AUD/USD extends correction to near 0.6480 amid uncertainty over US-China trade relations

AUD/USD retraces to near 0.6480 from an over six-month high of 0.6545 as investors lack details of the US-China trade deal.

US President Trump says China agrees to supply rare earths and magnets.

The US prepares to send letters to its trading partners stating tariff rates and the trade deal.

The AUD/USD pair slides to near 0.6480 during European trading hours on Thursday, following the corrective move from an over six-month high of 0.6545 posted the previous day. The Aussie pair weakens as the Australian Dollar (AUD) underperforms across the board, while investors doubt whether the trade truce between the United States (US) and China will last long.

Australian Dollar PRICE Today

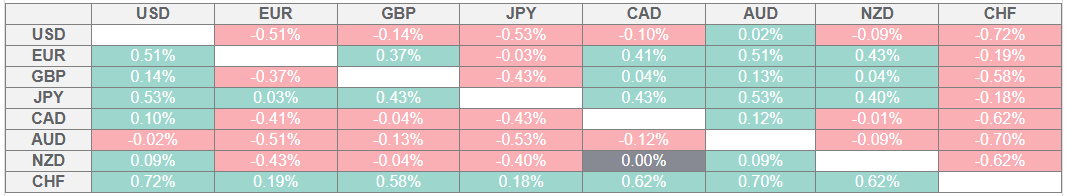

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

On Wednesday, US President Donald Trump stated in a post on Truth.Social that China has agreed to supply rare earths and magnets, but didn’t provide concrete details on what Beijing will get in return.

Full magnets, and any necessary rare earths, will be supplied, up front, by China. Likewise, we will provide to China what was agreed to, including Chinese students using our colleges and universities (which has always been good with me!)," Trump wrote. He further added, "We are getting a total of 55% tariffs, China is getting 10%. Relationship is excellent!

“While President Trump indicated favorable news that tariffs on Chinese imports would rise from 30% to 55% and Chinese rare-earth exports may resume, there is little news on what China gets in return. I doubt this is a one-way deal and hence the market caution seen overnight," analysts at Etera Investment Management said.

The uncertainty among market participants over the US-China trade deal weighs on the Australian Dollar (AUD), given that the Australian economy relies heavily on its exports to Beijing.

Although investors have underpinned the US Dollar (USD) against the AUD, it underperforms against the majority of its peers amid uncertainty surrounding US tariff policy. On Wednesday, US President Trump stated that Washington is prepared to send a final trade agreement, including tariff rates, to those trading partners from whom Washington has not received any proposal or those who are not negotiating in good faith.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.