FTSE 100 opens lower today; retail sales data better than expected

Investing.com – U.K. equities started with losses on Friday with drops in nearly all sectors. The top fallers are Personal Goods, Chemicals, Mobile Telecommunications and Automobiles & Parts sectors.

At the market open in London, the FTSE 100 Index fell 0.57%. The FTSE 250 Index and the FTSE 350 Index also declined. The FTSE 250 dropped 0.69%, while the FTSE 350 was down by 0.53%.

Top Gainers:

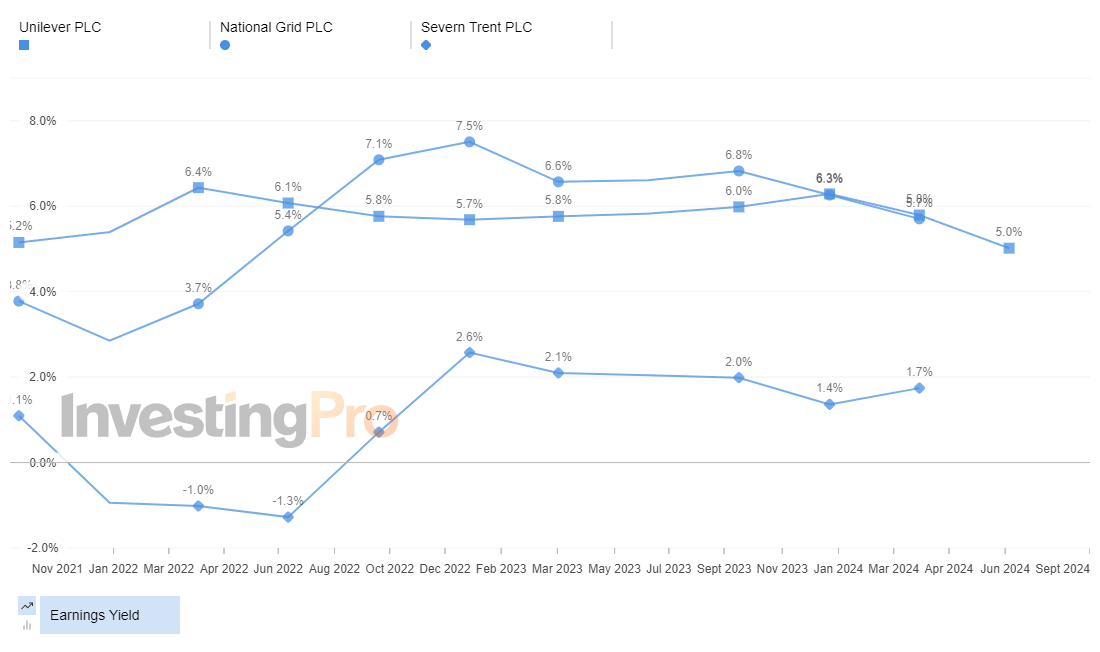

Unilever (LON:ULVR): Rose 0.18% or 9.0 points to 4,862.0.

National Grid (LON:NG): Increased 0.20% or 2.00 points to 1,025.00.

Severn Trent (LON:SVT): Climbed 0.04% or 1.0 point to 2,650.0.

Top Losers:

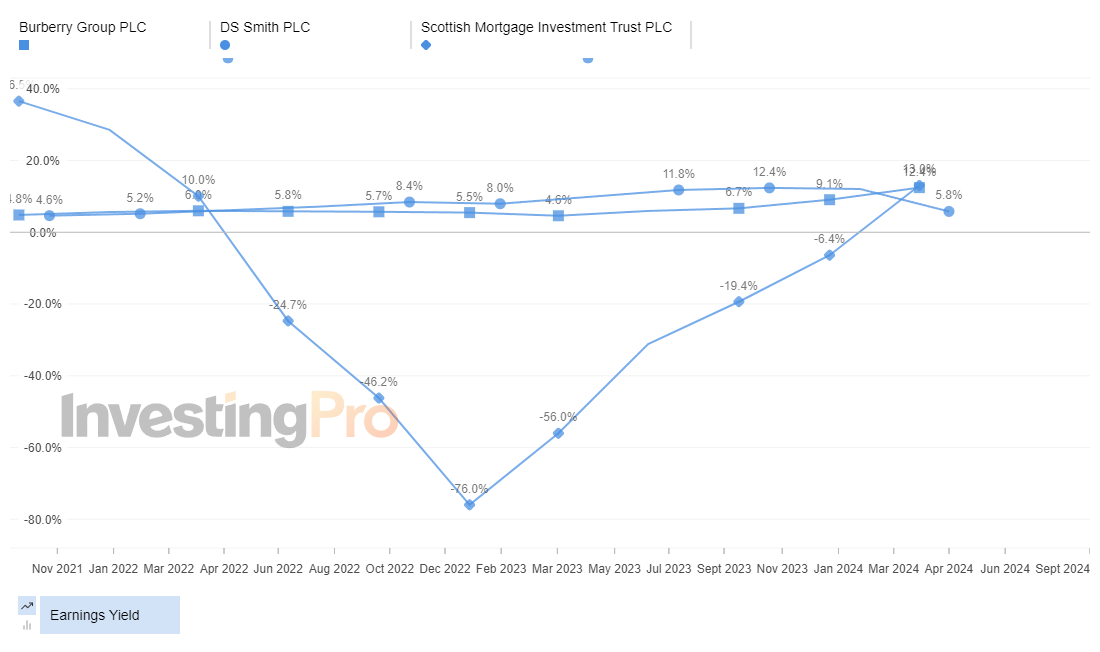

Burberry Group (LON:BRBY): Dropped 4.53% or 28.4 points to 598.0.

DS Smith (LON:SMDS): Fell 1.77% or 8.60 points to 476.00.

Scottish Mortgage (LON:SMT): Declined 1.61% or 13.40 points to 819.60.

In Commodities Trading:

- Gold Futures for December delivery climbed 18.30 points to 2,632.90 a troy ounce.

- Crude Oil for November delivery dropped 0.29 points to 70.87 a barrel.

- November Brent Oil Contract fell 0.45% or 0.34 points to 74.54 a barrel.

Currency Markets:

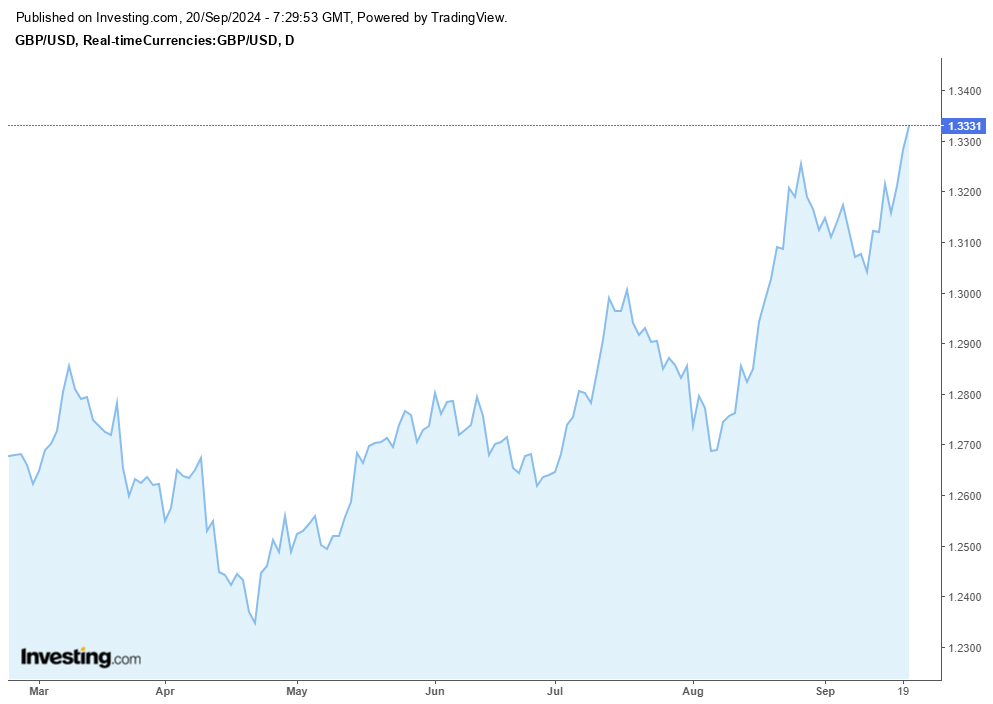

- GBP/USD climbed over 1.33 and trading at 1.3329 at the time of writing.

- EUR/GBP has dropped to 0.8384.

- The US Dollar Index Futures was down 0.05% at 100.272.

Main Economic Events:

Today's main economic events in the United Kingdom are the retail sales numbers and public sector borrowing data.

Retail sales increased 1.0% on the month, beating the 0.3% forecasted. Core retail sales doubled the expectations both monthly and annualy.

Public sector net borrowing increased more than forecasted and rose to 13.7 billion.