Crypto Gainers Today: PUMP, AVAX rally as MNT reaches record high

- Pump.fun gains momentum on the back of the Binance US listing and revenue surge.

- Avalanche hits an eight-month high following the WeBlock deal.

- Mantle reaches a record high, driven by 21 new trading pairs on Bybit.

Pump.fun (PUMP), Avalanche (AVAX), and Mantle (MNT) have all recorded double-digit growth over the last 24 hours, leading the broader cryptocurrency market recovery. PUMP and MNT gain momentum with listing on Binance US and Bybit, respectively, while AVAX jumps with the Ava Labs and WeBlock deal. The technical outlook holds a bullish bias for the top crypto gainers today, suggesting an extended recovery.

Pump.fun nears record high

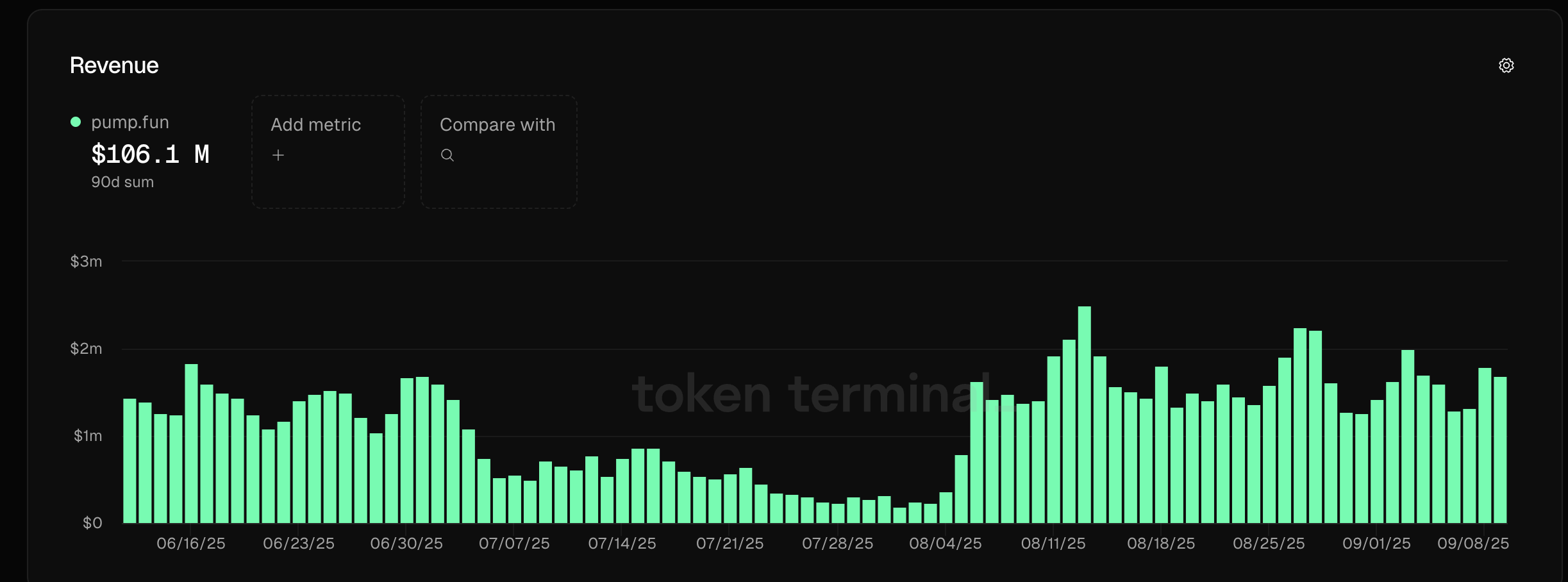

Pump.fun holds a steady rise above $0.005000 psychological level at press time on Thursday, driven by the Binance US listing and revenue surge. The Token Terminal, a data analytics platform, has shown successive daily revenue of more than $1 million since August 6.

Pump.fun revenue. Source: Token Terminal.

PUMP edges higher by 2% so far on Thursday, extending the 18% rise from the previous day. The path of least resistance for PUMP targets the record high of $0.006682 from July 15.

The momentum indicators on the daily chart flash bullish potential. The Moving Average Convergence Divergence (MACD) and its signal line display a sharp uptrend with successive rises in green histogram bars indicating an increase in bullish momentum. Additionally, the Relative Strength Index (RSI) at 74 suggests that the trend has reached overbought conditions as buying pressure increases.

PUMP/USDT daily price chart.

Looking down, a potential reversal in PUMP could retest the $0.005000 psychological level.

Avalanche struggles to surpass $30

Avalanche ranks among the top performers, underpinned by the recent Memorandum of Understanding signed between Ava Labs and WeBlock to push tokenization and Stablecoin in South Korea. AVAX ticks lower by 1% at the time of writing on Thursday, following the 13% jump on Wednesday, and is eyeing a break of the four consecutive days of uptrend.

The breakout rally of the supply zone near $26 reversed from the area below the R2 pivot at $29.78. To extend the recovery, AVAX should surpass this pivot resistance, which could lead to the R3 pivot level at $32.79.

Adding to the bullish trend, the 50-day Exponential Moving Average (EMA) crossed above the 200-day EMA, signaling a Golden Cross, which indicates a stronger short-term rally compared to the longer-term trend.

Additionally, the momentum indicators suggest increased buying pressure on the daily chart as the RSI at 67 draws closer to the overbought zone. The MACD and signal line journey upwards with the rise of green histogram bars from the zero line, indicating a rise in bullish momentum.

AVAX/USDT daily price chart.

On the flip side, if the intraday pullback deepens, AVAX could retest the $26 zone marked yellow on the chart above.

Mantle hits record high with Bybit listing

Mantle extends the uptrend for the fourth consecutive day, underpinned by the 21 new trading pairs on Bybit. At the time of writing, the MNT token appreciates 4% on Thursday, building on the 9% rise from Wednesday.

The multi-chain token holding above $1.50 has reached a record high, entering price discovery mode, potentially targeting the R2 pivot level at $1.80.

The MACD crossed above its signal line on Tuesday, triggering a buy signal with a bullish shift in trend momentum. Additionally, the RSI is at 73 steps into the overbought zone, suggesting that the buying pressure is heightened.

MNT/USDT daily price chart.

Looking down, if MNT drops below the $1.50 psychological level, it could trigger a bearish reversal to $1.36.