Forex Today: ECB rate decision, US inflation data to drive market action

- Gold tumbles as traders book profits ahead of key US inflation data

- Australian Dollar remains stronger following PBoC interest rate decision

- Gold tumbles as traders book profits ahead of key US inflation data

- Forex Today: US Dollar extends slide, Gold surges past $4,300

- Meme Coins Price Prediction: Dogecoin, Shiba Inu, Pepe flash bearish potential

- Japanese Yen strengthens on safe-haven flows, USD/JPY tests 150.00 amid weaker USD

Here is what you need to know on Thursday, September 11:

Major currency pairs trade in narrow ranges early Thursday as investors move to the sidelines ahead of key events. The European Central Bank (ECB) will announce its interest rate decision and the US Bureau of Labor Statistics (BLS) will release the Consumer Price Index (CPI) data for August later in the day.

US Dollar Price This week

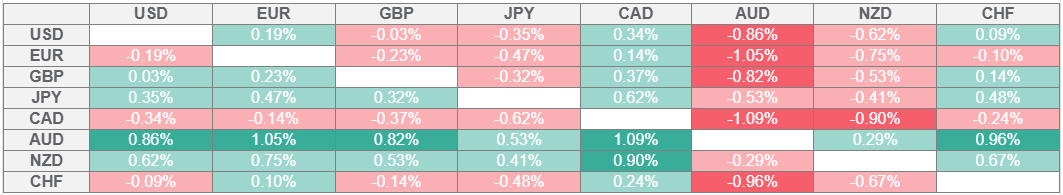

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Dollar (USD) Index failed to make a decisive move in either direction on Wednesday as the cautious market mood helped the USD stay resilient against its rivals despite the soft producer inflation data. The BLS reported on Wednesday that the Producer Price Index (PPI) rose 2.6% on a yearly basis in August. This reading followed the 3.1% increase recorded (revised from 3.3%) in July and came in below the market expectation of 3.3%. The annual CPI inflation is forecast to edge higher to 2.9% from 2.7% in July. On a monthly basis, the CPI and the core CPI are both seen increasing 0.3%. Early Thursday, the USD Index holds its ground and stays in positive territory at around 98.00. Meanwhile, US stock index futures trade marginally higher. The US economic calendar will also feature the weekly Initial Jobless Claims data.

EUR/USD stabilized near 1.1700 in the European morning on Thursday after registering small losses on Wednesday. The ECB is widely anticipated to leave key rates unchanged following the September meeting. Alongside the policy statement, the ECB will also release the revised macroeconomic projections.

During the Asian trading hours, Reserve Bank of New Zealand (RBNZ) Governor Christian Hawkesby reiterated that their central projection for the Official Cash Rate (OCR) is to drop to about 2.50% by the end of the year, but he added that this could happen faster or slower based on economic recovery evolution. NZD/USD showed no reaction to these comments and was last seen trading slightly below 0.5950.

GBP/USD continues to move sideways above 1.3500 after closing virtually unchanged on Wednesday.

USD/JPY clings to small daily gains above 147.50 in the European session on Thursday. The data from Japan showed that the PPI increased 2.7% on a yearly basis in August following the 2.5% increase seen in July. This print came in line with the market expectation.

After correcting from record highs on Tuesday, Gold registered modest gains on Wednesday. XAU/USD struggles to gather bullish momentum early Thursday and trades below $3,630.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.