Bitcoin Layer 2 Merlin chain TVL climbs 20%, defying broad market correction

- Merlin chain’s TVL added 20% this week, and crossed $800 million on Thursday.

- Bitcoin Layer 2 assets noted double-digit losses in the past week.

- Stacks, Elastos, SatoshiVM, BVM are hit by a correction as Bitcoin hovers around $61,000.

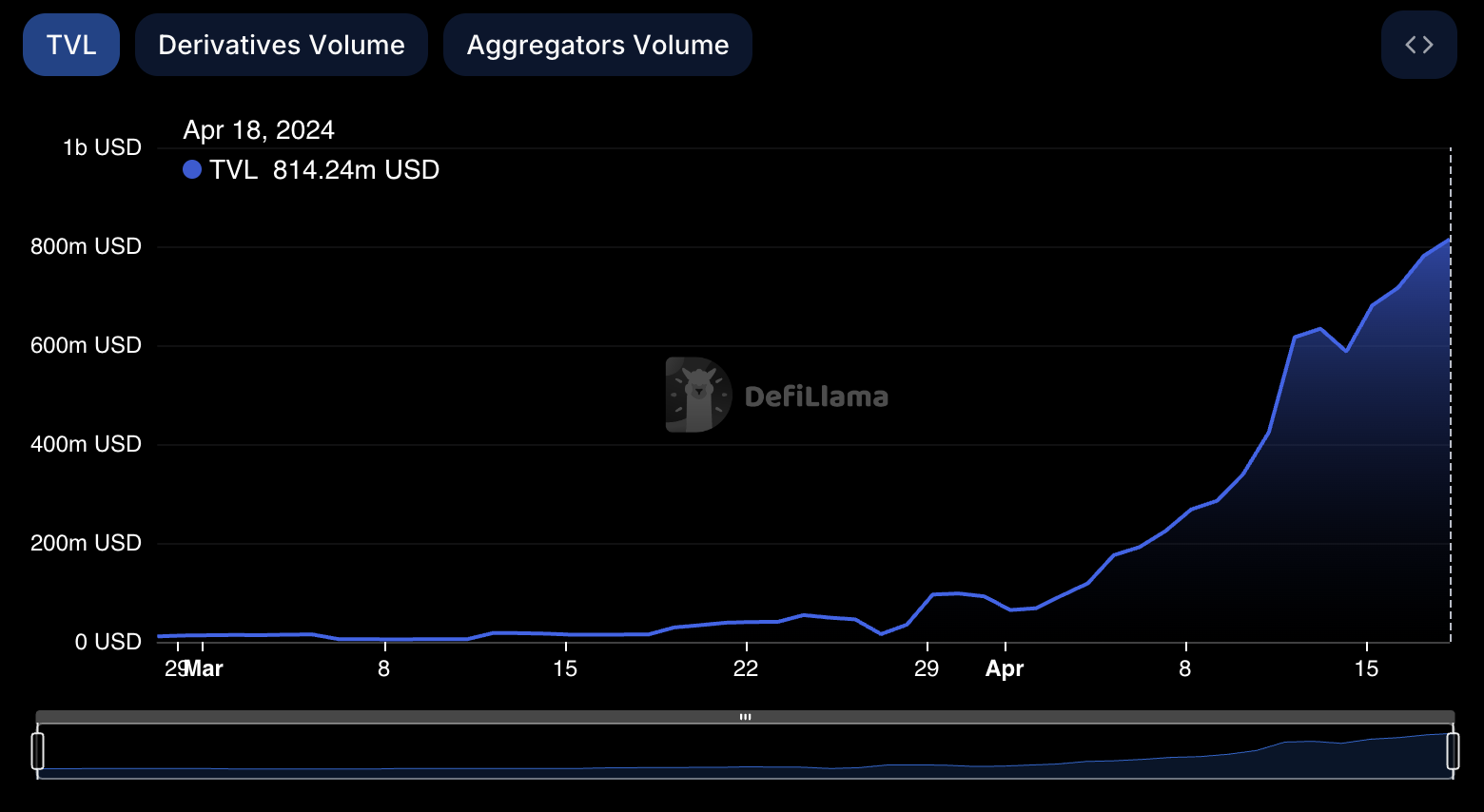

Merlin Chain, a Bitcoin Layer 2 solution, has amassed $814 million in total value of assets locked (TVL) in under two months, according to DeFiLlama data. The increase came despite Bitcoin’s decline to the $61,000 level, which dragged down the prices of other BTC Layer 2 solutions such as Stacks (STX), Elastos (ELA), SatoshiVM (SVM) and BVM (BVM).

New Bitcoin Layer 2 chain announces airdrop, amasses over $800 million TVL

Bitcoin Layer 2 chain Merlin experienced a 20% increase in its TVL this week despite the broad correction in BTC and its ecosystem tokens. BTC price has declined by around 13% in the weekly timeframe, dragging down its Layer 2 tokens with it.

STX, ELA, SVM and BVM prices declined between 25% and 30% in the past week, according to CoinGecko data. Despite these developments in Bitcoin, Layer 2 solution Merlin chain has amassed $814 million in TVL, with a steady increase throughout this week.

Merlin TVL

The increase in Merlin Chain could be attributed to the fact that its governance token MERL is expected to go live on several crypto exchanges, including OKX, on Friday. Alongside its exchange listing, Merlin announced an airdrop for eligible users on the OKX exchange, announced in an official tweet on X.

$MERL airdrop for @OKX users now live!

— Merlin Chain (@MerlinLayer2) April 18, 2024

40,000 of $MERL will be airdropped to 20,000 eligible OKX users on a First Come, First Serve basis.

https://t.co/nlORMfTN8T

Complete all tasks, including having a @zkPass attestation of a KYC-ed OKX account registered after Jan 1st,… pic.twitter.com/g85lDeUKQw

Traders need to exercise caution when participating in airdrops and when clicking on links associated with airdrop announcements. There have been several scams where participants lose their investment when attempting to claim airdrops, due to phishing scams and fake accounts on X.

$MERL Listings

— Crypto Koryo (@CryptoKoryo) April 18, 2024

Merlin Chain’s governance token $MERL will be listed on OKX, Gate, KuCoin among other CEXs tomorrow 19th.

This post is done in collaboration with Merlin Chain. NFA. Always DYOR. pic.twitter.com/Tg2K6gbNWU

The upcoming Bitcoin mining difficulty adjustment, known as the halving event, is likely the driver of the market correction. BTC holders and traders are likely offloading their risk assets prior to the scheduled halving on April 20.

In the last two weeks of March and the first ten days of April, Bitcoin rallied in response to net positive inflow to the Exchange Traded Funds (ETFs) and institutional interest in the asset. The halving and macroeconomic events have likely catalyzed the recent decline in the asset’s price, with Layer 2 assets and ecosystem tokens feeling the ripple effect.