Forex Today: Gold, Silver shine as US Dollar sags amid thin trading conditions

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Monday, September 1:

The US Dollar Index (DXY) is on the defensive at the beginning of a new week and a month, extending its bearish momentum, despite a risk-averse market environment.

US Dollar Price Today

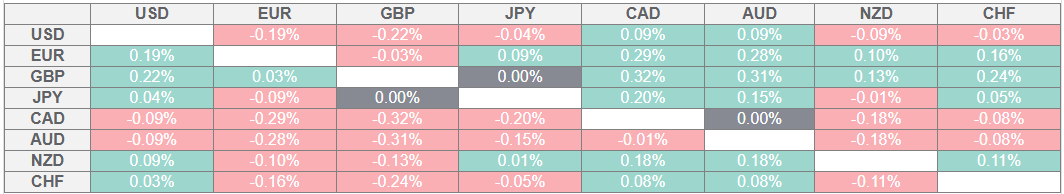

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

China’s private sector manufacturing activity unexpectedly returned to expansion in August, with a 50.5 reading, but the optimism is being offset by the trade quagmire and the tech sell-off on Wall Street indices last week.

The Japanese stocks tracked the Wall Street decline, sending the benchmark Nikkei 225 index as much as 2% lower on the day. Chinese indices were a mixed bag.

On Friday, a US court ruled that President Donald Trump’s global tariffs, unilaterally imposed, as largely illegal. However, US Trade Representative Jamieson Greer said in a Fox News interview on Sunday that the Trump administration will likely continue negotiations with its trade partners despite Friday’s US court ruling.

The Greenback also bears the brunt of increased dovish expectations surrounding the US Federal Reserve’s (Fed).

On Friday, in line with estimates US Core Personal Consumption Expenditures (PCE) Price Index - the Fed’s preferred inflation gauge, reaffirmed bets for an interest rate cut this month.

Markets now see a roughly 90% chance of the Fed lowering interest rates this month, according to the CME Group’s FedWatch Tool.

All eyes will be on a flurry of US employment data, including the critical Nonfarm Payrolls (NFP) on Friday, which will be closely scrutinized for the scope and the timing of the future Fed rate cuts.

EUR/USD trades firmer above 1.1700 in the European morning, while GBP/USD also grinds higher above 1.3500.

AUD/USD moves back and forth in a narrow range below 0.6550 while USD/CAD also oscillates around 1.3750 amid a broadly weaker US Dollar and falling Oil prices.

NZD/USD, however, bucks the side trend, currently posting moderate gains at around 0.5900.

USD/JPY made another attempt above 147.00 but sellers quickly jumped in to drag it back under that level, where it now wavers. The Japanese Yen (JPY) attracts haven demand amid a sell-off in Japanese equities.

Gold consolidates at five-month highs just below $3,490, looking for a fresh record high. Meanwhile, Silver hit the highest level since September 2011 above $40.50.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.