Bitcoin Whales Calm While Market Panics: Holdings Remain Strong

On-chain data shows the Bitcoin whales have continued to hold onto their coins despite the fact that BTC has gone through bearish action recently.

Bitcoin Whales Have Participated In Net Accumulation Since March 1st

As explained by the on-chain analytics firm Santiment in a post on X, the large BTC holders in the market haven’t been shaken by the recent downturn in the price.

The indicator of interest here is the “Supply Distribution,” which tells us about the total amount of Bitcoin that the various wallet groups in the sector are holding right now.

Addresses are divided into these wallet groups based on the number of coins they currently carry in their balance. The 1-10 coins cohort, for instance, includes all addresses or investors who own at least 1 and at most 10 BTC.

In the context of the current discussion, three cohorts are of relevance: the 100-1,000 BTC, 1,000-10,000 BTC, and 10,000-100,000 BTC. The first of these correlates to the “sharks.”

The sharks make up for one of the key parts of the market, although they aren’t quite as influential as the 1,000-10,000 BTC investors, called the whales. This is naturally due to the difference in the scale of holdings between the two.

The last one, the 10,000 to 100,000 BTC cohort, includes the largest of the entities in the sector, which are bigger than even the usual whales. Sometimes, they are popularly referred to as the “mega whales.”

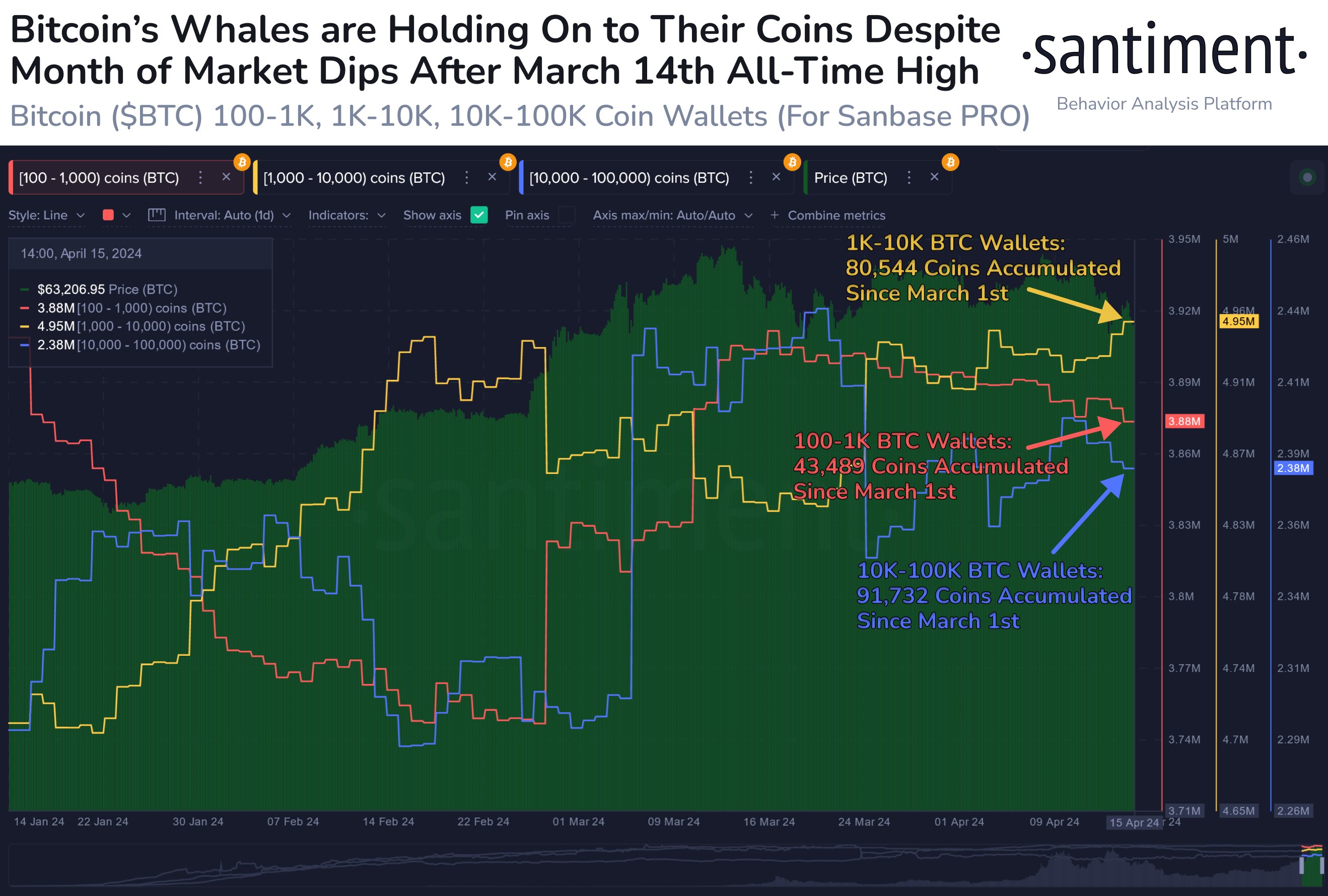

Now, here is a chart that shows the trend in the Bitcoin Supply Distribution over the last few months:

As displayed in the above graph, the Bitcoin Supply Distribution of all of these key holders has gone up since the start of March, suggesting that they have been participating in some net accumulation.

To be more specific, the sharks have bought 43,489 BTC (equivalent to $2.72 billion at the current exchange rate) inside this period, the whales 80,544 BTC ($5.04 billion), and the mega whales 91,732 BTC ($5.75 billion).

As is visible in the chart, though, the timing of the buys wasn’t quite the same between these cohorts. It would appear that the mega whales participated in some wholesale aggressive accumulation at the start of last month, which led to the rally towards the new all-time high (ATH) price.

The whales sold into this ATH and only bought once the drawdown had finished following this peak, while the sharks consistently bought as the rally towards the ATH took place and then stopped purchasing further.

Given this trend, it would appear possible that the ATH rally was fueled by massive purchases from the mega whales. These humongous investors sold some after the initial price drawdown but have since held tight.

In this same window, the sharks and whales also have more or less seen sideways movement in their holdings. This is despite the fact that bearish price action has continued for Bitcoin.

BTC Price

At the time of writing, Bitcoin is floating around $62,600, down more than 11% over the last seven days.