MicroStrategy Faces $9 Billion Outflow Risk as Index Providers Eye Bitcoin Holdings

MicroStrategy confronts a critical test as leading index providers consider rules that could strip the company of nearly $9 billion in passive investment flows.

MSCI is consulting on new criteria that would exclude firms with digital asset holdings exceeding 50% of total assets.

Index Exclusion Threatens Core Strategy

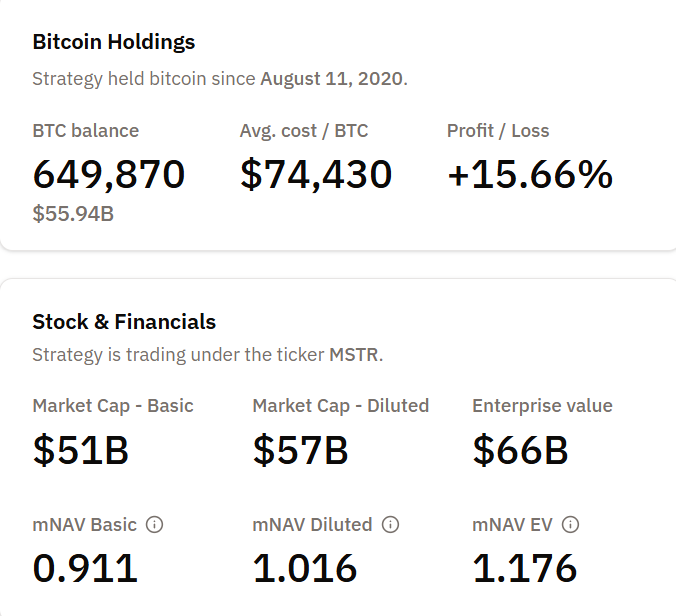

MicroStrategy, recently renamed Strategy Inc., holds 649,870 Bitcoin as of this writing, with an average cost of $74,430 per coin. The company’s break-even price matches this purchase point, leaving little margin as Bitcoin trades under pressure.

MicroStrategy BTC Holdings. Source: Bitcoin Treasuries

MicroStrategy BTC Holdings. Source: Bitcoin Treasuries

Its market capitalization is $51 billion on a basic share count and $57 billion fully diluted, while enterprise value is $66 billion.

MSCI began a formal consultation in September 2025 on how to treat digital-asset treasury companies (DATs).

According to MSCI’s official consultation documents, the proposed rule would exclude firms where digital assets comprise 50% or more of total assets and represent the main business activity.

Some clients argue that these companies resemble investment funds rather than eligible operating companies for equity indexes.

The risks extend further than MSCI. Strategy’s stock, MSTR, is listed in several key benchmarks, including the Nasdaq 100, CRSP US Total Market Index, and various Russell indexes.

Analysis from JPMorgan suggests that MSCI exclusion alone could result in $2.8 billion in passive fund sales. If other providers make similar changes, the total outflows could reach $8.8 billion.

The potential removal from benchmarks such as the MSCI USA and Nasdaq 100 presents the biggest challenge yet to Michael Saylor’s Bitcoin accumulation approach. A final decision is expected by January 15, 2026.

Valuation Premium Collapses Amid Bitcoin Downturn

Timing makes these issues more serious. Strategy’s shares have fallen 60% from recent highs, eroding the valuation premium that fueled its capital raise-and-buy strategy.

Its multiple to net asset value (mNAV) has compressed toward parity, reflecting reduced investor confidence in Saylor’s “sell stock, buy Bitcoin, repeat” flywheel.

This premium is crucial because Strategy’s model depends on it. The company issues equity and convertible debt to fund Bitcoin purchases, hoping shares will trade above the value of its Bitcoin holdings.

If that premium is lost, the business case weakens since investors can simply buy Bitcoin directly.

Meanwhile, funding costs have increased. Strategy issued convertible notes earlier in 2025 at higher terms. With Bitcoin underperforming, the firm faces squeezed profitability.

Its Bitcoin holdings show a 15.81% profit as of mid-November, but that margin shrinks if prices fall near the $74,430 break-even.

Market Divided on Index Classification

Not all market participants agree with the proposed exclusion. Matthew Sigel, VanEck’s head of digital assets research, pointed out on X that JPMorgan’s report reflects client feedback shaping index rules, rather than an explicit call for exclusion.

This highlights the issue as being about process, rather than just fundamental company characteristics.

The consultation exposes uncertainty around how finance should classify Bitcoin treasury companies. MSCI’s rules typically separate operating firms from investment vehicles.

Strategy runs analytics software, but gains most attention from its Bitcoin holdings, creating a hybrid identity that complicates classification.

Other companies also face review. MARA Holdings, Metaplanet Inc., and Bitcoin Standard Treasury Company all hold sizable digital assets.

Yet, Strategy’s scale and prominence make it a test case. If removed, it will set a precedent for how indexes treat public firms using Bitcoin as a reserve.

The January 15, 2026, decision date is critical. Strategy has to manage its Bitcoin position, funding costs, and meet shareholder expectations during this period.

The outcome will show whether Bitcoin treasury companies can maintain access to passive capital or risk reclassification and exclusion from major indexes. For Saylor’s model, the stakes are high.