A Crash After a Surge: Why Silver Lost 40% in a Week?

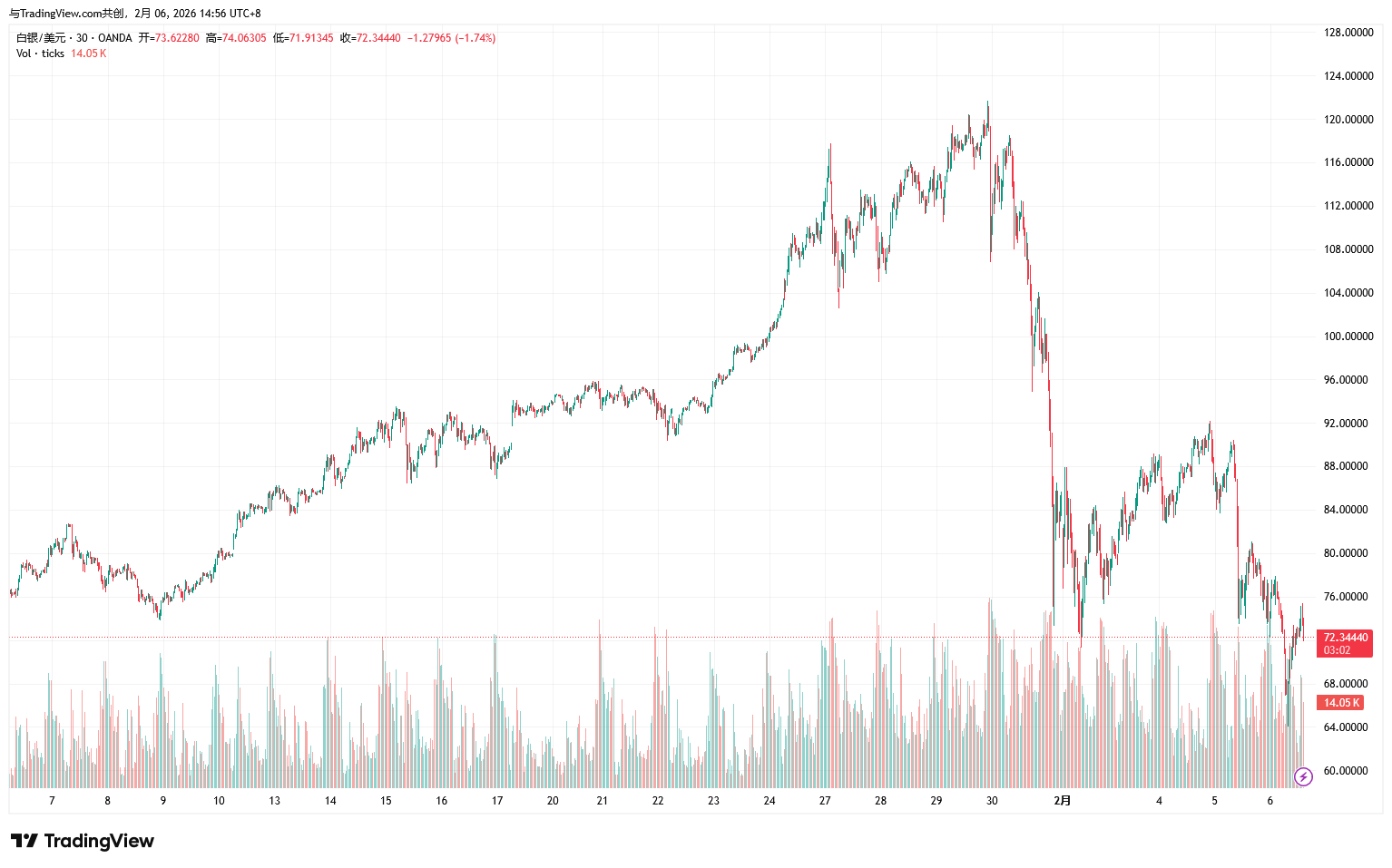

TradingKey - Spot Silver ( XAGUSD) prices have continued to decline; on Thursday, silver plummeted as much as 20% to break below $71 per ounce, and on Friday the sell-off intensified as prices fell further below $64.

Compared to the record high set on January 29, silver prices have retreated by more than 40%, erasing almost all the gains accumulated over the previous month.

Over the past year, precious metals overall exhibited a strong upward trend, driven by geopolitical tensions and concerns regarding the Federal Reserve's policy independence.

However, this rally came to an end last week. Silver suffered a historically rare plunge on Friday, becoming the worst-performing precious metal of the day, while gold ( XAUUSD) also recorded its largest single-day drop since 2013.

Due to its relatively small market size and limited liquidity, silver prices have historically been more prone to violent fluctuations than gold. The speed and magnitude of this correction have been particularly striking, marking the most severe since 1980. A massive influx of speculative capital, combined with thin over-the-counter trading, has further amplified the scale of price volatility.

This was not caused by a single factor, but rather a chain reaction resulting from the resonance of multiple forces, including a concentrated influx of speculative funds, structural market imbalances, a lack of liquidity, and tightening regulatory policies.

Speculation Drives Up Risk

Throughout January, investors aggressively built positions in the precious metals market, using leveraged exchange-traded products and a large volume of call options to bet on rising prices. This capital-intensive entry pushed metal prices higher in the short term but also planted the seeds of potential risk.

Once the rally stalled and market sentiment shifted, these positions transformed from drivers of the upside into sources of downward pressure, triggering a wave of margin calls and forced liquidations.

Ross Norman, CEO of Metals Daily, noted in a report that excessive speculation is severely disrupting the normal price discovery mechanism for gold. He believes that precious metal price volatility has detached from physical market fundamentals, becoming a self-driven trend that is gradually forming a vicious cycle.

Analysts Daria Efanova and Viktoria Kuszak of Sucden Financial also stated that silver prices have entered a phase highly dependent on capital flows, with their trajectory driven more by speculative forces and quantitative CTA positioning than physical supply and demand fundamentals.

They pointed out that while structural tightness remains in the silver market, its high-beta nature and sensitivity to macroeconomic expectations make it highly susceptible to sharp corrections once prices reach high levels. They added that volatility is likely to remain high; upside potential will depend on fresh capital inflows, while downside may be relatively limited, though violent price swings will be dominated by ongoing position adjustments.

Meanwhile, a lack of liquidity has further exacerbated market imbalances. Silver's market capacity is inherently smaller than gold's, with the London over-the-counter market being particularly vulnerable.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, noted that when market volatility surges, market makers often widen bid-ask spreads and reduce balance sheet utilization, leading to liquidity being tightest precisely when the market needs it most. He warned that until order is restored, volatility could fall into a 'self-reinforcing vicious cycle.'

CME Repeatedly Hikes Margins

Amid the extreme volatility in silver, regulators moved quickly to curb risks, with the CME Group hiking margins for silver futures six times within the past month.

In the latest adjustment on February 5, the CME announced it would raise the initial margin for COMEX 100 gold futures from 8% to 9%, while increasing the initial margin for COMEX 5000 silver futures from 15% to 18%.

Historically, whenever silver prices approach a cyclical peak, exchanges often resort to raising margins to suppress excessive speculation and potential bubbles.

Starting from mid-December 2025, the CME began a series of frequent margin hikes for silver futures. Initially, fixed amounts were used, gradually increasing from $22,000 to $24,200 and then to $25,000; subsequently, on December 31, the margin requirement was sharply raised to $32,500.

Entering 2026, the CME switched to percentage-based calculations, raising the initial margin from 9% to 11% on January 28, with the rate for high-risk accounts simultaneously increased to 12.1%; just three days later, it was hiked again to 15%, with high-risk accounts further rising to 16.5%.

Such a rapid pace of adjustments is extremely rare in the history of silver futures, reflecting the CME's grave concerns over current abnormal market volatility and liquidity risks.

Historical experience shows that regulatory policies are often one of the key variables that break silver rallies. Especially in a context where the market is already highly leveraged and vulnerable, continuous margin hikes limit leverage expansion, which, combined with the market's inherently high-risk structure, causes price support to rapidly collapse.

The silver crash of 1980 serves as the most representative case. At that time, silver prices hit a record high on January 21, but on the same day, the Commodity Exchange (COMEX) suddenly announced 'liquidation only' rules, prohibiting new positions and cutting off the path for bulls to increase exposure. Prior to this, the exchange had repeatedly raised margins and implemented position limits, eventually causing the bullish leverage chain to snap and silver prices to plummet 67% over the following four months.

The silver peak in 2011 was handled more moderately. The CME raised margins five times in just nine days. Although it did not 'kill the engine' all at once, the continuous increase in trading costs made it difficult for bulls to maintain momentum. Prices eventually peaked after the second margin hike, and silver declined by more than 36% over the next 16 months.

Precious Metals Struggle to Find Stable Support

Looking ahead, volatility in the precious metals market is likely to remain high.

Analysts point out that against the backdrop of an unclear outlook for U.S. monetary policy—particularly with significant uncertainty regarding the timing and pace of interest rate cuts—precious metal prices will continue to be disrupted by macroeconomic factors, making stable operation difficult.

Currently, Federal Reserve officials continue to deliver hawkish signals, reinforcing market expectations that high interest rates will be maintained for longer. This has driven the U.S. dollar stronger, putting pressure on dollar-denominated assets, especially silver and other precious metals. Under these circumstances, the upward momentum for precious metals will be constrained, and the market may continue to face violent price fluctuations in the short term.