Two Altcoins are Defying Market Odds With a Sustained Rally

Bitcoin hovered around the $100,000 mark through the weekend as traders searched for signs of recovery across the broader crypto market. Its muted performance contrasted with sharper advances among select altcoins, where fresh liquidity clustered around decentralized infrastructure and privacy-focused assets.

Data from Santiment showed that several mid-cap tokens, including Filecoin, DASH, Internet Computer Protocol, and Zcash, outpaced the market. Their rally underscored how traders have shifted toward narratives with clearer fundamental catalysts while Bitcoin remained locked in a narrow range.

Filecoin Leads Altcoins Rally

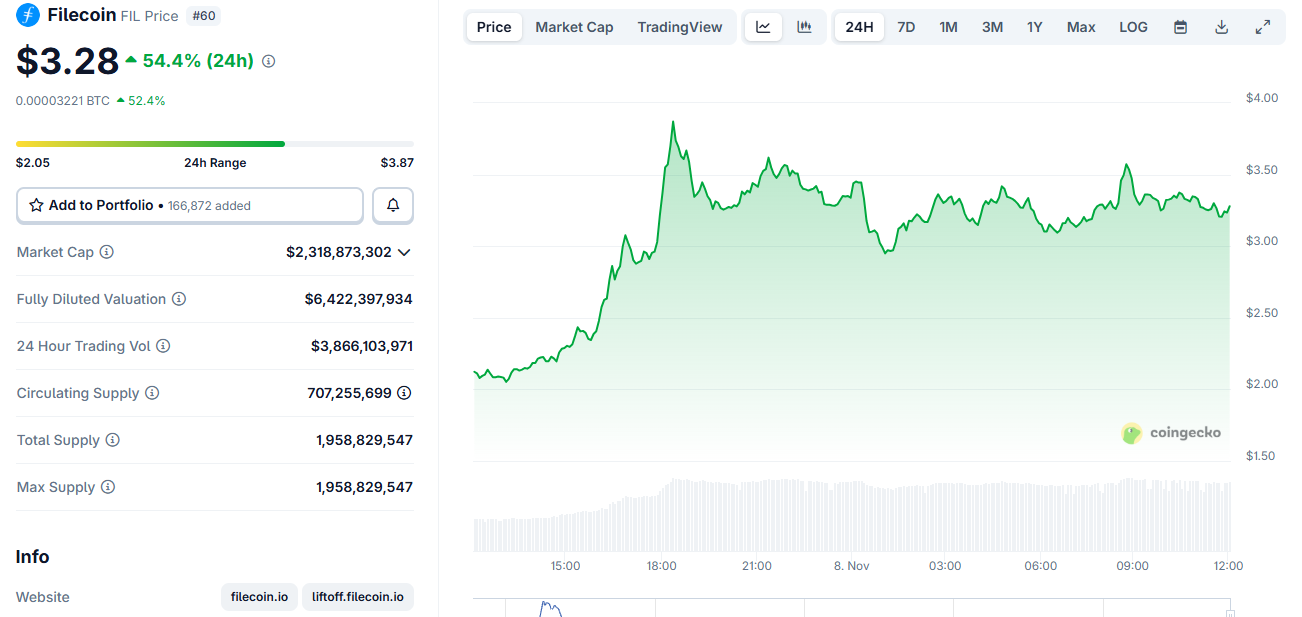

According to BeInCrypto data, Filecoin led the recent surge, with the storage token jumping more than 60% in the past 24 hours to roughly $3.47, its highest level since February.

Filecoin Price Chart. Source: CoinGecko

Filecoin Price Chart. Source: CoinGecko

The move extended a broader rotation into the decentralized physical infrastructure (DePIN) sector. In that sector, Filecoin has positioned itself as a modular data layer for Web3 and AI workloads.

Notably, assets in this sector gained additional traction after Amazon Web Services suffered a multi-hour outage in October, which disrupted major platforms, including Coinbase and Robinhood.

The event reignited debate around centralized cloud dependencies and strengthened the case for hybrid, decentralized infrastructure.

Meanwhile, Messari data shows that Filecoin recently celebrated its fifth anniversary with a rise in developer activity and new milestones.

“Originally focused on incentivized cold storage, the network has expanded to support smart contract programmability through the Filecoin Virtual Machine (FVM), enabling applications in DeFi, data management, and decentralized autonomous organizations,” Messari wrote.

So, traders who had been waiting for a broader market impulse instead rotated into assets with narrative-driven momentum.

Privacy Tokens Like Zcash Draw New Capital

At the same time, privacy tokens also picked up new flows.

For context, Zcash reached a multi-year high of approximately $712 on November 7 before retreating to the mid-$500s.

The correction marked its first major pullback since a sustained rally that began in early autumn, yet the token remains significantly higher on the year.

Arthur Hayes, co-founder of BitMEX, said ZEC has become the second-largest liquid position in his family office, Maelstrom.

His comments helped fuel interest in privacy-focused settlement and trading. That demand has re-emerged as an alternative to increasingly visible, compliance-heavy payment rails.

Dash followed a similar pattern, reaching multi-year highs above $100 alongside rising privacy-transaction volumes and renewed developer engagement.

Market analysts tracking sector-wide flows note that capital rotated into privacy and infrastructure tokens. They argue these assets offered clearer catalysts than Bitcoin’s consolidation phase.

Whether this marks the early stages of an altseason remains uncertain. However, the speed of inflows and the focus of traders suggest that positioning is now happening ahead of potential catalysts rather than in response to them.