BNB, Solana, Cardano record double-digit losses as crypto market liquidations surge

- The total cryptocurrency market liquidations have crossed the $1 billion mark in the last 24 hours.

- BNB, Solana, and Cardano declined over 10% in the same time period, resulting in the largest losses among the top 10 cryptocurrencies.

- The futures Open Interest drops over 5% in the 24 hours, signaling a risk-off sentiment among traders.

The cryptocurrency market trades in the red with BNB (previously known as Binance Coin), Solana (SOL), and Cardano (ADA) leading the losses in the top altcoins list. Over the last 24 hours, total liquidations exceeding $1 billion amid a market pullback signal a massive wipeout of bullish-aligned traders, similar to what was seen last week.

Crypto market is bleeding again!

The total cryptocurrency market drops below $3.5 trillion with a 3% loss at press time on Friday. The fourth consecutive day in decline confirms the early recovery from this week as a dead cat bounce move.

Total cryptocurrency market capitalization daily price chart.

Amid the pullback, Bitcoin is trading below $105,000 at the time of writing, which fuels a broader market sell-off wave. BNB, Solana, and Cardano have recorded double-digit losses in the last 24 hours.

BTC/USDT daily price chart.

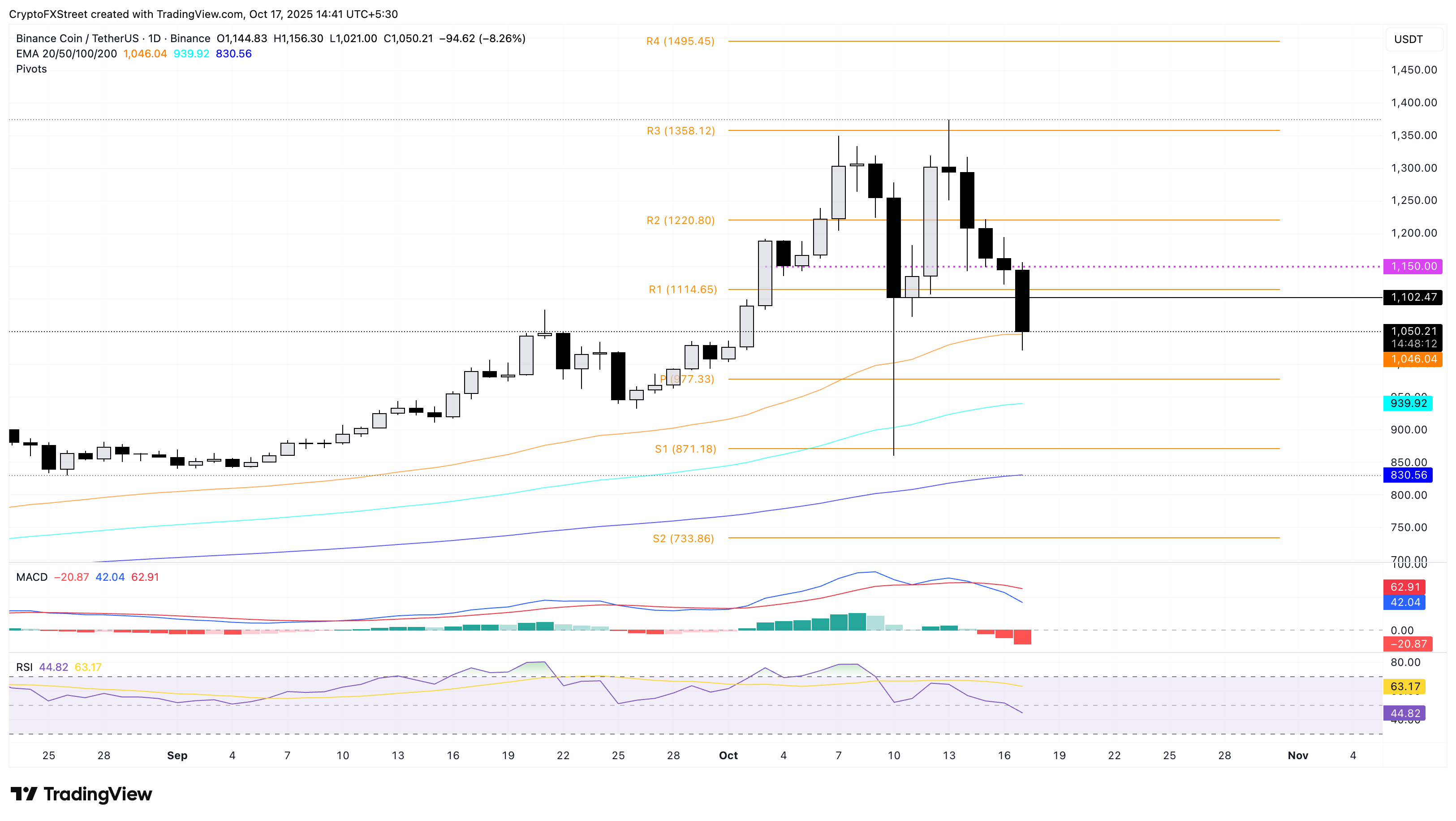

BNB is testing the 50-day Exponential Moving Average (EMA) at $1,046, and a decisive close below this dynamic support could threaten the $1,000 psychological support. The centre Pivot Point level at $977 could act as the next support.

BNB/USDT daily price chart.

Similarly, Solana pressures the $175 support zone, which provided a bounce back last week, after crossing below its 200-day EMA at $186. If SOL drops below $175, the $155 support zone could be tested against rising selling pressure.

SOL/USDT daily price chart.

On the other hand, Cardano, trading at $0.60 at press time, struggles to find support, risking a free-fall move to the $0.5118 level, which provided support twice, on April 7 and June 22.

SOL/USDT daily price chart.

Technically, BNB, SOL, and ADA experience a significant surge in selling pressure as the Moving Average Convergence Divergence (MACD) extends the downward trend below the signal line. At the same time, the Relative Strength Index (RSI) in BNB drops below the halfway line to 44, indicating a loss in bullish momentum, while SOL and ADA experience the RSI approaching the oversold zone, reflecting heightened supply pressure.

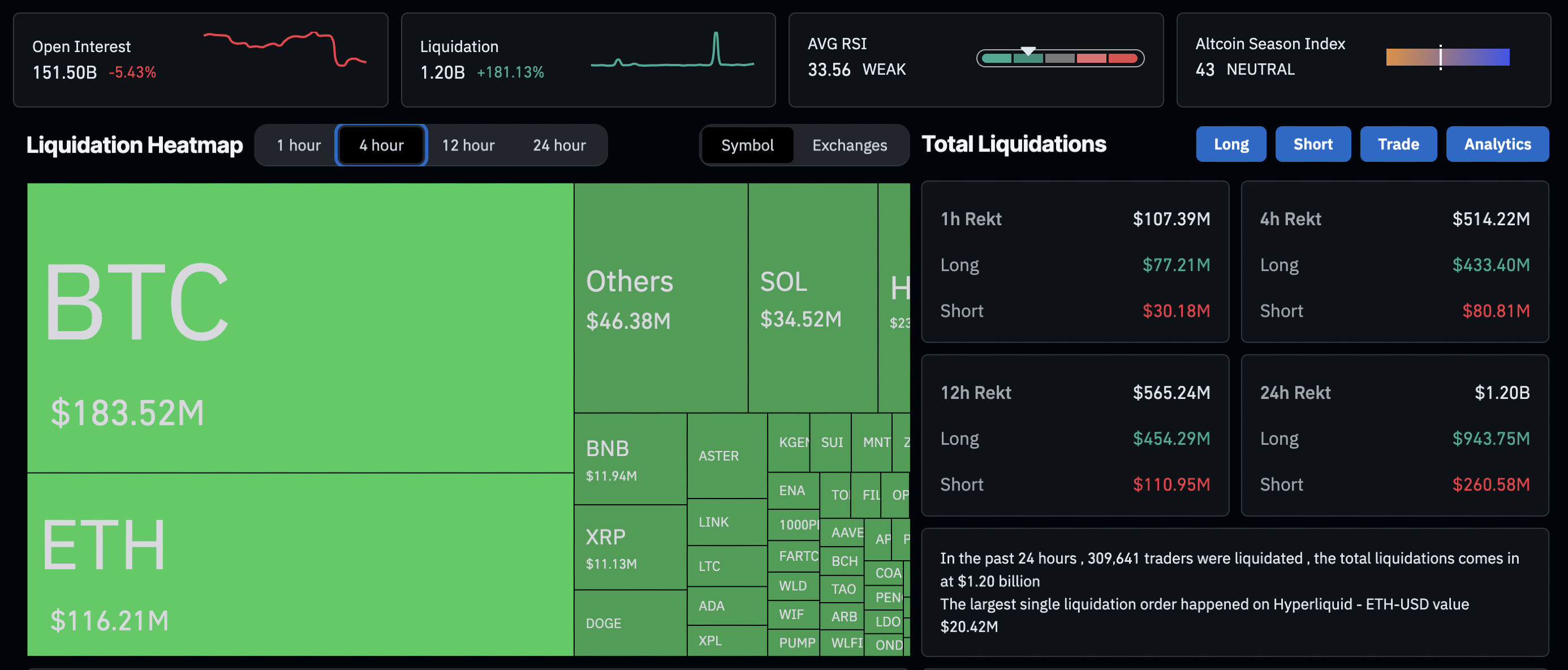

Crypto investors turn back to the market

With the prices of cryptocurrencies taking a nosedive, the derivatives market witnesses a biased wipeout of largely bullish-aligned positions. CoinGlass data shows that the total liquidations account for $1.20 billion in the last 24 hours, with long liquidations of $943.75 million outpacing short liquidations of $260.58 million.

The liquidation surge cracks traders’ confidence in market stability, spiralling to increased capital outflow. The broader crypto market Open Interest (OI) stands at $151.50 billion, recording a 5.43% decline in the last 24 hours. A decline in OI refers to a decrease in the notional value of outstanding futures contracts, suggesting that investors are limiting risk exposure.

Crypto market derivatives and liquidation data. Source: CoinGlass

If Bitcoin fails to find an external catalyst to lift off from the nearest support level, it could revisit levels below $100,000, threatening further panic in the market.