Ethereum Price Forecast: ETH could pick up pace in Q4 amid cool-off in risk-on sentiment

Ethereum price today: $4,470

- Derive highlights Ethereum has potential for explosive growth in Q4 due to high institutional demand and rate cut expectations.

- Despite strong institutional accumulation, risk-on sentiment surrounding ETH has cooled over the past week.

- ETH is eyeing a recovery above $4,500 after it bounced off an ascending trendline support.

Ethereum's (ETH) price could see strong growth in Q4 due to rising institutional demand and expectations of rate cuts, according to Nick Forster, founder of crypto options exchange Derive. The prediction comes amid a range-bound movement in ETH over the past week.

Ethereum could gain momentum in Q4 despite decline in risk-on sentiment

Ethereum could see a strong Q4 following strong institutional accumulation and rising expectations of a rate cut, according to Forster.

"With rates expected to fall and institutions stockpiling ETH, markets are setting up for explosive potential heading into Q4," wrote Forster in a Wednesday note.

Over the past week, Ethereum exchange-traded funds (ETFs) expanded their holdings by 250,000 ETH, worth about $1.08 billion at the time, their fourth-best week since launching in July 2024. On top of that, strategic ETH reserve (SER) entities, led by BitMine Immersion (BMNR) and SharpLink Gaming (SBET), added 330,000 ETH last week to their cumulative balance, now valued at 3.6 million ETH.

"Institutional adoption of ETH is building serious momentum," noted Forster.

Meanwhile, expectations of a rate cut in the Federal Open Market Committee (FOMC) September meeting have stayed elevated above 90%, according to the CME FedWatch tool. The strong projection follows Fed Chair Jerome Powell's dovish hints at Jackson Hole on August 22. Historically, the crypto market has posted positive returns during periods of low interest rates.

"SERs now hold nearly 4% of the total ETH supply and are rapidly catching up to the 5.5% held by ETFs. With rates expected to decline, we could plausibly see SERs holding 6-10% of ETH's supply by year-end, positioning them as a major force behind ETH's price action," Forster added.

However, the recent market lull has cooled the strong risk-on sentiment that ETH saw in the majority of August.

Derive traders' projections of ETH hitting the $6,000 mark in October have dropped from 45% to 30% and expectations to reach the same figure by year-end are at 44%. ETH short-term volatility on the platform also declined from 75% to 65%.

Ethereum ETFs echo a similar sentiment, with investors triggering $300 million in net outflows in the past two trading days, according to SoSoValue data.

The decline in bullish momentum is more evident across CME futures contracts tracking ETH, as the top altcoin saw a notable basis contraction from 10% to 6.5% over the past week, according to a Tuesday report by K33 Research.

Ethereum Price Forecast: ETH bounces off trendline support, tests $4,500 key level

Ethereum experienced $56.7 million in futures liquidations in the past 24 hours, comprising $22.7 million and $34 million in long and short liquidations, per Coinglass data.

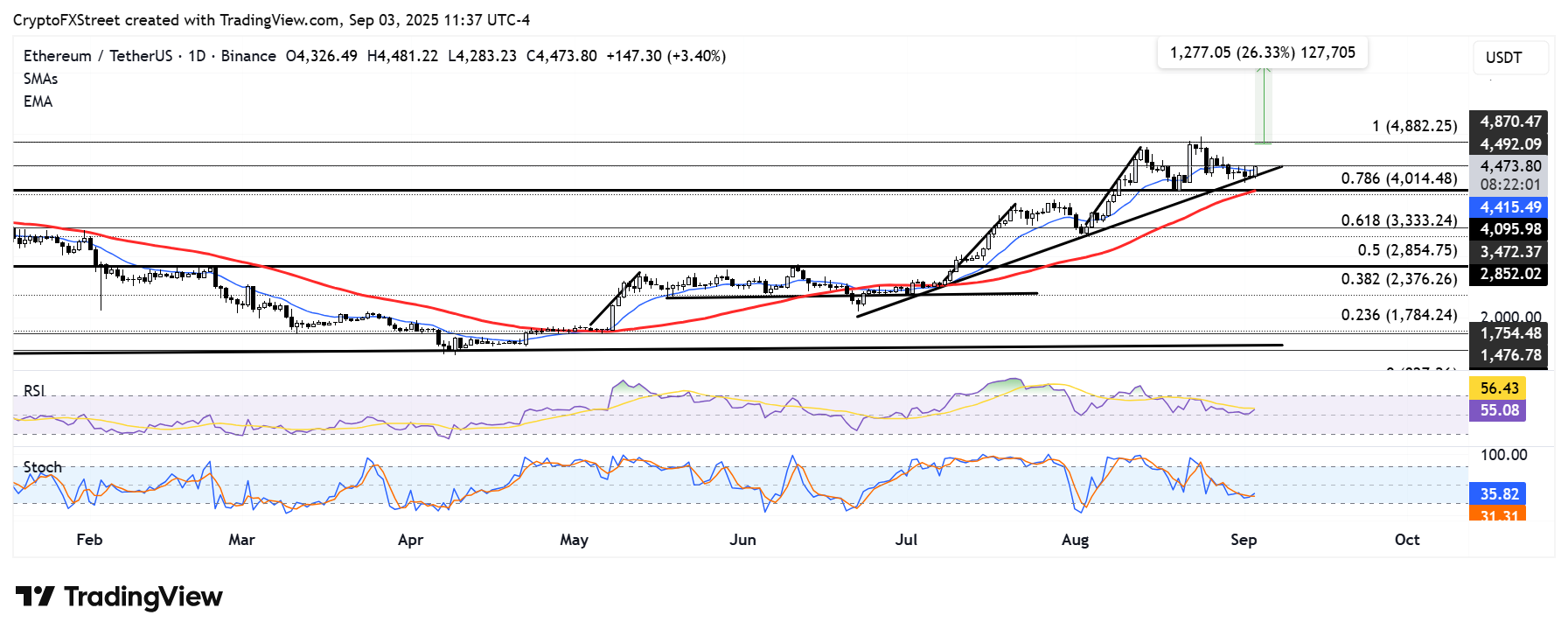

ETH bounced off a key ascending trendline support extending from June and is looking to test the resistance level near $4,500. If the top altcoin reclaims and holds $4,500 as support, it could retest the resistance near its all-time high at $4,956.

ETH/USDT daily chart

A firm cross above its all-time high will validate a bullish flag pattern and potentially push ETH above $6,000 — a level obtained by measuring the height of the flag's pole and projecting it upward from a potential breakout level.

The Relative Strength Index (RSI) edged slightly above its neutral level and is testing its moving average, while the Stochastic Oscillator (Stoch) remains below its midline. A firm cross above the moving average and the midline in both indicators, respectively, could mark the return of dominance in bullish momentum.