3 Altcoins To Watch If Bitcoin Drops Under $80,000

Traders might be looking for coins to buy if Bitcoin drops under $80,000, as the market keeps turning lower. BTC has already fallen about 24% since November 11 and continues to drag most major assets down due to its strong market dominance.

But a few altcoins show either strong structures or negative correlation with Bitcoin. These names may hold better if BTC heads toward $80,000 or even breaks below it. Here are the top picks, starting with the strongest setup.

Zcash (ZEC)

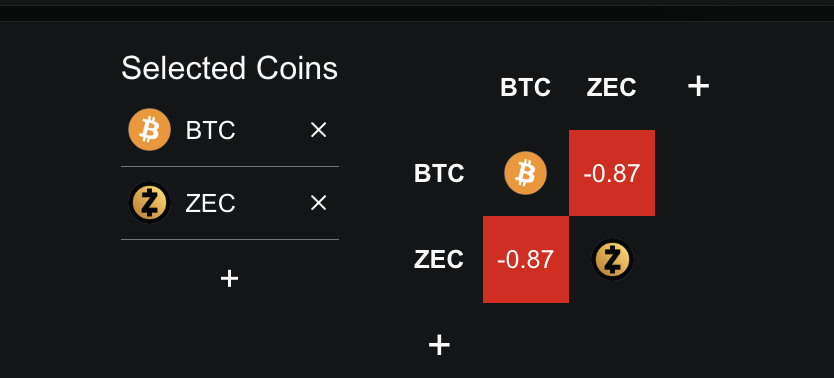

Zcash remains one of the cleaner charts in a market full of breakdowns. It also carries a one-month correlation of –0.87 with Bitcoin, meaning ZEC often moves opposite to BTC.

Zcash Correlation: Defillama

Zcash Correlation: Defillama

This matters now because Bitcoin’s trend is weakening as the 100-day EMA moves closer to crossing below the 200-day EMA. If that crossover happens, the drop under $80,000 becomes much more likely.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BTC Price Analysis: TradingView

BTC Price Analysis: TradingView

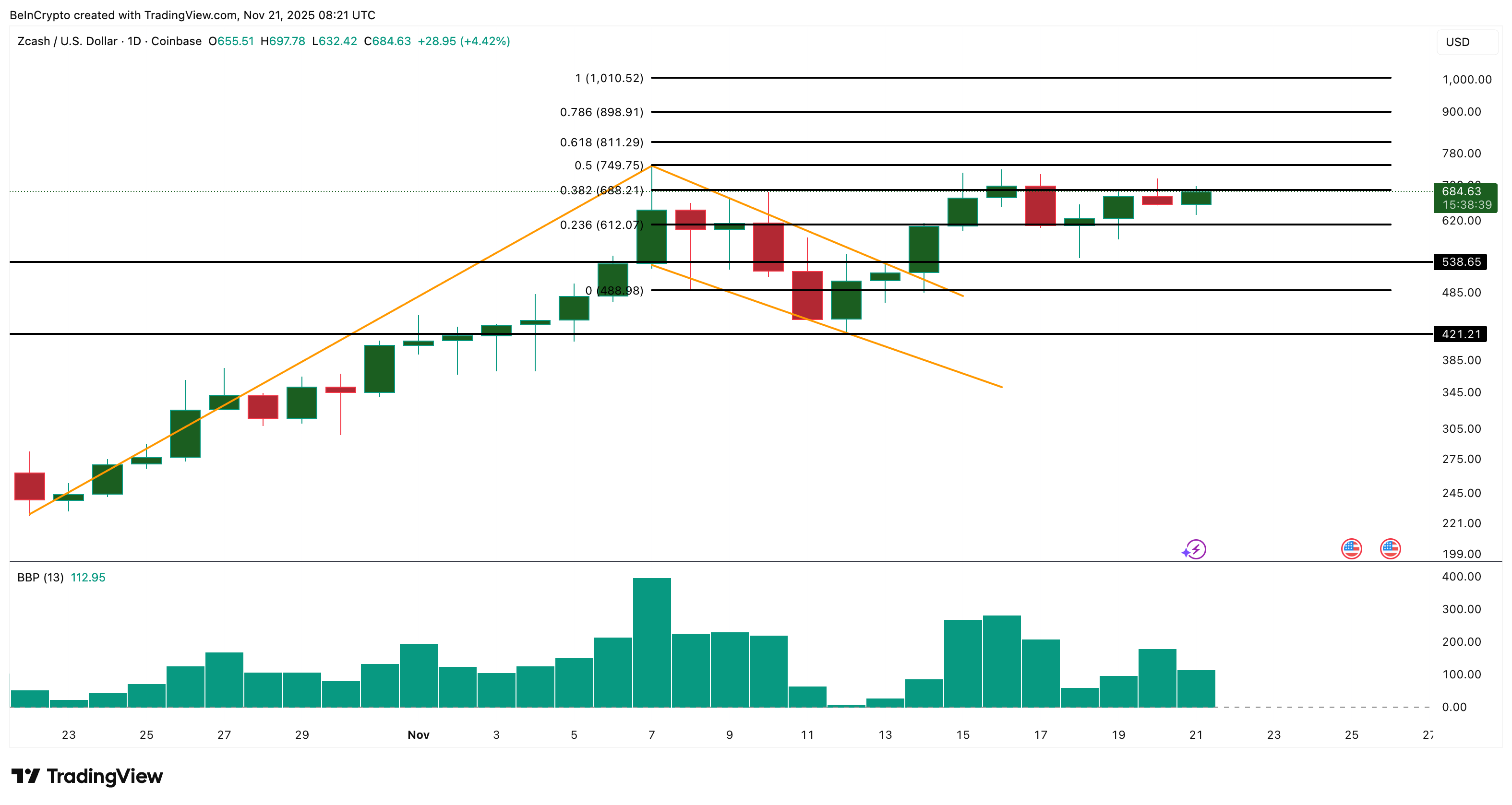

ZEC price continues to hold its flag breakout from November 14. Buyers have defended every dip, keeping the trend intact even as BTC lost support levels. The key resistance sits at $749. A clean breakout above this level opens the path to $898, followed by the round-number zone near $1,010.

Zcash Price Analysis: TradingView

Zcash Price Analysis: TradingView

If Bitcoin falls again, this negative correlation gives Zcash a chance to move higher while the broader market slips.

One more sign supports the move. The Bull Bear Power indicator, which compares price to a basic trend line, shows whether buyers or sellers are controlling momentum. Despite minor pullbacks, this indicator has stayed positive for more than a month. That means buyers have not lost control during any dip.

With Bitcoin weakening again, this steady buyer strength and the negative correlation give Zcash a real chance to push higher if BTC slips further.

The invalidation sits near $488. A daily close below this level would mean the breakout has failed, and ZEC may slip towards $421. That scenario becomes more likely only if the Bitcoin price finds stability again.

Pi Coin (PI)

Pi Coin has become one of the key coins to buy if Bitcoin drops under $80,000, mainly because it has shown clear strength while the market turns weak. Over the past month, Bitcoin has been down about 19%, yet Pi Coin is still up almost 18%.

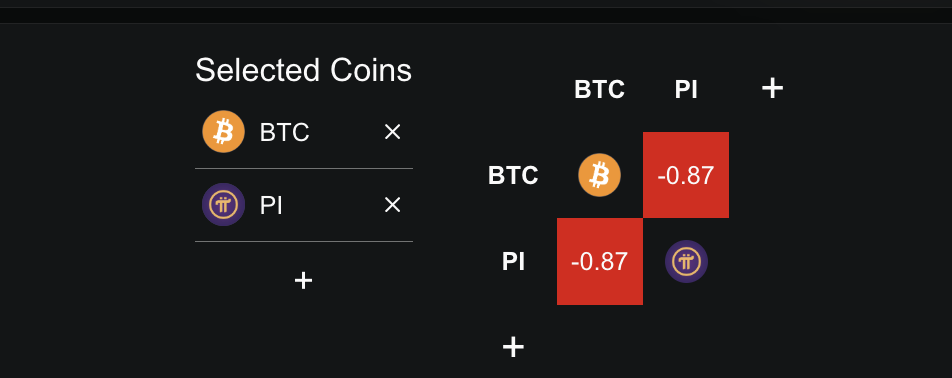

One important factor is its seven-day correlation with Bitcoin. Pi Coin holds a negative correlation of –0.87, which means it usually moves in the opposite direction. When Bitcoin falls, Pi often has room to rise. This negative link alone makes PI an attractive hedge in the current setup.

PI Correlation: Defillama

PI Correlation: Defillama

The price structure also supports the view. Pi trades close to a key resistance at $0.25. A clean push above this level can open a path toward $0.29, especially if Bitcoin stays weak. But if Pi drops under $0.22, the next support sits near $0.20.

Money flow data confirms the short-term strength. The Chaikin Money Flow (CMF), which shows whether big money is entering or leaving an asset, remains above zero. A reading above zero means buy-side pressure is stronger. Between November 14 and November 21, both the price and CMF formed higher lows.

This shows that larger buyers supported the recent bounce.

PI Price Analysis: TradingView

PI Price Analysis: TradingView

CMF is now close to 0.11. If it breaks above this level, it will form a higher high. That would show bigger money returning again, which may fuel another move higher if Bitcoin continues sliding.

Pi Coin remains a rare green spot in a red market. With strong money flow, a negative correlation of –0.87, and a clear breakout level at $0.25, it stands out as one of the cleaner setups during the Bitcoin drop scenario.

Tensor (TNSR)

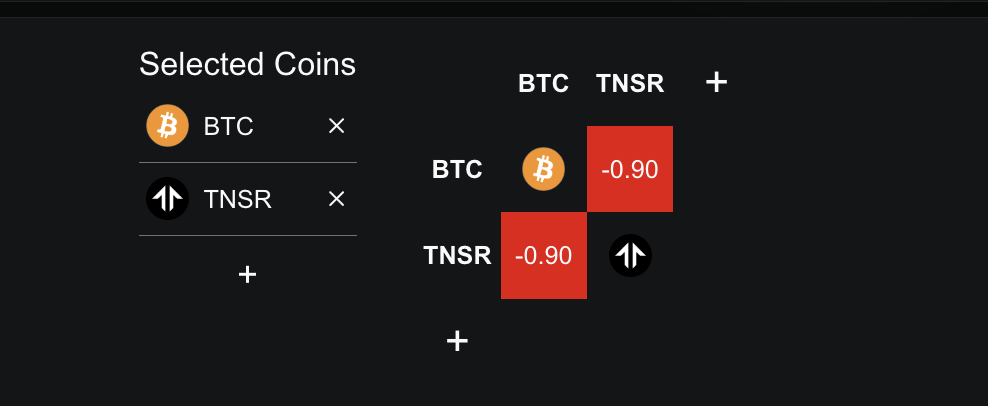

Tensor also fits the list of coins to buy if Bitcoin drops under $80,000, mainly because it has shown one of the strongest negative correlations with Bitcoin in the short term. Its seven-day Pearson coefficient sits near –0.90, meaning it often moves the opposite way when Bitcoin falls.

TNSR Correlation: Defillama

TNSR Correlation: Defillama

The recent move supports this view. Tensor gained more than 340% over the past week, even though the broader market dropped. A single newly created wallet steadily accumulated over 16 million TNSR during the rally. This steady buying helped push the price up despite weak activity on Tensor’s NFT marketplace, where trading and fees have been sliding for months.

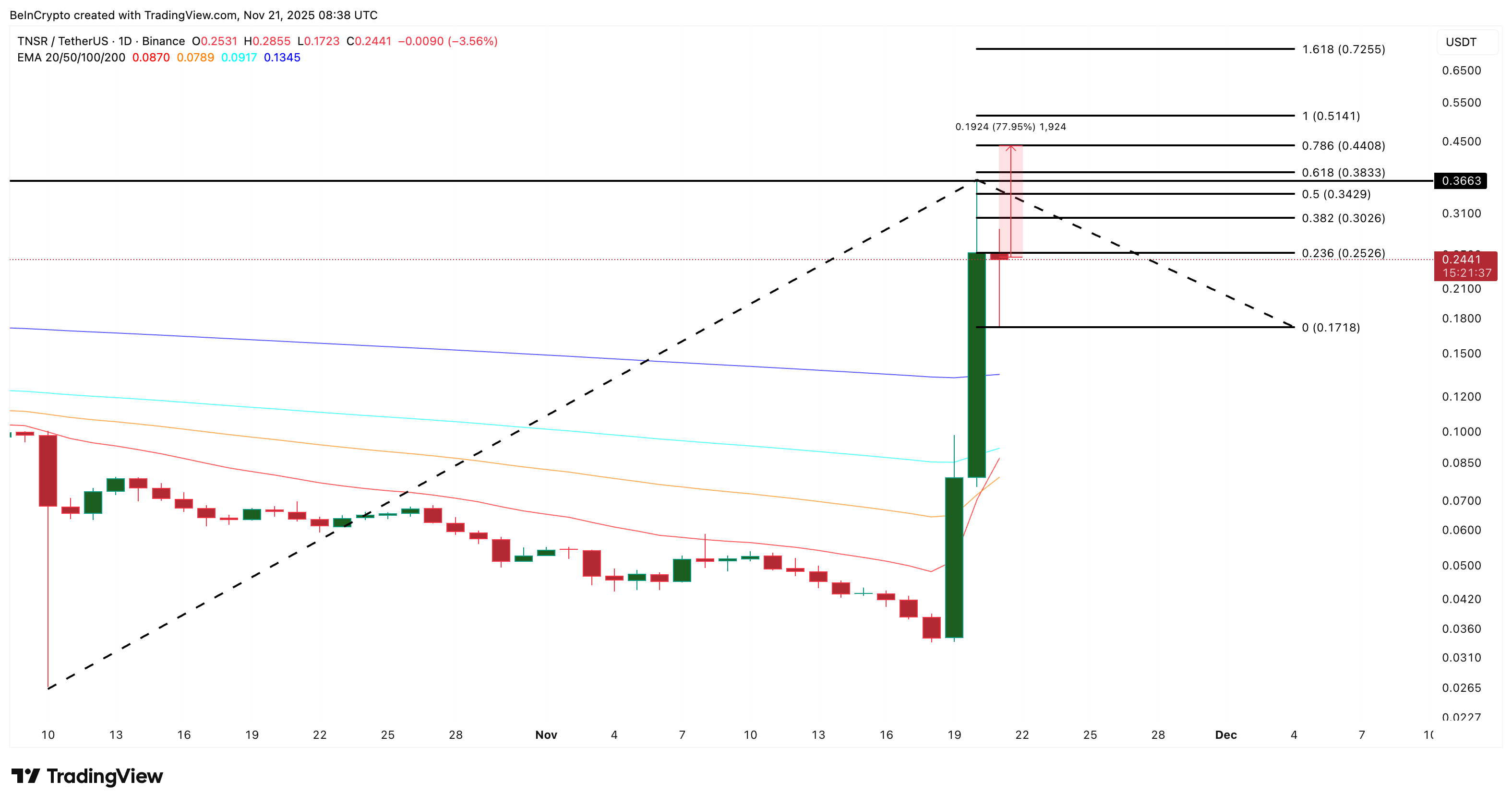

The chart shows why momentum remains strong. The 20-day exponential moving average (EMA) has already crossed above the 50-day average and is now moving toward the 100-day average. If the 20 breaks above the 100, traders treat it as a stronger bullish signal because it shows recent strength overtaking longer-term weakness.

An exponential moving average (EMA) is a type of price average that gives more weight to recent data, so it reacts faster than a simple moving average.

Tensor trades near $0.24 after hitting $0.36 earlier. To extend the rally, it needs a clear break above $0.36 and then $0.38. If Bitcoin continues to drop and the negative correlation stays firm, Tensor could reach $0.44, with even $0.72 possible based on extension levels.

TNSR Price Analysis: TradingView

TNSR Price Analysis: TradingView

If the market turns and Bitcoin rebounds sharply, TNSR may retrace toward $0.17, which is the previous support zone.

For now, strong accumulation, improving averages, and a sharp negative correlation make Tensor a reasonable pick on this list.