Ripple Price Forecast: XRP holds $3.00 as bullish divergence signals 12% upside

- XRP shows recovery signals targeting $3.38, underpinned by strong technical indicators.

- Declining exchange reserves underscore positive sentiment and strong conviction in the XRP price recovery.

- XRP futures funding rate and Open Interest point to investor optimism and possible price rebound.

Ripple (XRP) offers short-term recovery signals on Wednesday after reclaiming support at $3.00. Backing the reversal in the cross-border money remittance token is, among other factors, renewed interest in the derivatives market, growing retail demand and a significant decrease in XRP exchange reserves.

XRP eyes short-term recovery as exchange reserves shrink

XRP is poised for another bullish move above $3.00, buoyed by growing optimism among token holders. According to CryptoQuant data, the XRP Exchange Reserves on-chain metric has significantly declined from its July peak of 3 billion XRP to 2.9 billion XRP. This peak also coincided with the local top in XRP price, following the run-up to $3.66, the highest level on record.

The reduction in the exchange reserves implies fewer tokens on crypto exchange platforms, which subsequently reduces potential selling pressure. If this trend persists and demand increases, a strong tailwind will propel XRP higher, increasing the chances of reaching the medium-term resistance at $3.38 and later the record high of $3.66, set on July 18.

-1756311742402-1756311742404.png)

XRP Exchange Reserves | Source: CryptoQuant

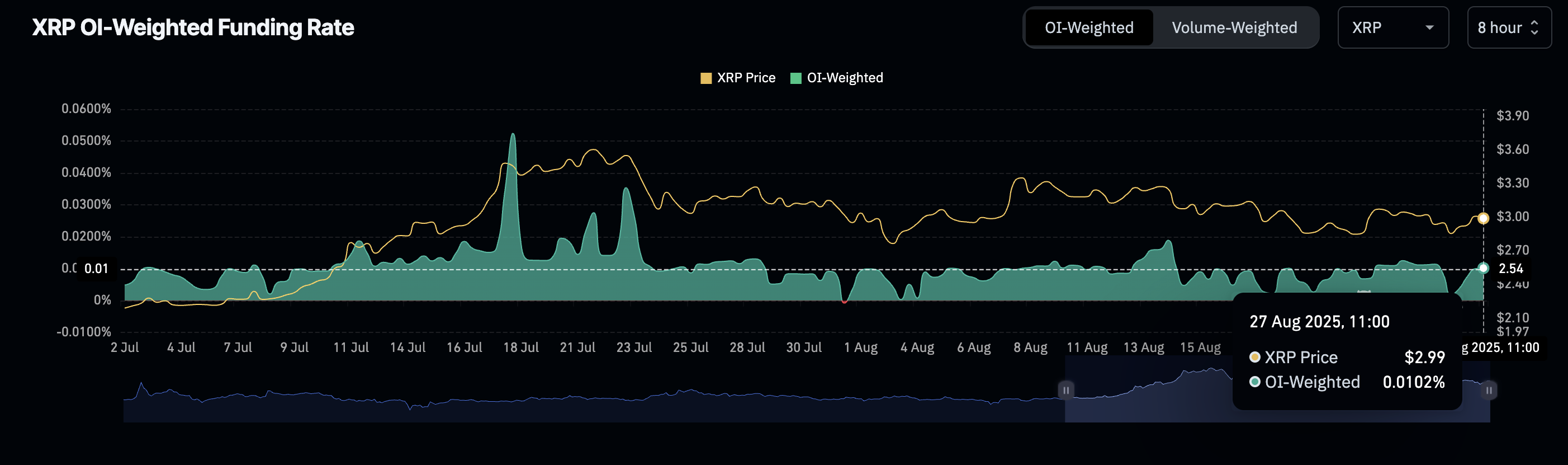

Interest in XRP remains relatively high, despite fluctuations in the price over the past few weeks, as reflected in the futures funding rate. CoinGlass data shows the funding rate averaging at 0.0102% at the time of writing, suggesting that more traders are increasingly leveraging long positions in XRP. A strong conviction in XRP’s recovery potential could boost short-term interest.

XRP futures funding rate | Source: CoinGlass

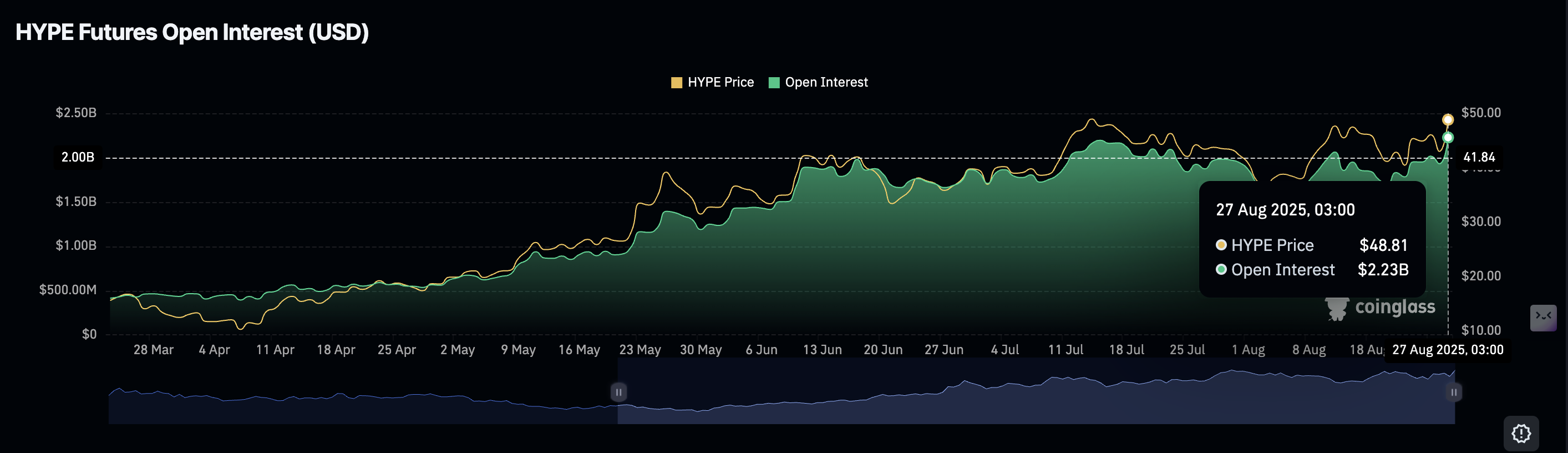

XRP Open Interest (OI), representing the value of outstanding futures contracts, is back above the $8 billion mark after falling to $7.36 billion on August 22 and $7.02 billion on August 3.

If the OI steadies in the coming days and weeks, it will indicate positive sentiment and heightened trading activity as traders increasingly bet on higher XRP prices.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP bulls target 12% breakout

XRP price remains above $3.00 at the time of writing, underpinned by multiple positive technical indicators. A buy signal from the SuperTrend indicator on the 4-hour chart calls on traders to increase exposure.

Additionally, the Moving Average Convergence Divergence (MACD) indicator backs XRP’s short-term bullish outlook after validating another buy signal on Tuesday.

The Relative Strength Index (RSI), positioned above the midline and stabilizing at 54, upholds steady buying pressure. A reversal toward overbought territory would corroborate the growth in retail demand as highlighted by the recovery in the futures Open Interest and increase the probability of testing resistance at $3.38 – a 12% move above the current level.

XRP/USDT -4-hour chart

Still, XRP is not out of the woods despite the short-term support at $3.00. If sentiment wobbles in the broader crypto market ahead of the potential Federal Reserve (Fed) interest rate cuts in September, XRP could drop to test the 50-period Exponential Moving Average (EMA) at $2.98. Other areas of interest for traders include the support at $2.90, which was tested on August 6 and the demand at $2.72, tested on August 3.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.