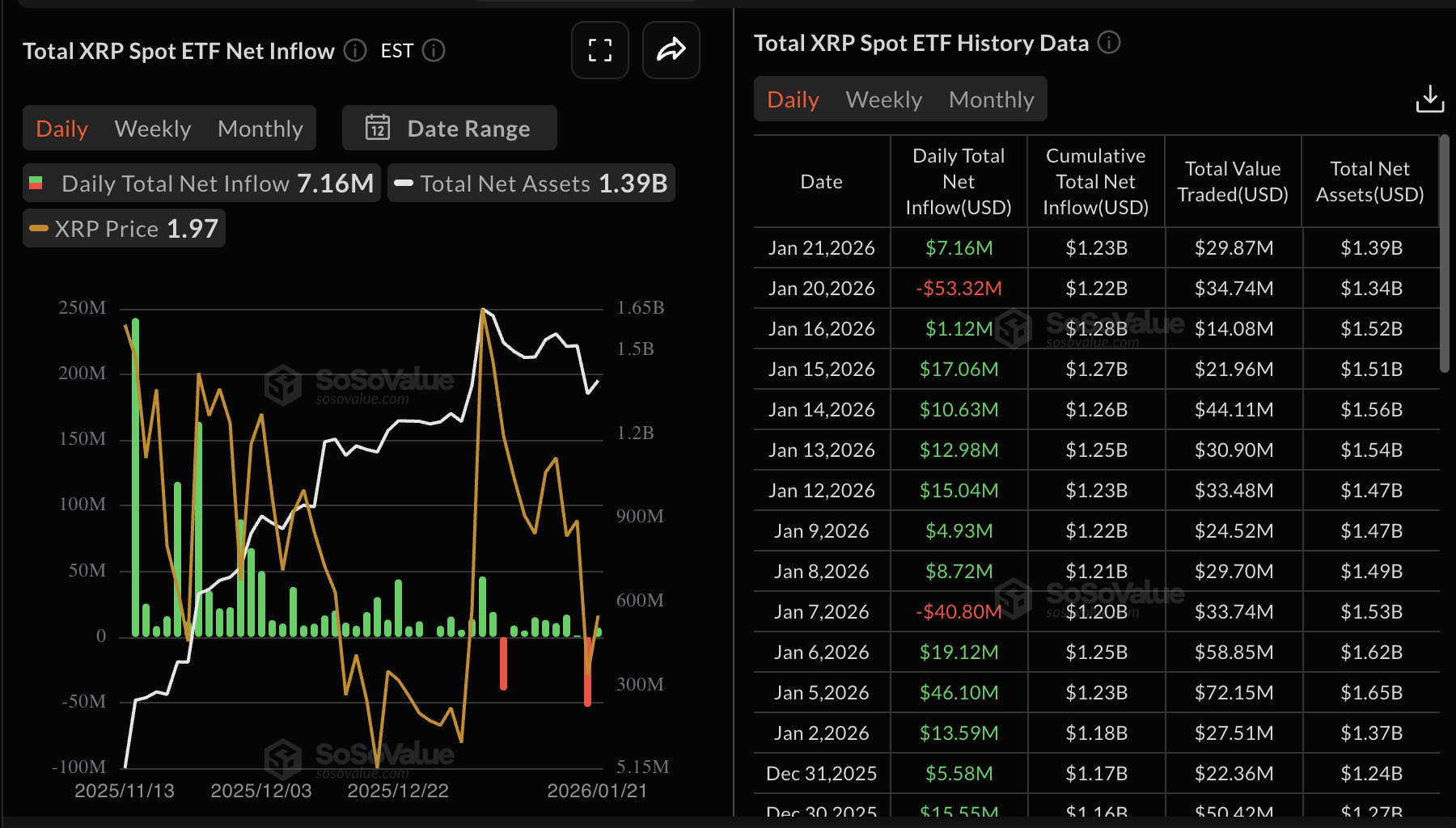

Meanwhile, XRP spot ETFs turned around and posted mild inflows of approximately $7 million on Wednesday, following $53 million in outflows on Tuesday. So far, XRP ETFs have received cumulative inflows of $1.23 billion and have net assets of $1.39 billion.

Despite the overall steady inflows into XRP ETFs, retail interest has remained largely subdued. CoinGlass shows futures Open Interest (OI) averaging $3.38 billion on Thursday, up slightly from $3.35 the previous day. The OI has declined from $4.55 billion recorded on January 6, underlining the prevailing risk-off sentiment.

Chart of the day: Bitcoin bulls push to regain control

Bitcoin edges up above $90,000 as crypto majors push for stability and to shake off recent volatility, triggered by regulatory headwinds, macroeconomic risks and geopolitical tensions.

The Relative Strength Index (RSI) has risen to 45 on the daily chart, indicating that bearish momentum is fading. The RSI should push above the midline to mark a potential transition from bearish to bullish, as Bitcoin establishes higher support above $90,000.

The 50-day Exponential Moving Average (EMA) caps the upside at $92,047, the 100-day EMA at $95,497 and the 200-day EMA at $99,055. Moreover, the Moving Average Convergence Divergence (MACD) indicator is below the signal line on the same chart, prompting investors to reduce exposure, especially as the histogram bars expand below the zero line.

A daily close below the descending trendline support could push Bitcoin down to retest the Wednesday low at $87,263.

Altcoins technical outlook: Ethereum, XRP hold key support

Ethereum has reclaimed $3,000 as an immediate support level as bulls tighten their grip for the second day. The RSI is at 43 on the daily chart and recovering toward the midline, aligning with the short-term bullish bias.

A break above the descending trend line resistance and the horizontal hurdle highlighted at $3,057 could encourage risk-on sentiment and pave the way for an extended swing toward the 50-day EMA at $3,145.

The MACD indicator, on the other hand, has remained below the signal line, supporting the bearish outlook. The red histogram bars below the zero line could continue to encourage traders to short ETH, adding to the selling pressure. A close below the pivotal $3,000 level may drive ETH to retest the Wednesday low at $2,866.

XRP has similarly extended its recovery for the second consecutive day, trading above $1.95. The RSI at 45 on the daily chart could rise above the midline, a move that would signal a technical transition from bearish to bullish.

The 50-day EMA caps the upside at $2.05, the 100-day EMA at $2.18 and the 200-day EMA at $2.30. A larger breakout would be anticipated if XRP breaches this moving average cluster and sets the pace toward $2.50. Traders should temper their expectations in case profit-taking and risk-off sentiment persist, leading to extended losses toward the Monday low of $1.85.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.