Here is what you need to know on Wednesday, September 10:

The US Dollar (USD) largely ignored the significant downward benchmark revision to the employment data and outperformed its rivals on Tuesday. Early Wednesday, the USD stays in a consolidation phase as market focus shifts to producer inflation data for August. Later in the American session, the US Treasury will hold a 10-year note auction.

US Dollar Price This week

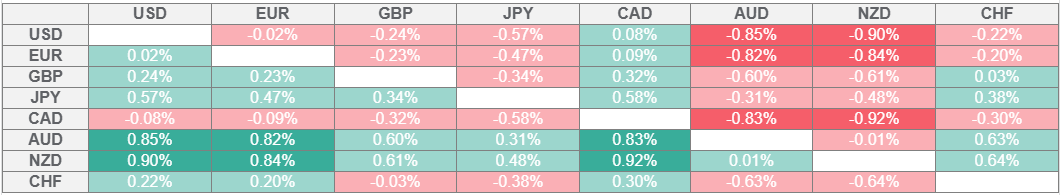

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Bureau of Labor Statistics' preliminary benchmark revision to employment data showed that 911,000 fewer jobs than initially reported were added by March 2025. Although this reading caused the USD to come under with the immediate reaction, the USD Index managed to reverse its direction, possibly supported by the 'buy the rumor, sell the fact' market action. In the European morning on Wednesday, the USD Index holds steady above 97.50, while US stock index futures trade mixed. Later in the session, the Producer Price Index is forecast to rise by 3.3% on a yearly basis in August, matching July's increase.

Escalating tensions in the Middle East allowed Gold to gather bullish momentum and reach a new record-high above $3,670 on Tuesday. Following a downward correction, XAU/USD ended the day marginally lower. Early Friday, Gold holds steady at around $3,650. Israel carried out a strike on senior Hamas leaders in Qatar's capital, Doha, claiming to have targeted those "directly responsible for the brutal October 7 massacre." Qatar released an official response, calling the attack a "flagrant violation of international law" and condemning Israel's "cowardly" strike.

In the Asian session on Wednesday, the data from China showed that the Consumer Price Index (CPI) declined by 0.4% on a yearly basis in August, after remaining unchanged in July. AUD/USD gains traction midweek and trades in positive territory above 0.6600.

EUR/USD lost more than 0.4% on Tuesday and erased a large portion of Monday's gains. After dipping below 1.1700, the pair found support and was last seen trading marginally higher on the day above 1.1710.

After rising toward 1.3600 on Tuesday, GBP/USD reversed its direction and closed the day in negative territory. The pair stays relatively quiet early Wednesday and trades slightly below 1.3550.

USD/JPY moves sideways slightly below 147.50 in the European session on Wednesday after closing virtually unchanged on Tuesday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.