Meme Coins Price Prediction: Dogecoin confirms uptrend, reviving Shiba Inu, Pepe

- Gold Price Forecast: XAU/USD slumps to near $4,000 on US-China trade progress

- Gold Price Forecast: XAU/USD tumbles to near $3,950 on Fed's hawkish comments, trade optimism

- Gold holds gains near $3,950 ahead of Trump-Xi meeting

- Bitcoin, cryptos fail to rally as Fed Chair sparks cautious sentiment

- Silver slips below $47.00 due to optimism over US-China trade deal

- Bitcoin Stalls Below $110,000 as Miners Step In to Sell

Dogecoin extends recovery ahead of DOJE ETF launch.

Shiba Inu crosses above the 100-day EMA, targeting further gains to the 200-day EMA.

Pepe reclaims the key $0.00001000 psychological level, facing opposition from crucial moving averages.

Meme coins are on a bullish rebound, with Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) leading the way. Dogecoin warms up ahead of the DOJE Exchange-Traded Fund (ETF) launch due on Thursday, boosting the investors’ sentiment around meme coins, resulting in a recovery in Shiba Inu and Pepe. The technical outlook remains optimistic, suggesting further gains as momentum builds amid breakouts.

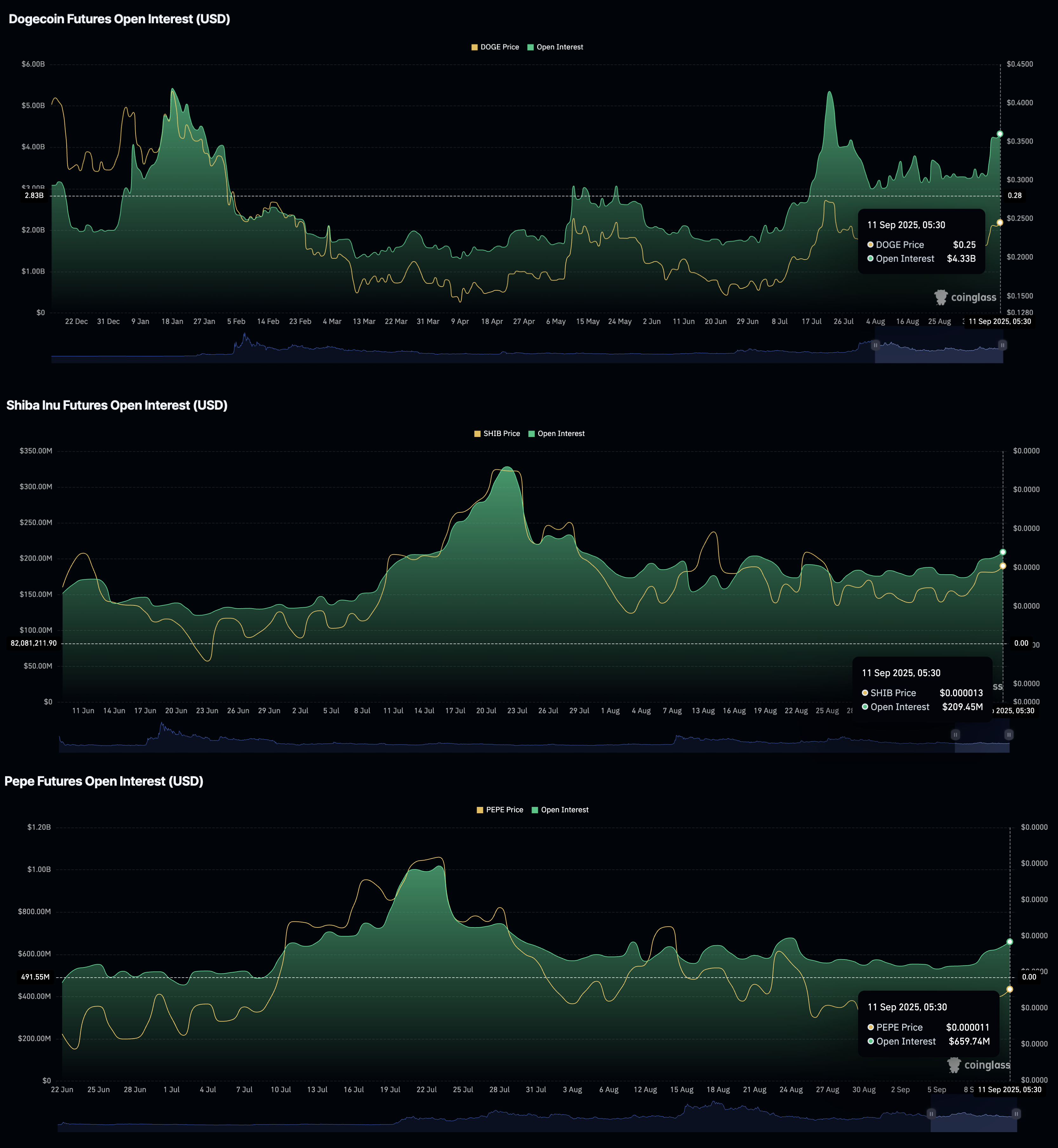

Derivatives traders grow interest in meme coins

CoinGlass data shows a significant surge in Open Interest (OI) of meme coins such as Dogecoin, Shiba Inu, and Pepe. The DOGE OI has increased to $4.33 billion, from $3.31 billion on Sunday, while the SHIB OI records a surge to $209.45 million, from $173.75 million on Sunday.

Similarly, the PEPE OI at $659.74 million is up from $545.77 million in the same period. This indicates a boost in risk-on sentiment among investors on the back of the first-ever US meme coin ETF of Dogecoin by Rex Osprey.

Meme Coins Open Interest. Source: CoinGlass

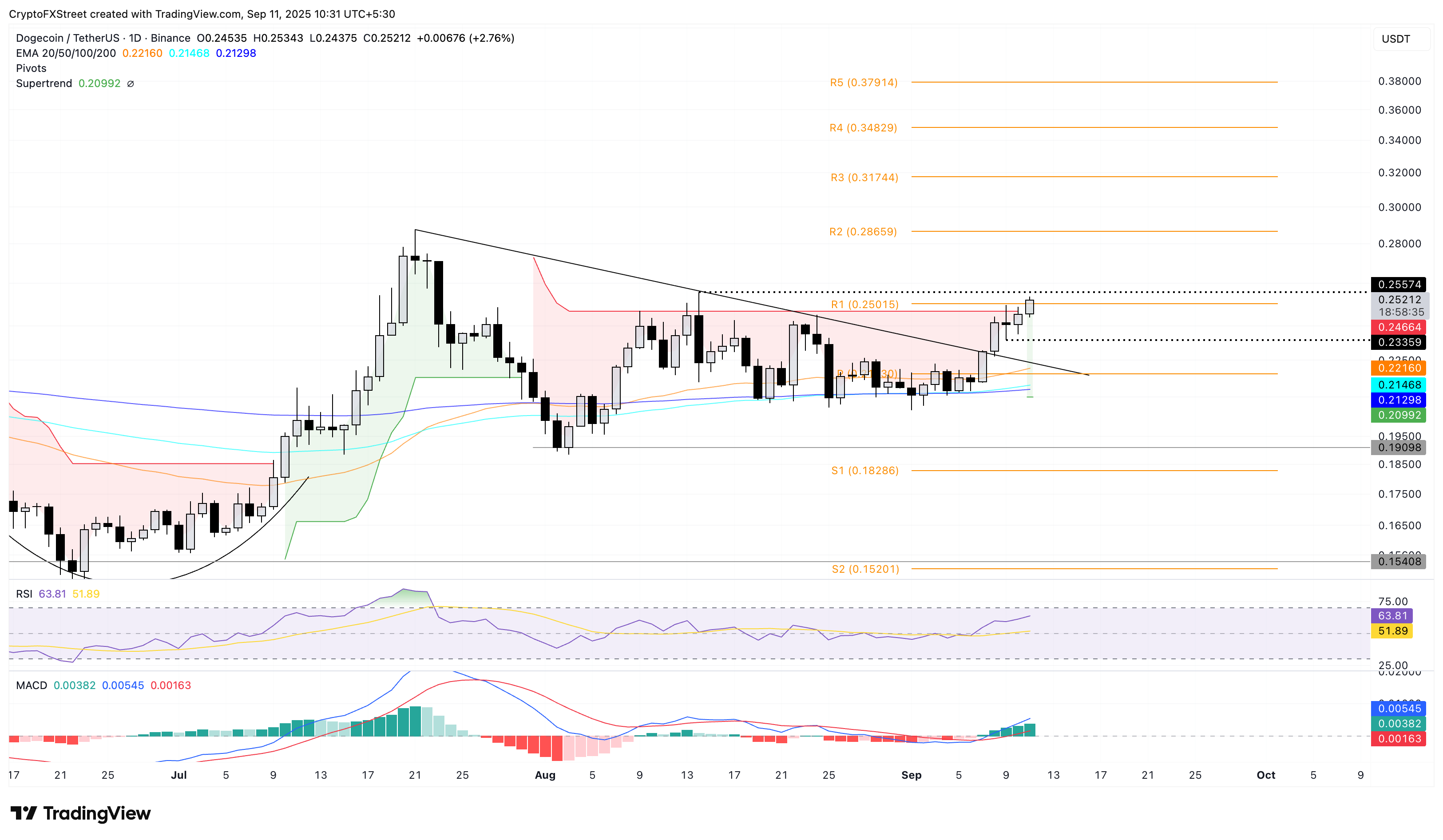

Dogecoin breakout rally gains momentum

Dogecoin is on a recovery run this week ahead of the DOJE ETF launch on Thursday, as anticipated by Eric Balchunas, a Bloomberg ETF specialist.

Dogecoin extends the trendline breakout rally above $0.25000 on the daily chart, targeting the $0.25574 resistance marked by the peak of August 14. A clean push above this level could extend the rally to the R2 pivot level at $0.28659.

Adding to the breakout, the momentum indicators on the daily chart are presenting a surge in buying pressure as the Relative Strength Index (RSI) maintains an upward-moving slope, reaching 63, with further space for recovery before reaching overbought levels.

Similarly, the Moving Average Convergence Divergence (MACD) indicator displays a steady rise in bullish momentum based on the increasing green histogram bars and an uptrend in the average lines.

DOGE/USDT daily price chart.

On the downside, if DOGE flips from the $0.25574 level, it could retest the centre pivot level at $0.21930.

Shiba Inu rally targets the 200-day EMA

Shiba Inu gains traction on the back of segment leader Dogecoin’s recovery, marking its fifth consecutive day of uptrend. SHIB bounces off the 100-day Exponential Moving Average (EMA) at $0.00001297 with a near 1% gain at press time on Thursday.

The path of least resistance for SHIB points to the 200-day EMA at $0.00001384 as the next crucial obstacle, presenting the possibility of an additional 5% gain.

Buying pressure is on the rise, evident by the RSI crossing above the halfway line, reaching 56 on the daily chart. Additionally, the MACD line approaches the zero line with the signal line following, indicating a bullish shift in trend momentum.

SHIB/USDT daily price chart.

Looking down, if SHIB loses the 50-day EMA at $0.00001276, it could reverse the trend to the $0.00001166 support level.

Pepe faces headwinds at the 50-day EMA

Pepe stalls the upward trend following a 2% rise on Wednesday, after reclaiming the $0.00001000 psychological level. The frog-themed meme coin faces headwinds from the 50-day EMA at $0.00001062, followed by the declining 100-day and 200-day EMAs.

If PEPE clears above the 200-day EMA at $0.00001098, it could extend the recovery to the $0.00001266 level, last tested on August 14.

The RSI at 53 has crossed above the halfway line, suggesting a positive shift in buying activity. Furthermore, the MACD and signal line extend the uptrend after the crossover on Sunday.

PEPE/USDT daily price chart.

On the flipside, a potential reversal from the 50-day EMA at $0.00001062 could retest the $0.0000900 figure.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.