GBP/USD rises as risk appetite floats higher heading into tense week

- GBP/USD climbed 0.3% on Monday, bolstered by a general uptick in market sentiment.

- Markets are tilted into the risk-on side ahead of a packed data docket.

- This week will culminate in key US NFP jobs data.

GBP/USD found room on the high end on Monday, kicking off a fresh trading week with another leg up the charts. Cable rose around three-tenths of one percent despite a general lack of meaningful data or headlines as investors continue to bank on a fresh round of interest rate cuts from the Federal Reserve (Fed) this month.

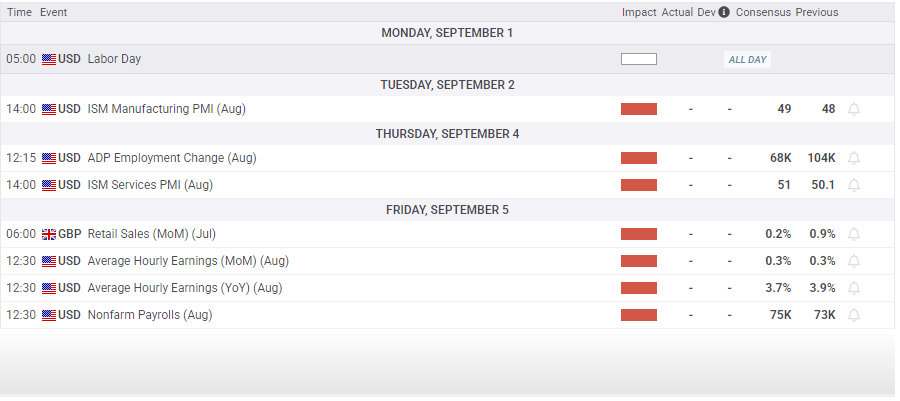

Tuesday will be dominated by US economic data, with a clear docket on the UK side. US ISM Manufacturing PMI figures from August will be dropping during the American market session, and median market forecasts are expecting a general uptick to 49.0 from 48.0. The response rate for PMI surveys is generally too low to stretch the final figure into an accurate sample size, thus rendering any conclusions drawn from the survey a moot point. However, the final figure will nonetheless be watched by investors.

US Nonfarm Payrolls (NFP) are due on Friday, and will dominate this week’s general market water supply. The Federal Reserve (Fed) is barreling toward an interest rate cut on September 17 thanks to its sometimes-conflicting dual mandate of influencing interest rates to both bolster job creation and control inflation. A recent bout of softening US labor figures has investor hopes riding high that the Fed will brush off a recent uptick in inflation pressures and deliver a rate in a few weeks to prop up US employment numbers that took a sharp downward turn heading into the middle of the year.

GBP/USD price forecast

Bullish momentum underpinning GBP/USD has carried Cable up around 1.2% from its last swing low point near 1.3390, and the pair is now poised for a fresh challenge of the 1.3600 handle. The pair has closed in the green for all but two of the last seven straight market sessions, and has either closed flat or gained ground in all but eight daily sessions since August 1.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.