Bitcoin Investors In The Red: Losses Trump Profits As Ratio Dips Below 1

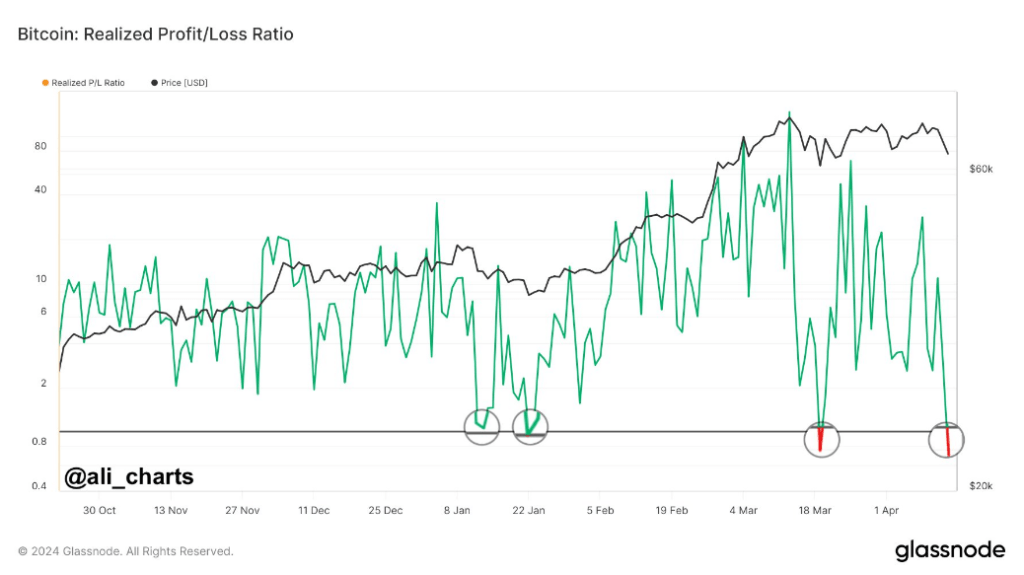

Investors are bracing themselves for a rollercoaster ride as Bitcoin, the flagship digital asset, navigates through choppy waters. Recent data from Glassnode has revealed a noteworthy development: the Realized Profit/Loss Ratio for Bitcoin has dipped below one.

This crucial metric, which compares the sell value of Bitcoin with the price at which it was bought, indicates that investors are currently realizing more losses than profits. Historically, such a dip has often heralded a potential bottoming out of Bitcoin’s price, serving as a vital signal for market watchers.

Sense Of Optimism Despite Bitcoin Price Decline

The past 24 hours have witnessed significant volatility in Bitcoin’s price trajectory. A sharp decline early in the day saw Bitcoin’s price plummet to approximately $64,000, worrying many investors.

However, a remarkable recovery ensued, with the price steadily climbing and peaking at around $66,000. This robust rebound has instilled a sense of optimism, with a prevailing bullish sentiment taking hold as the day progressed.

Institutional interest in Bitcoin continues to grow, with recent developments signaling potential shifts in capital inflows. The approval of a spot Bitcoin ETF by Hong Kong regulators has opened the floodgates for increased institutional engagement, particularly from Asia.

This move could inject fresh capital into Bitcoin markets, potentially fueling further price momentum. Furthermore, regional dynamics play a significant role in shaping investor sentiment and behavior. Varying investment trends across different regions highlight the diverse responses to prevailing market conditions.

While some regions may exhibit cautious sentiment amidst volatility and geopolitical uncertainties, others may embrace Bitcoin as a hedge against inflation and currency devaluation.

Critical Support Levels

Bitcoin analyst Willy Woo has pinpointed a critical support level at $59,000. Breaching this threshold could signify a transition into a bearish market sentiment. Conversely, there’s anticipation among investors for potential short liquidations that could drive the price upwards, potentially reaching between $70,000 and $75,000, provided that current support levels hold steady.

These anticipated events hinge on market liquidity and investor reactions to the rapidly evolving price movements. As Bitcoin continues its consolidation phase near all-time highs, investors remain cautiously optimistic about its future prospects.

The upcoming halving event adds another layer of complexity to the already intricate market dynamics, with expectations of heightened volatility in the days ahead.

Analysts suggest that this period of lateral movement serves as a crucial stage for the redistribution of assets among investors, potentially laying the groundwork for a more sustainable recovery in the long run.

The cryptocurrency market, particularly Bitcoin, is navigating through a period of heightened uncertainty and volatility. The recent dip in the Realized Profit/Loss Ratio signals a potential turning point in Bitcoin’s price trajectory, while institutional interest and regional dynamics continue to shape market sentiment.

Featured image from Pexels, chart from TradingView