AUD/USD jumps to near 0.6600 as Australian Dollar gains on cheerful market mood

- Gold tumbles as traders book profits ahead of key US inflation data

- Australian Dollar remains stronger following PBoC interest rate decision

- Gold tumbles as traders book profits ahead of key US inflation data

- Forex Today: US Dollar extends slide, Gold surges past $4,300

- Meme Coins Price Prediction: Dogecoin, Shiba Inu, Pepe flash bearish potential

- Japanese Yen strengthens on safe-haven flows, USD/JPY tests 150.00 amid weaker USD

AUD/USD climbs to near 0.6600 amid risk-on market mood.

The Fed is widely anticipated to cut interest rates next week.

Investors await key US PPI data for August.

The AUD/USD pair advances to near 0.6600 during the European trading session on Wednesday. The Aussie pair strengthens as the market sentiment turns favorable for riskier assets amid firm expectations that the Federal Reserve (Fed) will resume its monetary-easing campaign next week, which it paused earlier this year.

Australian Dollar Price Today

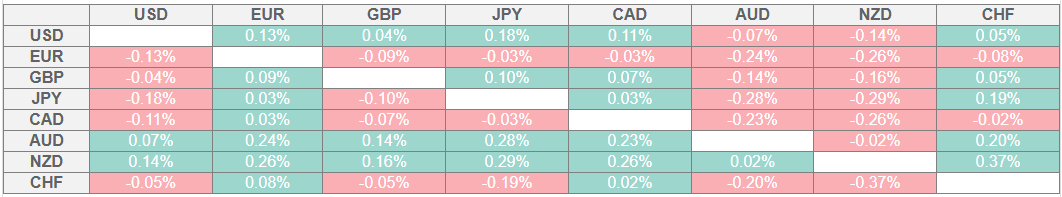

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

S&P 500 futures have posted significant gains during European trading hours, demonstrating an upbeat market mood.

According to the CME FedWatch tool, traders see an 8.4% chance that the Fed will cut interest rates by 50 basis points (bps) to 3.75%-4.00%, while the rest point a standard 25-bps interest rate reduction.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades calmly near Tuesday’s high around 97.80. The Greenback trades stable, even as the Nonfarm Payrolls (NFP) benchmark revision report for 12 months ending showed that the US economy created 911K fewer jobs than had been anticipated earlier.

In Wednesday’s session, investors will focus on the US Producer Price Index (PPI) data for August, which will be published at 12:30 GMT.

The US headline PPI is expected to have grown steadily at an annualized pace of 3.3%. Meanwhile, the core PPI – which excludes volatile food and energy items – is estimated to have risen moderately by 3.5%, against 3.7% in July.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.