Ethereum Whales Make a $110 Million Move as Market Pressure Builds

Ethereum (ETH) is experiencing notable selling pressure in January 2026, as whale wallets and institutional players have moved over $110 million worth of ETH to major exchanges.

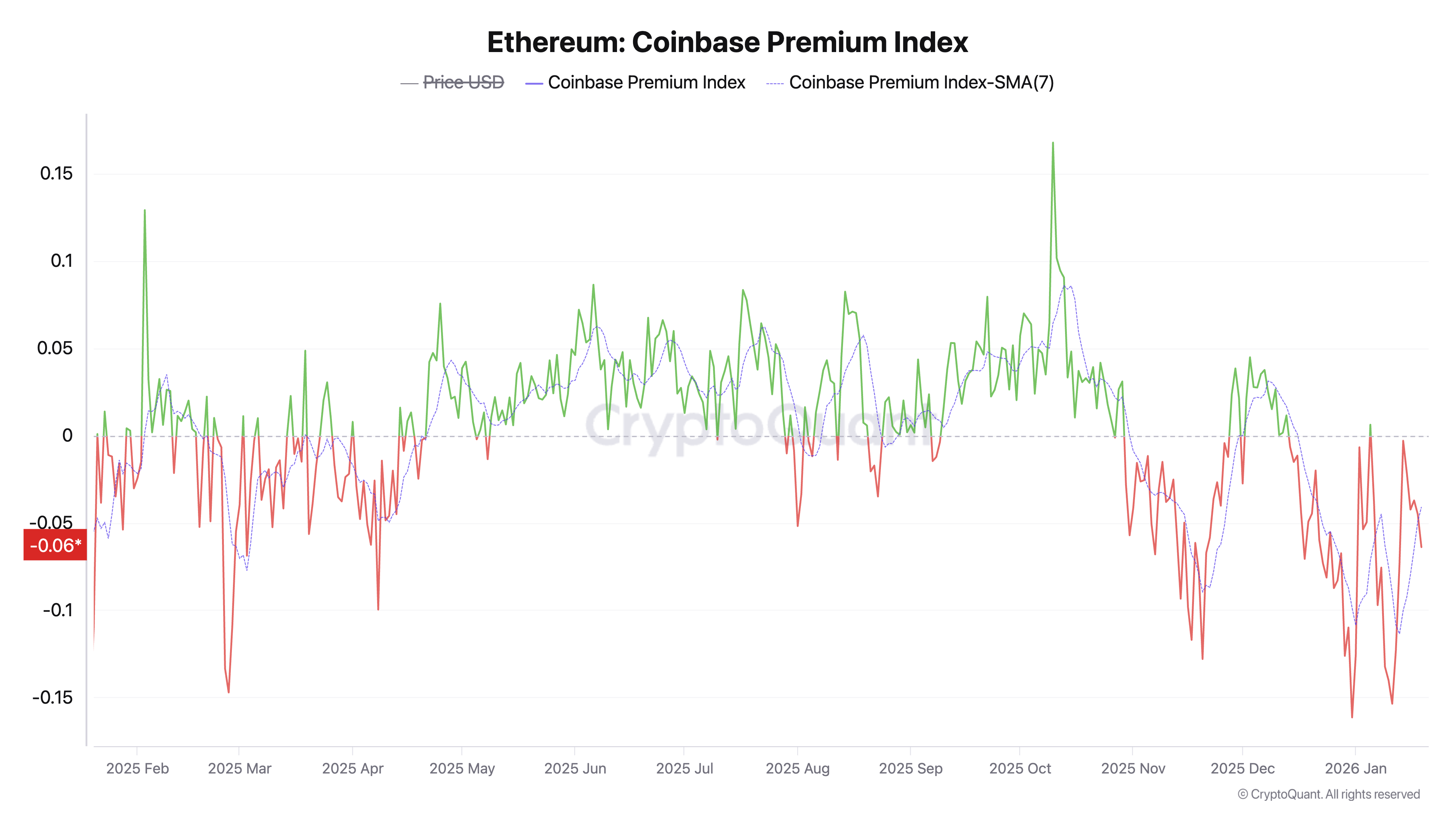

At the same time, the Coinbase Premium Index indicates weakening demand across the US market. Nonetheless, rising staking demand and supportive technical signals point to a cautiously optimistic outlook for the asset.

Large Ethereum Transfers Signal Elevated Activity From Whales and Institutions

On-chain data indicates a wave of large Ethereum transactions. Blockchain analytics firm Lookonchain reported that a wallet identified as 0xB3E8, which began trading ETH eight years ago, transferred 13,083 ETH, worth approximately $43.35 million, to Gemini last week.

Despite the recent movement, the wallet still holds 34,616 ETH, valued at roughly $115 million.

Besides whales, institutional players have also made notable moves. Lookonchain noted that Ethereum treasury company FG Nexus sold 2,500 ETH, worth about $8.04 million.

“Ethereum holding company FG Nexus sold another 2,500 $ETH($8.04M) today and still holds 37,594 $ETH($119.7M). Their last $ETH sale was in November 2025, when they transferred 10,975 $ETH($33.6M) to Galaxy Digital on Nov 18 and 19,” the post stated.

Furthermore, Lookonchain revealed that a wallet possibly linked to venture capital firm Fenbushi Capital sent 7,798 ETH worth $25 million to Binance. The tokens had been staked for two years before re-entering circulation.

It’s worth noting that market participants often view such exchange inflows as an early signal of potential selling, as assets are typically transferred to centralized exchanges to access liquidity or execute trades.

However, these movements do not necessarily translate into immediate market sales, as the funds may also be intended for internal rebalancing, collateral deployment, hedging strategies, or over-the-counter settlements. As a result, while exchange deposits can increase short-term selling risk, they do not, on their own, confirm that liquidation is imminent.

In parallel with these on-chain movements, market-based indicators provide additional context on current conditions. The Coinbase Premium Index, which measures the percentage difference between the Coinbase Pro price (USD pair) and the Binance price (USDT pair), is in negative territory. This signals relatively weaker demand from US-based institutional investors.

ETH’s Negative Coinbase Premium Index. Source: CryptoQuant

ETH’s Negative Coinbase Premium Index. Source: CryptoQuant

Ethereum Staking and Technical Signals Suggest Resilience

Nonetheless, Ethereum’s staking ecosystem continues to show persistent demand. Based on validator queue data, 2.7 million ETH sits in the entry queue to begin staking, resulting in a 47-day wait. This large backlog reveals strong interest in validator participation and long-term support for the network.

The comparison between entry and exit queues is noteworthy. 36,960 ETH are waiting to exit. This imbalance suggests that while some large holders are selling, the broad validator base remains committed to earning staking rewards and helping secure the network.

In addition, market analysts are pointing to technical signals which suggest further upside for the asset. Commenting on the current setup, analyst Crypto Gerla noted that ETH appears to be in a re-accumulation phase. The analyst added that a move toward $3,600 could materialize.

As of the latest data from BeInCrypto Markets, Ethereum’s trading price was $3,166.51, down 1.11%. Whether selling pressure continues to weigh on the asset or bullish momentum regains control will be a key trend to watch in the coming period.