U.S. July Nonfarm Payroll Commentary: Short-Term Economic Headwinds May Turn into Mid-Term Bullish Signal for US Stocks

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

TradingKey - On 1 August 2025, the U.S. Department of Labour published the July Non-Farm Payrolls Report, revealing a job growth of 73,000, well below the anticipated 104,000. Additionally, employment figures for the prior two months were significantly revised downward, signalling a pronounced slowdown in the U.S. labour market. A striking anomaly emerged this month: despite the weak job growth, the unemployment rate only edged up slightly.

Our analysis attributes this divergence primarily to the effects of immigration deportation policies under the Trump administration, which have reduced employment among foreign workers, heavily impacting non-farm payroll growth while minimally affecting the unemployment rate. Consequently, the July jobs report has markedly heightened market expectations for interest rate reductions.

Looking forward, the U.S. stock market is poised to benefit from the renewed interest rate cut cycle and the short- to medium-term impacts of the " One Big Beautiful Bill Act", which are expected to counterbalance the pressures from decelerating economic growth and a softening labour market. Consequently, we maintain a bullish outlook on U.S. equities over the medium term. Should disappointing economic data lead to short-term market corrections, these dips are likely to offer attractive entry points for medium-term investors. In essence, short-term economic challenges could pave the way for medium-term investment opportunities.

Source: Mitrade

Main Body

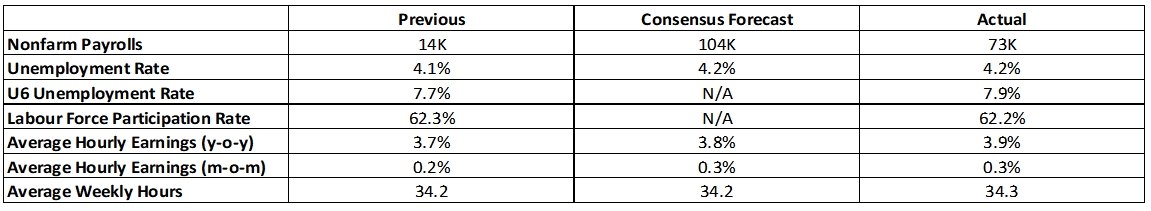

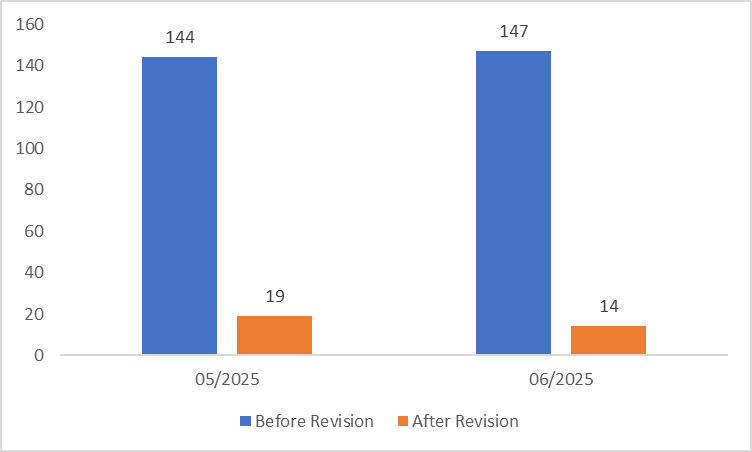

On 1 August 2025, the U.S. Department of Labour published the July Non-Farm Payrolls Report, indicating a job growth of 73,000, well short of the anticipated 104,000 (Figure 1). Additionally, significant downward revisions were made to the prior two months' employment figures, with May and June collectively adjusted downward by 258,000 jobs—May was revised from its original figure by 125,000 to 19,000, and June reduced by 133,000 to 14,000 (Figure 2). These metrics collectively signal a pronounced slowdown and weakening in the U.S. labour market.

Figure 1: Market Consensus Forecasts vs. Actual Data

Source: Refinitiv, TradingKey

Figure 2: U.S. Non-Farm Payroll in May and June, Before and After Revision (000)

Source: Refinitiv, TradingKey

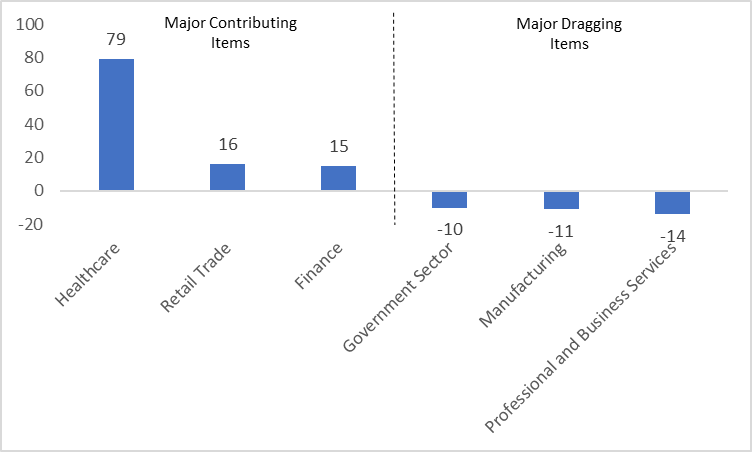

Structurally, the July labour market exhibited a mixed performance: the public sector shed 10,000 jobs, contrasted by a gain of 83,000 jobs in the private sector. By industry, job growth was primarily driven by healthcare (up 79,000 jobs), retail trade (up 16,000 jobs), and finance (up 15,000 jobs). Conversely, declines in professional and business services (down 14,000 jobs), manufacturing (down 11,000 jobs), and the public sector (down 10,000 jobs) significantly weighed on overall employment gains (Figure 3).

In July, the U.S. labour market displayed an atypical pattern: non-farm payrolls significantly underperformed expectations, with May and June data also heavily revised downward, yet the unemployment rate only edged up from 4.1% in June to 4.2% in July. Our analysis indicates that this discrepancy stems primarily from the emerging effects of Trump’s immigration deportation policies. These measures have notably reduced employment among foreign workers, significantly hindering non-farm job growth, while exerting a comparatively smaller influence on the unemployment rate.

Figure 3: U.S. New Jobs Added by Sectors (000)

Source: Refinitiv, TradingKey

The July non-farm payrolls report altered investors' views on the U.S. labour market, revealing a marked slowdown where stability was once assumed. This development significantly boosted expectations for interest rate cuts and sparked considerable market turbulence. Post-release, the likelihood of a September rate cut jumped from 46% to 89%, while the S&P 500 index experienced a roughly 1% decline.

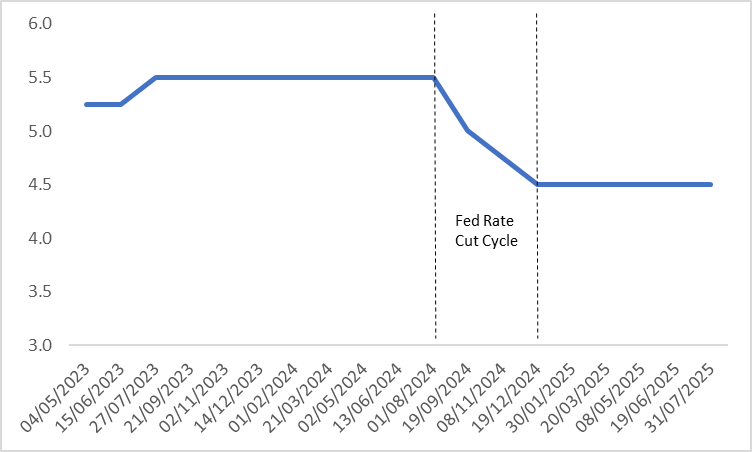

Looking forward, the U.S. stock market is expected to benefit from the resumed interest rate cut cycle (Figure 4) and the short- to medium-term impacts of the " One Big Beautiful Bill Act", which will counterbalance the pressures from decelerating economic growth and a softening labour market. Consequently, we maintain a bullish outlook on U.S. equities over the medium term. Should disappointing economic data lead to short-term market dips, these corrections are likely to offer attractive entry points for medium-term investors. In essence, short-term economic challenges could pave the way for medium-term investment opportunities.

Figure 4: Fed Policy Rate (%)

Source: Refinitiv, TradingKey

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.