TradingKey - Berkshire Hathaway, led by Warren Buffett, has once again increased its exposure to Japan, sparking a broad rally in the country’s trading house sector. On Thursday local time, Mitsubishi Corporation announced that a subsidiary of Berkshire had raised its stake from 9.74% in March to 10.23%, marking the first time the holding has crossed the 10% threshold.

Mitsui & Co. also confirmed it has received additional investment from Buffett. Following the news, shares of Mitsubishi Corp. surged as much as 2.9%, Mitsui & Co. rose 1.8%, and Itochu Corporation climbed as high as 3.5%. Marubeni and Sumitomo Corporation also posted gains.

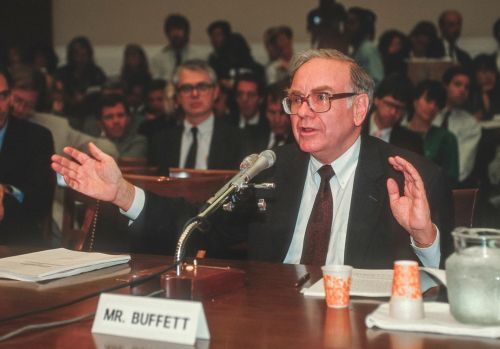

.jpg)

[Source: Google Finance]

The move signals Buffett’s strong and sustained confidence in the long-term outlook for Japan’s “Big Five” trading houses. Since first announcing its investment in 2020, Berkshire has built substantial stakes in Itochu, Marubeni, Sumitomo, Mitsubishi, and Mitsui & Co. These sogo shosha (general trading companies) operate across energy, agriculture, retail, and infrastructure, with strong global supply chain networks and resilient, countercyclical business models.

Market analysts say Japanese trading houses have become increasingly attractive to international investors due to improved shareholder returns, including expanded buybacks and higher dividends. Norikazu Shimizu, analyst at Iwai Cosmo Securities, noted that Berkshire’s continued ownership creates a “halo effect,” encouraging other firms to adopt more shareholder-friendly policies.

Notably, Berkshire had previously stated it would keep its stakes below 10% to avoid triggering stricter disclosure rules. However, after Japanese firms agreed to “moderately” relax governance constraints, Berkshire was able to exceed the threshold. A spokesperson for Mitsui & Co. said the increase reflects “a continued vote of confidence and trust.”

In a period of rising global geopolitical uncertainty, Japan’s trading houses are gaining favor among global investors for their stable cash flows and diversified international operations. Buffett’s latest move not only boosted trading house valuations but also reinforced confidence in the broader Japanese equity market — underscoring the enduring global influence of his long-term, value-driven investment philosophy.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.