Is Bitcoin’s “Uptober” Here? Analysts Look to a 4-Year Cycle

Bitcoin’s recent surge at the start of October has reignited market excitement for a continued rally. Is October truly set to become a historic “Uptober”?

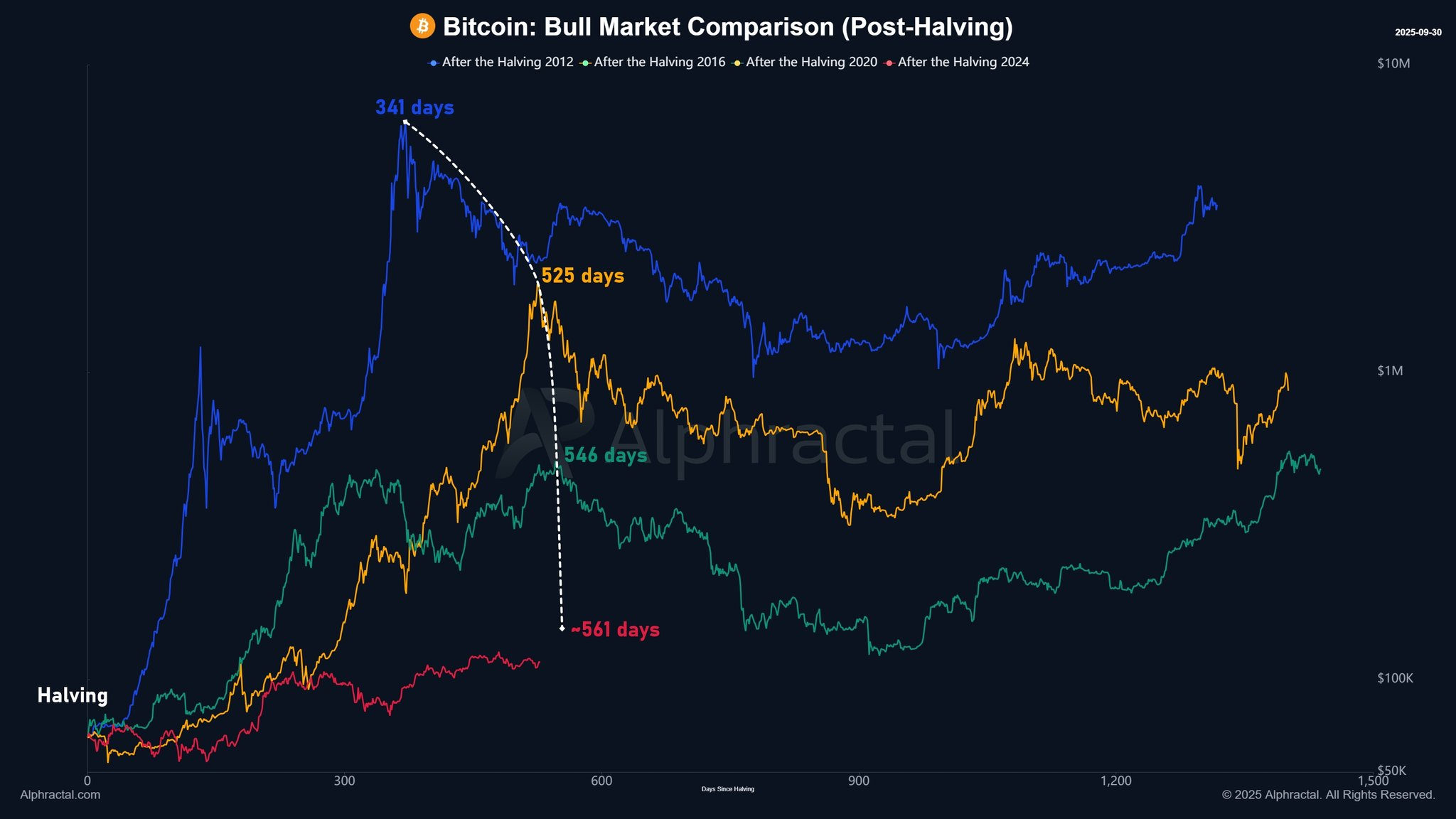

This has brought new attention to the “4-year cycle” theory, which posits that Bitcoin’s bull and bear markets repeat in a predictable pattern tied to the halving.

A Look at Historical Patterns

Joao Wedson, CEO of investment analysis firm Alphractal, is focusing on a key number: 548 days.

An analysis of Bitcoin’s past cycles shows subtle differences in the number of days between each halving and its subsequent all-time high (ATH). The cycle in 2012 took 371 days, followed by 525 days in 2016, and 546 days in 2020.

This subtly lengthening trend suggests that the current cycle is in its final stages. Wedson said this aligns strongly with other fractal and market cycle indicators like fractal cycles and the Max Intersect SMA.

He believes the magic number for this cycle is 548, as it is the likely day for the price to hit its peak. Bitcoin is currently 528 days into the rally since its last halving on April 19, 2024.

Bitcoin: Bull Market Comparison. Source: Alphractal.com

Bitcoin: Bull Market Comparison. Source: Alphractal.com

If Bitcoin hits its peak on day 548, that would be exactly October 19, 2025. Extending his hypothesis to its maximum range, the price peak could occur as late as November 1, 2025. Wedson said, “Considering that the 4-year cycles remain consistent, we’re at most 30 days (or less) away from the price peak of this cycle.”

Another Forecast: The Peak Hits December 23, 2025

Another crypto analyst, ‘seliseli46’, has also calculated the end of the current bull run. A closer look at Bitcoin’s past cycles shows that each has lasted for about 152 weeks. He explained on his X account that this is roughly 1,064 days.

- The first cycle began after a market bottom in early 2015 and ended with a peak in late 2017.

- The second cycle started in late 2018 and peaked in November 2021.

Assuming the third cycle began at the market bottom in November 2022, adding 152 weeks would place its end around December 23, 2025.

The analyst explained that this calculation aligns well with Bitcoin’s historical tendency to hit an all-time high about 12 to 18 months after a halving. However, he noted that this 152-week cycle is more of a hypothesis and is subject to external factors like regulation, market sentiment, and technological advancements.